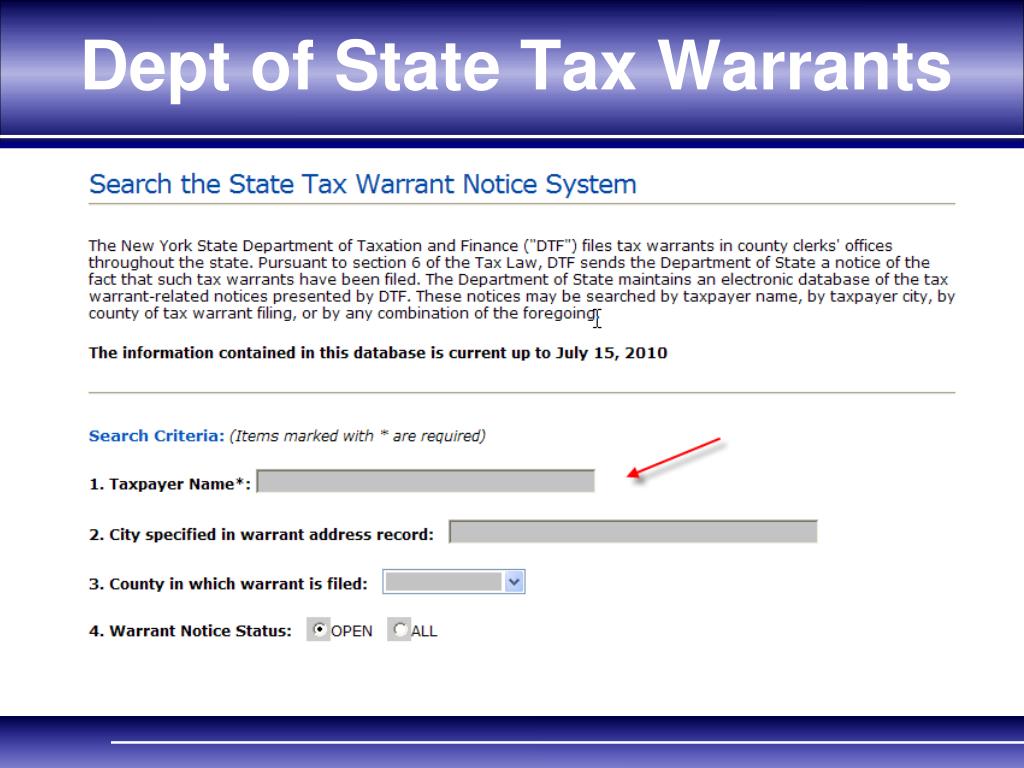

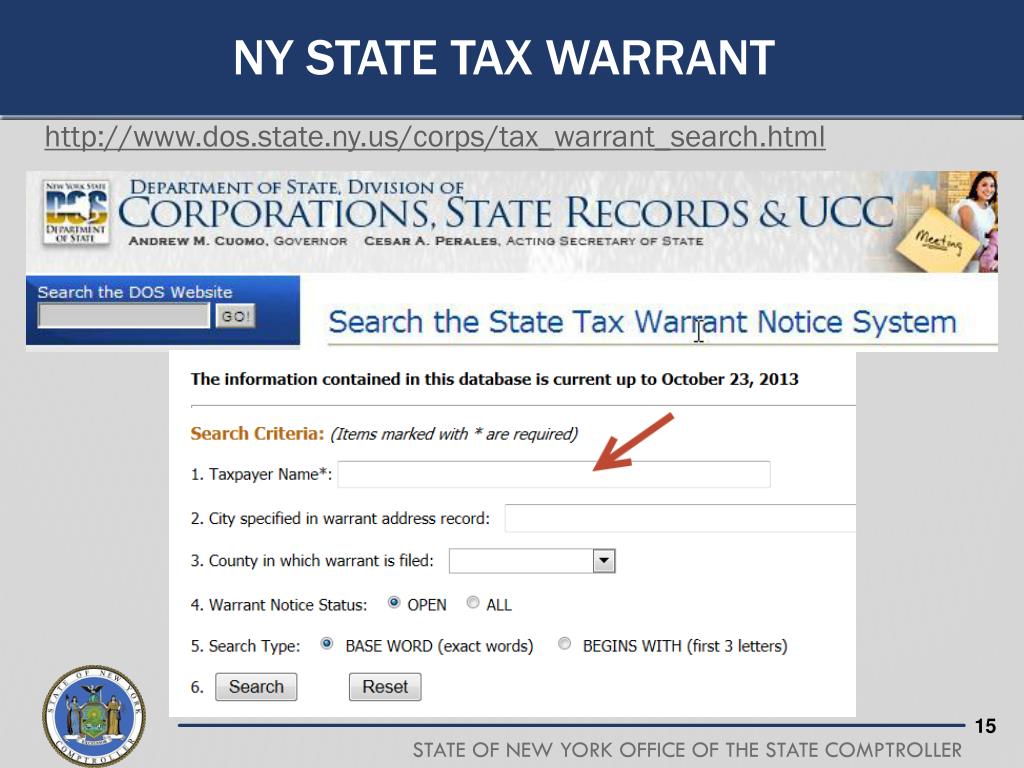

State Tax Warrant - What is a state tax warrant? When a tax debt is paid in full, the warrant is satisfied and removed from our search tool. A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes. For information on a satisfied warrant, visit. We file a tax warrant with the appropriate new york state county clerk’s office and the new york state department of state,. If you fail to pay your state taxes or resolve the past due balance within a reasonable time, the tax bureau in your. The indiana department of revenue (dor) offers the electronic exchange of tax warrants between the state of indiana and the county clerks,.

