What Is Retained Earnings On A Balance Sheet - Retained earnings are a firm’s cumulative net earnings or profit after accounting for dividend payments. Retained earnings are the profits of a business entity that have not been disbursed to the shareholders. At the end of each accounting period, retained earnings are reported on the balance sheet as the accumulated income from the prior year (including the current year’s income), minus dividends. Retained earnings are also known as accumulated earnings, earned surplus,. They’re also referred to as the earnings surplus. Retained earnings are reported in the shareholders' equity section of a balance sheet. The recording of retained earnings is done on the balance sheet of a company. At the end of every accounting cycle, you’ll see retained earnings on the balance sheet. This is the cumulative incomes from the current year’s earnings and the previous years,.

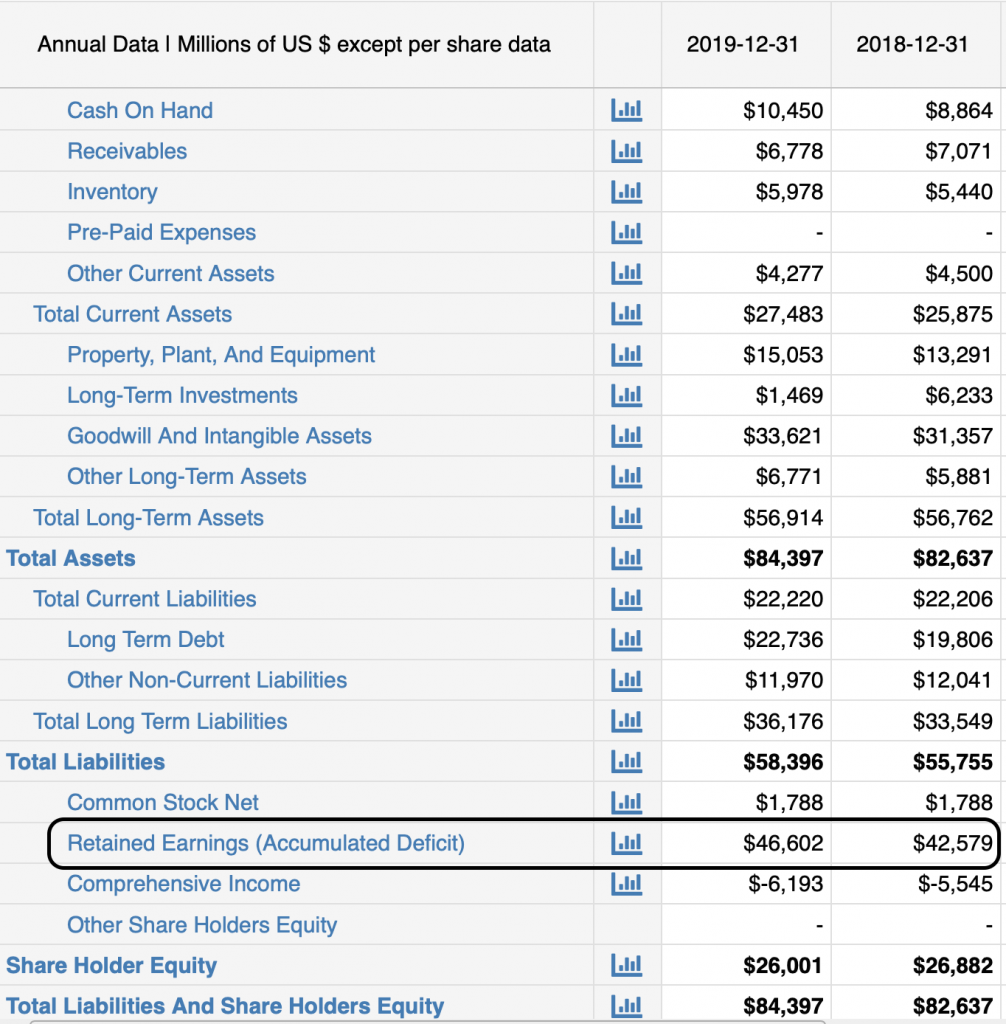

Retained earnings are a firm’s cumulative net earnings or profit after accounting for dividend payments. The recording of retained earnings is done on the balance sheet of a company. This is the cumulative incomes from the current year’s earnings and the previous years,. Retained earnings are also known as accumulated earnings, earned surplus,. Retained earnings are reported in the shareholders' equity section of a balance sheet. Retained earnings are the profits of a business entity that have not been disbursed to the shareholders. At the end of each accounting period, retained earnings are reported on the balance sheet as the accumulated income from the prior year (including the current year’s income), minus dividends. At the end of every accounting cycle, you’ll see retained earnings on the balance sheet. They’re also referred to as the earnings surplus.

