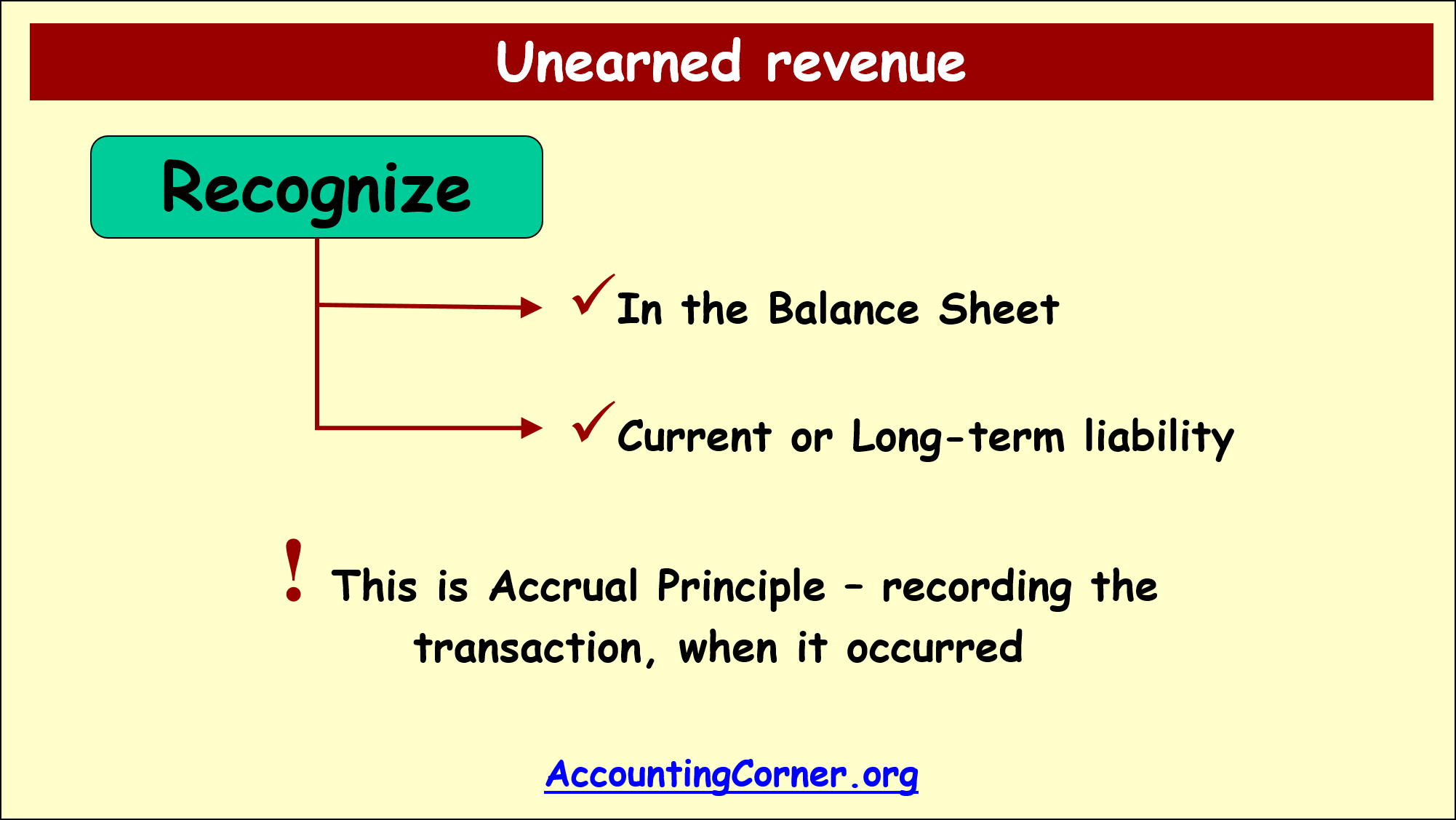

Unearned Revenue Balance Sheet - Unearned revenue is recorded on the liabilities side of the balance sheet since the company collected cash payments upfront and. As a company earns the revenue, it reduces the balance in the unearned revenue account (with a debit) and increases the.

As a company earns the revenue, it reduces the balance in the unearned revenue account (with a debit) and increases the. Unearned revenue is recorded on the liabilities side of the balance sheet since the company collected cash payments upfront and.

As a company earns the revenue, it reduces the balance in the unearned revenue account (with a debit) and increases the. Unearned revenue is recorded on the liabilities side of the balance sheet since the company collected cash payments upfront and.

