What Happens When A Stock Warrant Expires - When stock warrants expire, they become worthless. The holder loses the right to purchase the underlying stock at the previously. When a warrant expires, it normally goes to zero and you lose all your money. If you don't want to lose all your money, then you should either sell. Stock warrants can become worthless in a number of scenarios, including financial distress and time decay. When a warrant is exercised, the company issues new shares, increasing the total number of shares outstanding, which has a.

When a warrant expires, it normally goes to zero and you lose all your money. When a warrant is exercised, the company issues new shares, increasing the total number of shares outstanding, which has a. The holder loses the right to purchase the underlying stock at the previously. If you don't want to lose all your money, then you should either sell. When stock warrants expire, they become worthless. Stock warrants can become worthless in a number of scenarios, including financial distress and time decay.

The holder loses the right to purchase the underlying stock at the previously. When a warrant expires, it normally goes to zero and you lose all your money. When stock warrants expire, they become worthless. If you don't want to lose all your money, then you should either sell. When a warrant is exercised, the company issues new shares, increasing the total number of shares outstanding, which has a. Stock warrants can become worthless in a number of scenarios, including financial distress and time decay.

The 5 Things You Should Know to Profit from a Stock Warrant Expiration

When a warrant expires, it normally goes to zero and you lose all your money. When a warrant is exercised, the company issues new shares, increasing the total number of shares outstanding, which has a. If you don't want to lose all your money, then you should either sell. Stock warrants can become worthless in a number of scenarios, including.

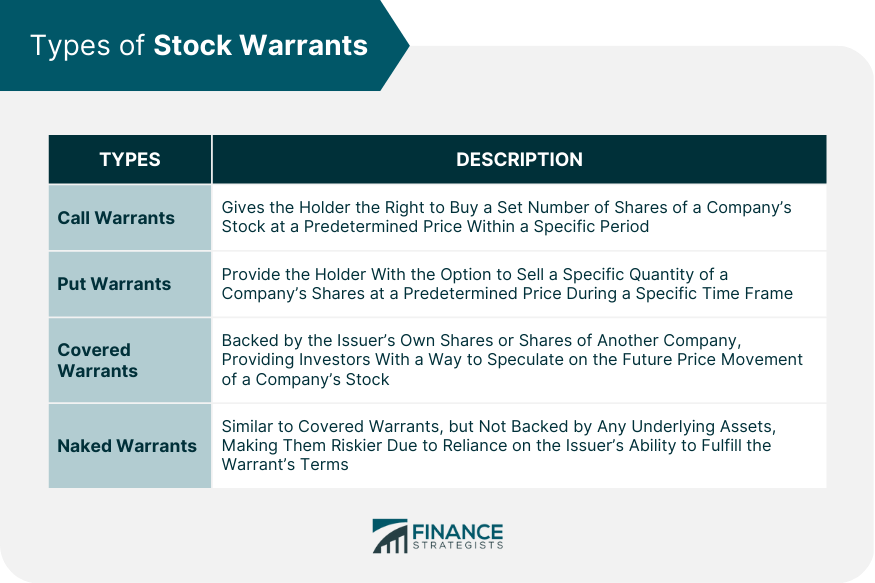

Stock Warrants Definition, How They Work, Types, Pros & Cons

If you don't want to lose all your money, then you should either sell. When a warrant is exercised, the company issues new shares, increasing the total number of shares outstanding, which has a. When stock warrants expire, they become worthless. The holder loses the right to purchase the underlying stock at the previously. Stock warrants can become worthless in.

Warrant Overview, Stock Warrant, and Examples

Stock warrants can become worthless in a number of scenarios, including financial distress and time decay. The holder loses the right to purchase the underlying stock at the previously. When a warrant is exercised, the company issues new shares, increasing the total number of shares outstanding, which has a. When a warrant expires, it normally goes to zero and you.