At the end of each accounting period, retained earnings are reported on the balance sheet as the accumulated income from the prior year (including the current year’s income), minus dividends. Retained earnings are a firm’s cumulative net earnings or profit after accounting for dividend payments. The recording of retained earnings is done on the balance sheet of a company. They’re also referred to as the earnings surplus. This is the cumulative incomes from the current year’s earnings and the previous years,. Retained earnings are the profits of a business entity that have not been disbursed to the shareholders. At the end of every accounting cycle, you’ll see retained earnings on the balance sheet. Retained earnings are also known as accumulated earnings, earned surplus,. Retained earnings are reported in the shareholders' equity section of a balance sheet.

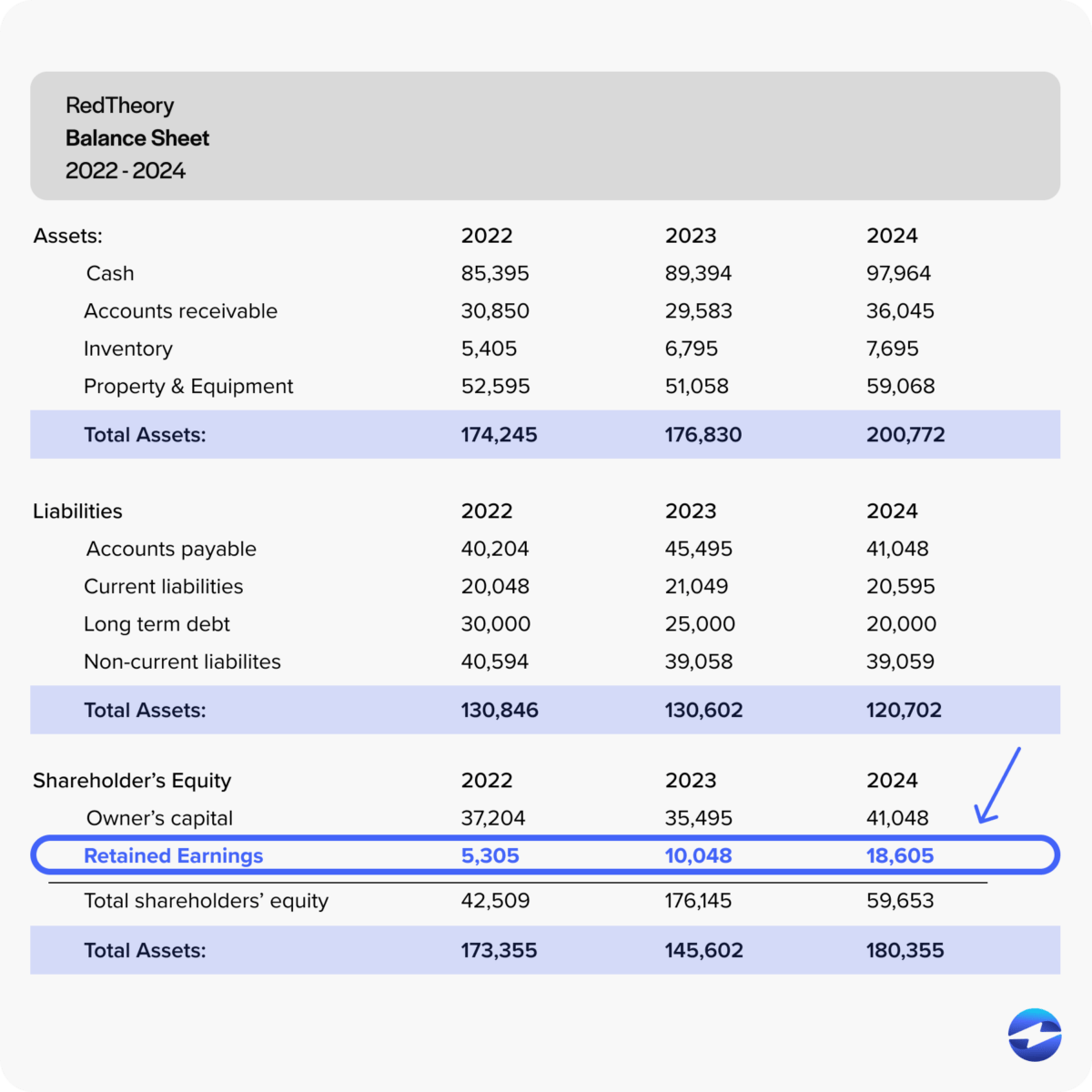

Retained Earnings Calculation Balance Sheet at Wayne Owen blog

Retained earnings are reported in the shareholders' equity section of a balance sheet. The recording of retained earnings is done on the balance sheet of a company. They’re also referred to as the earnings surplus. Retained earnings are the profits of a business entity that have not been disbursed to the shareholders. Retained earnings are a firm’s cumulative net earnings.

Retained Earnings Balance Sheet

Retained earnings are also known as accumulated earnings, earned surplus,. Retained earnings are the profits of a business entity that have not been disbursed to the shareholders. The recording of retained earnings is done on the balance sheet of a company. Retained earnings are a firm’s cumulative net earnings or profit after accounting for dividend payments. They’re also referred to.