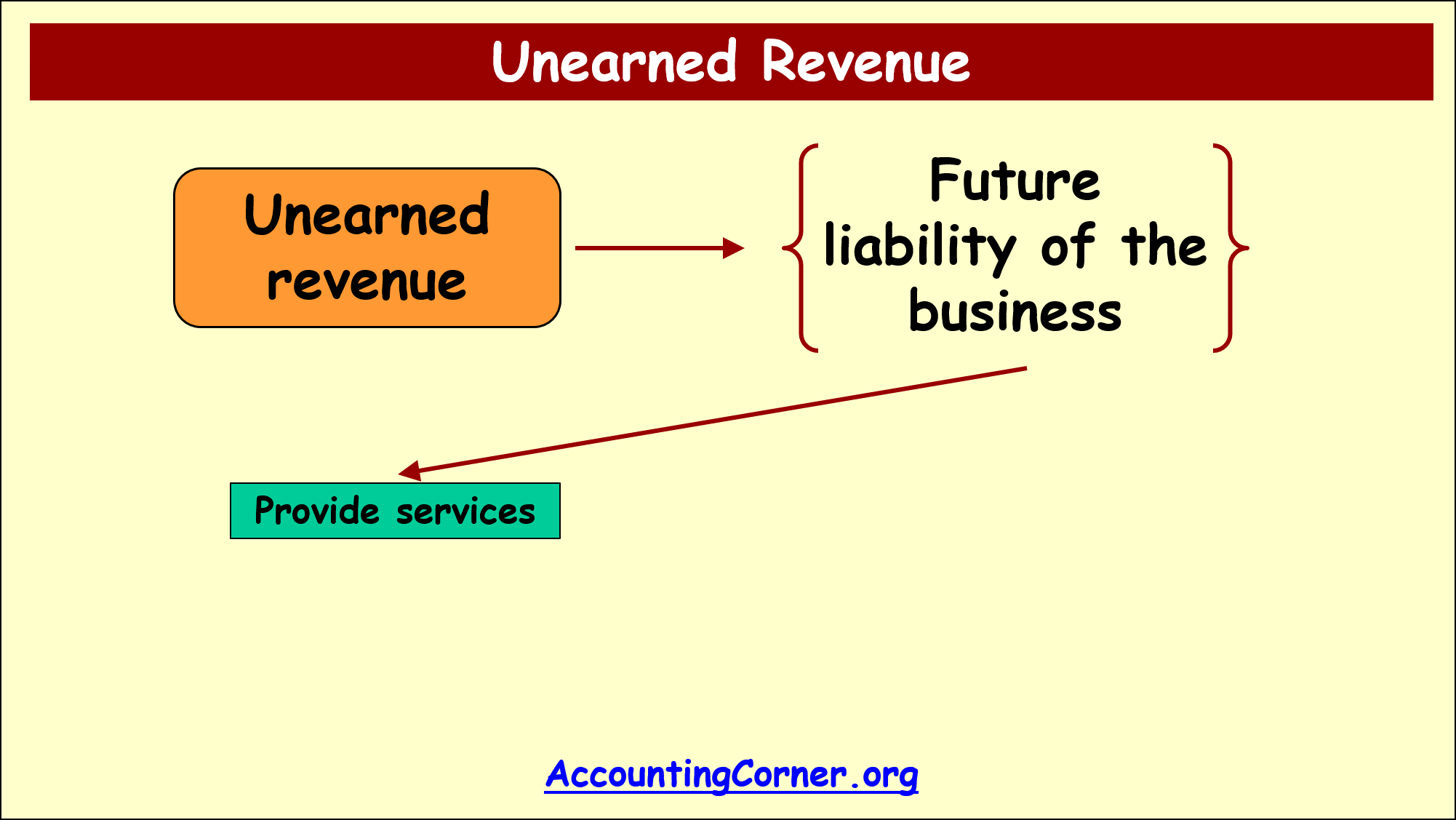

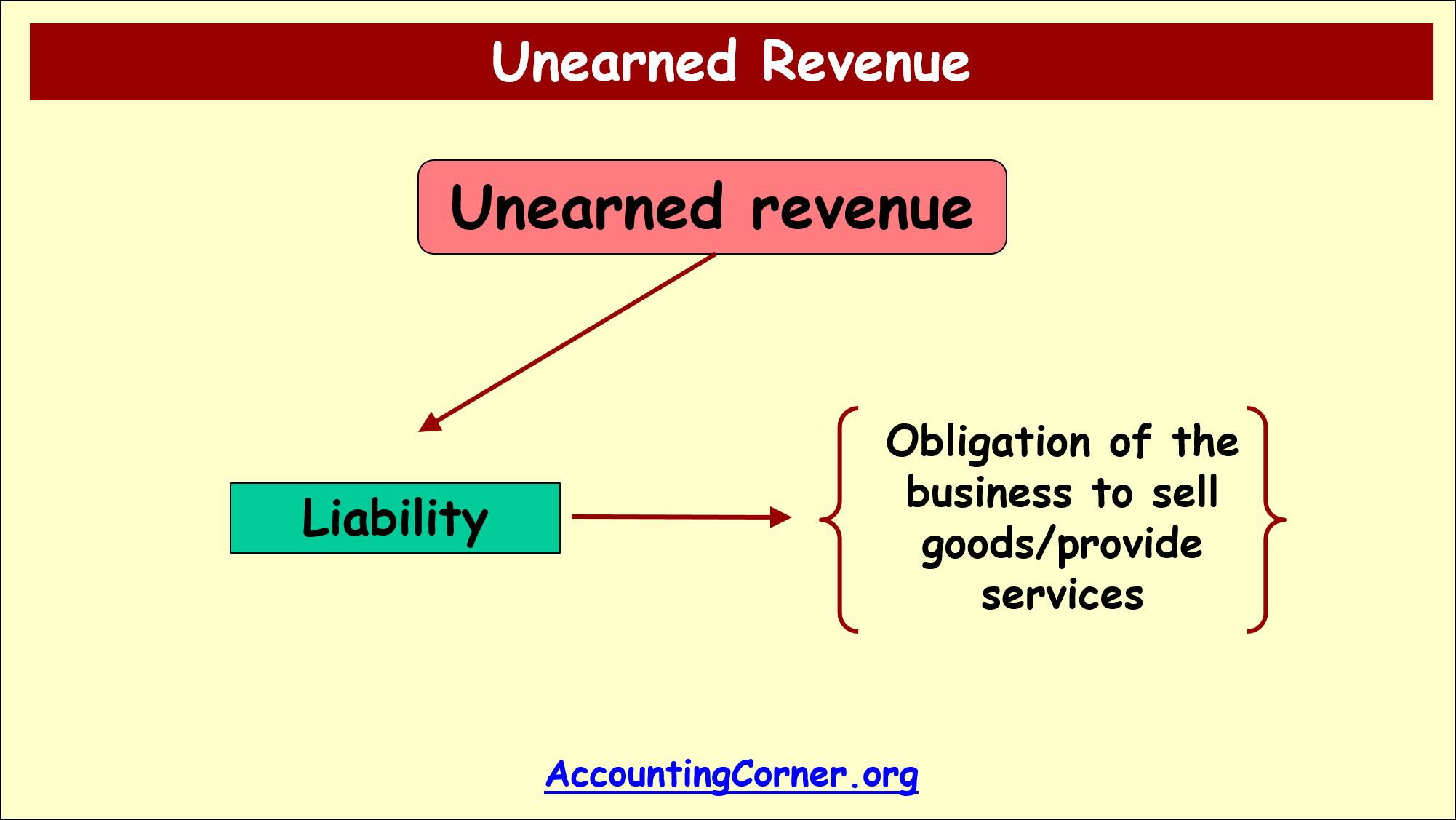

Unearned Revenue Accounting Corner

As a company earns the revenue, it reduces the balance in the unearned revenue account (with a debit) and increases the. Unearned revenue is recorded on the liabilities side of the balance sheet since the company collected cash payments upfront and.

Unearned Revenue Accounting Corner

Unearned revenue is recorded on the liabilities side of the balance sheet since the company collected cash payments upfront and. As a company earns the revenue, it reduces the balance in the unearned revenue account (with a debit) and increases the.

Unearned Revenue Definition, How To Record, Example

Unearned revenue is recorded on the liabilities side of the balance sheet since the company collected cash payments upfront and. As a company earns the revenue, it reduces the balance in the unearned revenue account (with a debit) and increases the.

Unearned revenue examples and journal entries Financial

Unearned revenue is recorded on the liabilities side of the balance sheet since the company collected cash payments upfront and. As a company earns the revenue, it reduces the balance in the unearned revenue account (with a debit) and increases the.

Unearned Revenue (Sales) on Balance Sheet Example Journal Entries

Unearned revenue is recorded on the liabilities side of the balance sheet since the company collected cash payments upfront and. As a company earns the revenue, it reduces the balance in the unearned revenue account (with a debit) and increases the.

What Is Unearned Revenue? QuickBooks Global