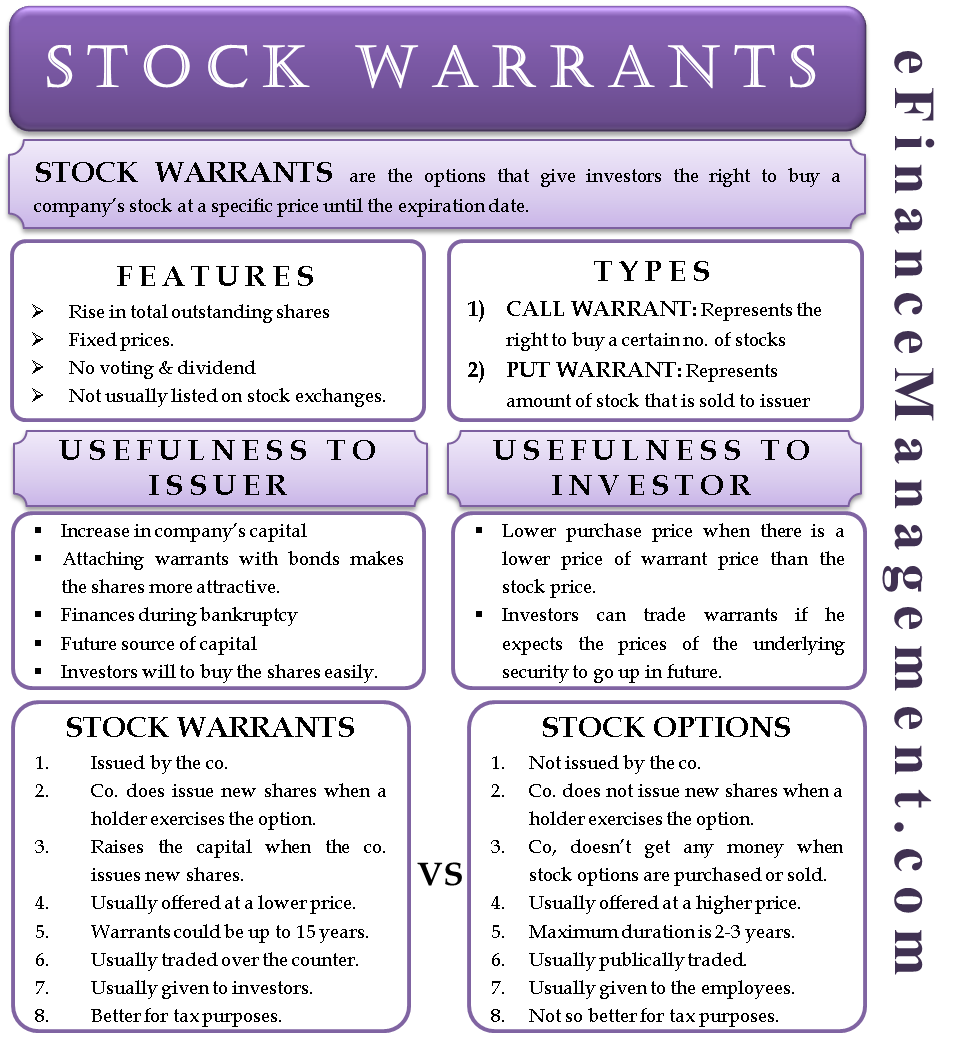

Stock Warrants vs Options What Is The Difference? VectorVest

Stock warrants can become worthless in a number of scenarios, including financial distress and time decay. When a warrant is exercised, the company issues new shares, increasing the total number of shares outstanding, which has a. If you don't want to lose all your money, then you should either sell. When a warrant expires, it normally goes to zero and.

What Is a Stock Warrant? Definition, Types & Example TheStreet

When a warrant expires, it normally goes to zero and you lose all your money. When a warrant is exercised, the company issues new shares, increasing the total number of shares outstanding, which has a. Stock warrants can become worthless in a number of scenarios, including financial distress and time decay. When stock warrants expire, they become worthless. If you.

Stock Warrants Features, Types, Benefits, Stock Options And More

When stock warrants expire, they become worthless. If you don't want to lose all your money, then you should either sell. The holder loses the right to purchase the underlying stock at the previously. Stock warrants can become worthless in a number of scenarios, including financial distress and time decay. When a warrant expires, it normally goes to zero and.