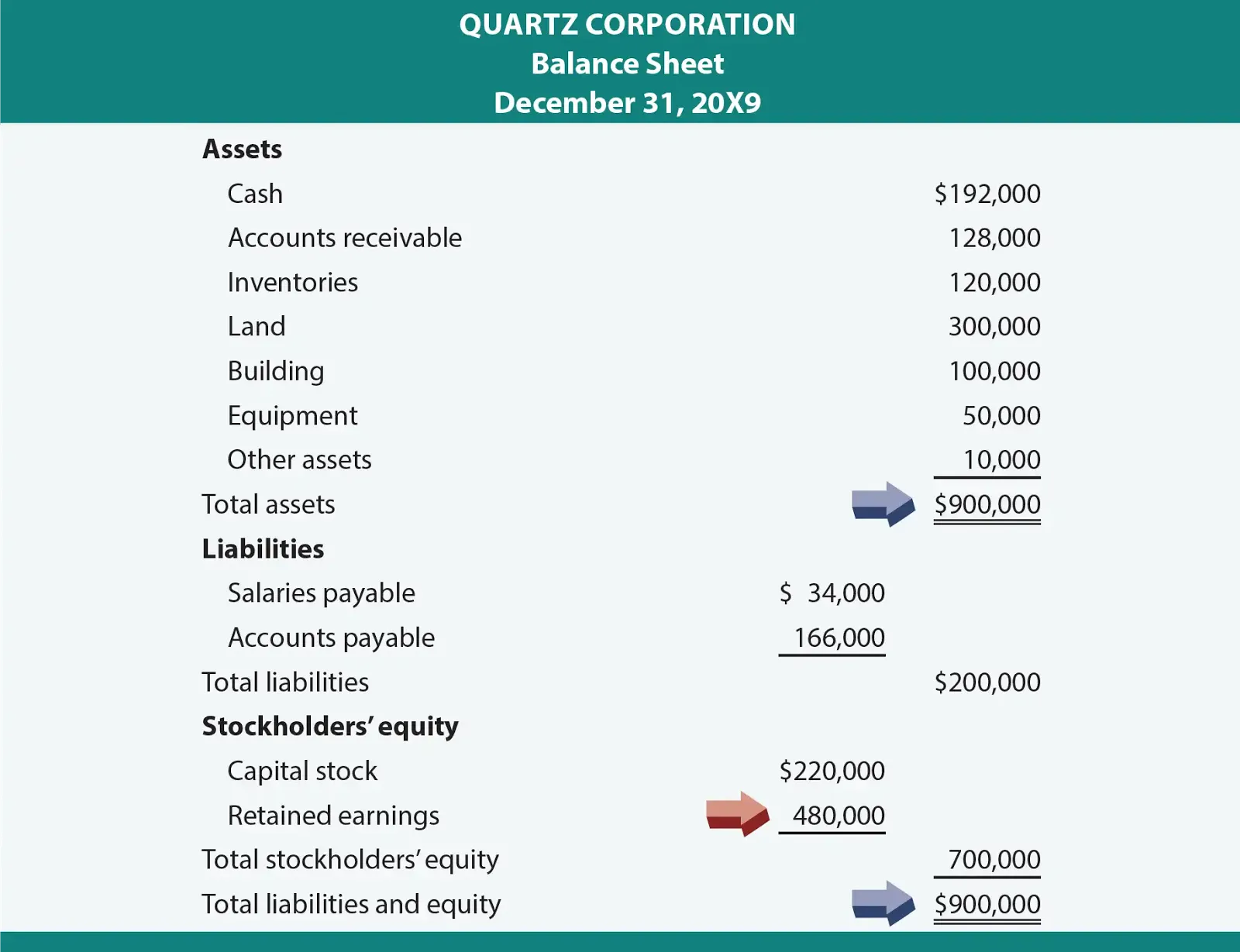

Statement of Retained Earnings What is it? How to Prepare It, and Examples

They’re also referred to as the earnings surplus. Retained earnings are the profits of a business entity that have not been disbursed to the shareholders. At the end of each accounting period, retained earnings are reported on the balance sheet as the accumulated income from the prior year (including the current year’s income), minus dividends. Retained earnings are reported in.

Retained Earnings Balance Sheet

They’re also referred to as the earnings surplus. Retained earnings are also known as accumulated earnings, earned surplus,. At the end of each accounting period, retained earnings are reported on the balance sheet as the accumulated income from the prior year (including the current year’s income), minus dividends. Retained earnings are reported in the shareholders' equity section of a balance.

AFRPreparation of Financial statementCPA KENYA AFRPreparation of

Retained earnings are reported in the shareholders' equity section of a balance sheet. At the end of each accounting period, retained earnings are reported on the balance sheet as the accumulated income from the prior year (including the current year’s income), minus dividends. Retained earnings are the profits of a business entity that have not been disbursed to the shareholders..

Retained Earnings Balance Sheet

Retained earnings are also known as accumulated earnings, earned surplus,. Retained earnings are reported in the shareholders' equity section of a balance sheet. At the end of each accounting period, retained earnings are reported on the balance sheet as the accumulated income from the prior year (including the current year’s income), minus dividends. Retained earnings are a firm’s cumulative net.

Looking Good Retained Earnings Formula In Balance Sheet Difference

The recording of retained earnings is done on the balance sheet of a company. Retained earnings are the profits of a business entity that have not been disbursed to the shareholders. This is the cumulative incomes from the current year’s earnings and the previous years,. Retained earnings are a firm’s cumulative net earnings or profit after accounting for dividend payments..