As a company earns the revenue, it reduces the balance in the unearned revenue account (with a debit) and increases the. Unearned revenue is recorded on the liabilities side of the balance sheet since the company collected cash payments upfront and.

What is Unearned Revenue? A Complete Guide Pareto Labs

As a company earns the revenue, it reduces the balance in the unearned revenue account (with a debit) and increases the. Unearned revenue is recorded on the liabilities side of the balance sheet since the company collected cash payments upfront and.

What is Unearned Revenue? QuickBooks Australia

As a company earns the revenue, it reduces the balance in the unearned revenue account (with a debit) and increases the. Unearned revenue is recorded on the liabilities side of the balance sheet since the company collected cash payments upfront and.

Unearned Revenue Accounting Corner

Unearned revenue is recorded on the liabilities side of the balance sheet since the company collected cash payments upfront and. As a company earns the revenue, it reduces the balance in the unearned revenue account (with a debit) and increases the.

Is unearned revenue a revenue? Leia aqui What is unearned revenue

As a company earns the revenue, it reduces the balance in the unearned revenue account (with a debit) and increases the. Unearned revenue is recorded on the liabilities side of the balance sheet since the company collected cash payments upfront and.

Unearned Revenue Is Recorded On The Liabilities Side Of The Balance Sheet Since The Company Collected Cash Payments Upfront And.

As a company earns the revenue, it reduces the balance in the unearned revenue account (with a debit) and increases the.