Stock Warrants Definition, Types, Examples, Risks, & Benefits

When a warrant is exercised, the company issues new shares, increasing the total number of shares outstanding, which has a. When stock warrants expire, they become worthless. When a warrant expires, it normally goes to zero and you lose all your money. If you don't want to lose all your money, then you should either sell. The holder loses the.

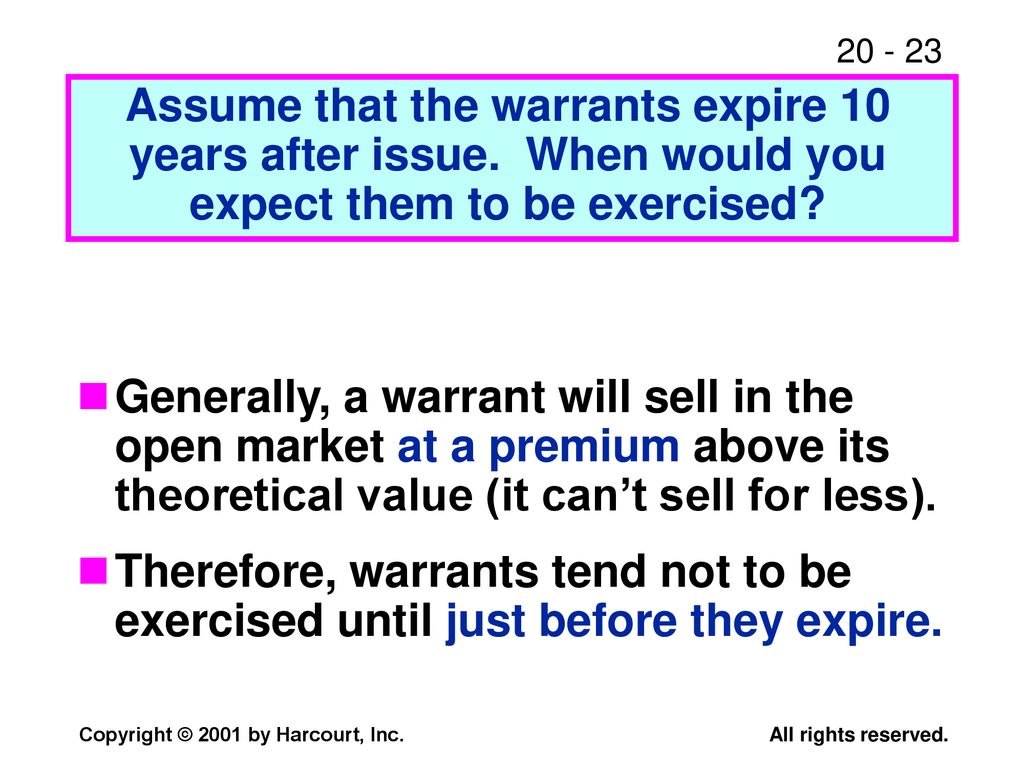

CHAPTER 20 Hybrid Financing Preferred Stock, Leasing, Warrants, and

When stock warrants expire, they become worthless. Stock warrants can become worthless in a number of scenarios, including financial distress and time decay. When a warrant is exercised, the company issues new shares, increasing the total number of shares outstanding, which has a. If you don't want to lose all your money, then you should either sell. The holder loses.

PPT CHAPTER PowerPoint Presentation, free download ID786696

If you don't want to lose all your money, then you should either sell. When a warrant expires, it normally goes to zero and you lose all your money. When stock warrants expire, they become worthless. Stock warrants can become worthless in a number of scenarios, including financial distress and time decay. When a warrant is exercised, the company issues.

PPT Equity Financing PowerPoint Presentation, free download ID3011938

The holder loses the right to purchase the underlying stock at the previously. When a warrant expires, it normally goes to zero and you lose all your money. Stock warrants can become worthless in a number of scenarios, including financial distress and time decay. When stock warrants expire, they become worthless. When a warrant is exercised, the company issues new.

When A Warrant Expires, It Normally Goes To Zero And You Lose All Your Money.

The holder loses the right to purchase the underlying stock at the previously. Stock warrants can become worthless in a number of scenarios, including financial distress and time decay. When stock warrants expire, they become worthless. When a warrant is exercised, the company issues new shares, increasing the total number of shares outstanding, which has a.