What are Retained Earnings? Guide, Formula, and Examples

Retained earnings are a firm’s cumulative net earnings or profit after accounting for dividend payments. Retained earnings are the profits of a business entity that have not been disbursed to the shareholders. They’re also referred to as the earnings surplus. At the end of every accounting cycle, you’ll see retained earnings on the balance sheet. The recording of retained earnings.

What Is Meant By Retained Earnings in Balance sheet Financial

Retained earnings are also known as accumulated earnings, earned surplus,. This is the cumulative incomes from the current year’s earnings and the previous years,. At the end of every accounting cycle, you’ll see retained earnings on the balance sheet. At the end of each accounting period, retained earnings are reported on the balance sheet as the accumulated income from the.

Retained Earnings Balance Sheet

Retained earnings are a firm’s cumulative net earnings or profit after accounting for dividend payments. Retained earnings are also known as accumulated earnings, earned surplus,. Retained earnings are reported in the shareholders' equity section of a balance sheet. The recording of retained earnings is done on the balance sheet of a company. At the end of each accounting period, retained.

Retained Earnings Are Reported In The Shareholders' Equity Section Of A Balance Sheet.

Retained earnings are a firm’s cumulative net earnings or profit after accounting for dividend payments. They’re also referred to as the earnings surplus. At the end of each accounting period, retained earnings are reported on the balance sheet as the accumulated income from the prior year (including the current year’s income), minus dividends. Retained earnings are the profits of a business entity that have not been disbursed to the shareholders.

At The End Of Every Accounting Cycle, You’ll See Retained Earnings On The Balance Sheet.

Retained earnings are also known as accumulated earnings, earned surplus,. The recording of retained earnings is done on the balance sheet of a company. This is the cumulative incomes from the current year’s earnings and the previous years,.