For information on a satisfied warrant, visit. The indiana department of revenue (dor) offers the electronic exchange of tax warrants between the state of indiana and the county clerks,. A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes. When a tax debt is paid in full, the warrant is satisfied and removed from our search tool. We file a tax warrant with the appropriate new york state county clerk’s office and the new york state department of state,. What is a state tax warrant? If you fail to pay your state taxes or resolve the past due balance within a reasonable time, the tax bureau in your.

What is a state tax warrant? If you fail to pay your state taxes or resolve the past due balance within a reasonable time, the tax bureau in your. When a tax debt is paid in full, the warrant is satisfied and removed from our search tool. We file a tax warrant with the appropriate new york state county clerk’s office and the new york state department of state,. The indiana department of revenue (dor) offers the electronic exchange of tax warrants between the state of indiana and the county clerks,. For information on a satisfied warrant, visit. A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes.

How To Check State Return Flatdisk24

For information on a satisfied warrant, visit. A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes. When a tax debt is paid in full, the warrant is satisfied and removed from our search tool. What is a state tax warrant? We file a.

PPT State Authorities Vendor Responsibility PowerPoint Presentation

What is a state tax warrant? We file a tax warrant with the appropriate new york state county clerk’s office and the new york state department of state,. When a tax debt is paid in full, the warrant is satisfied and removed from our search tool. For information on a satisfied warrant, visit. A tax warrant is a legal action.

New York State Tax Warrant Search How To Find Info YouTube

What is a state tax warrant? For information on a satisfied warrant, visit. We file a tax warrant with the appropriate new york state county clerk’s office and the new york state department of state,. The indiana department of revenue (dor) offers the electronic exchange of tax warrants between the state of indiana and the county clerks,. A tax warrant.

New York State Tax Warrant? [ Beware Enforcement Tactics ] YouTube

If you fail to pay your state taxes or resolve the past due balance within a reasonable time, the tax bureau in your. The indiana department of revenue (dor) offers the electronic exchange of tax warrants between the state of indiana and the county clerks,. For information on a satisfied warrant, visit. A tax warrant is a legal action that.

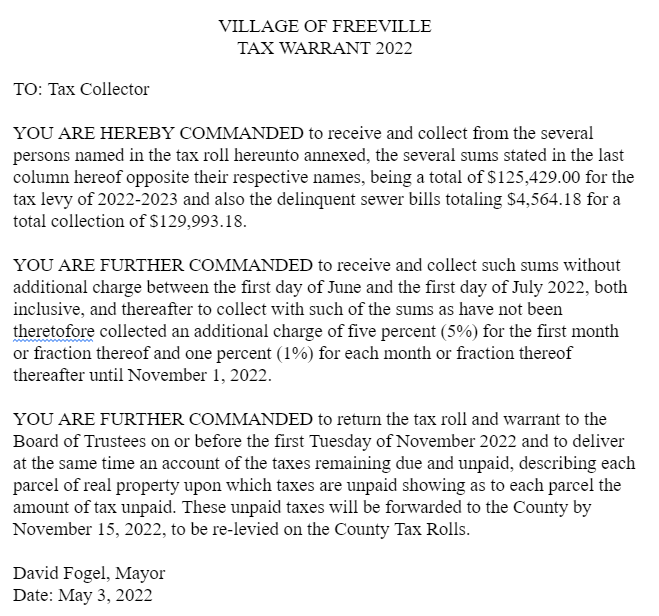

Legal Notice Tax Warrant Freeville NY

When a tax debt is paid in full, the warrant is satisfied and removed from our search tool. What is a state tax warrant? If you fail to pay your state taxes or resolve the past due balance within a reasonable time, the tax bureau in your. The indiana department of revenue (dor) offers the electronic exchange of tax warrants.

Warrant Taxpayer Taxes

For information on a satisfied warrant, visit. A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes. The indiana department of revenue (dor) offers the electronic exchange of tax warrants between the state of indiana and the county clerks,. We file a tax warrant.

PPT Vendor Responsibility 101 PowerPoint Presentation, free download

If you fail to pay your state taxes or resolve the past due balance within a reasonable time, the tax bureau in your. When a tax debt is paid in full, the warrant is satisfied and removed from our search tool. The indiana department of revenue (dor) offers the electronic exchange of tax warrants between the state of indiana and.

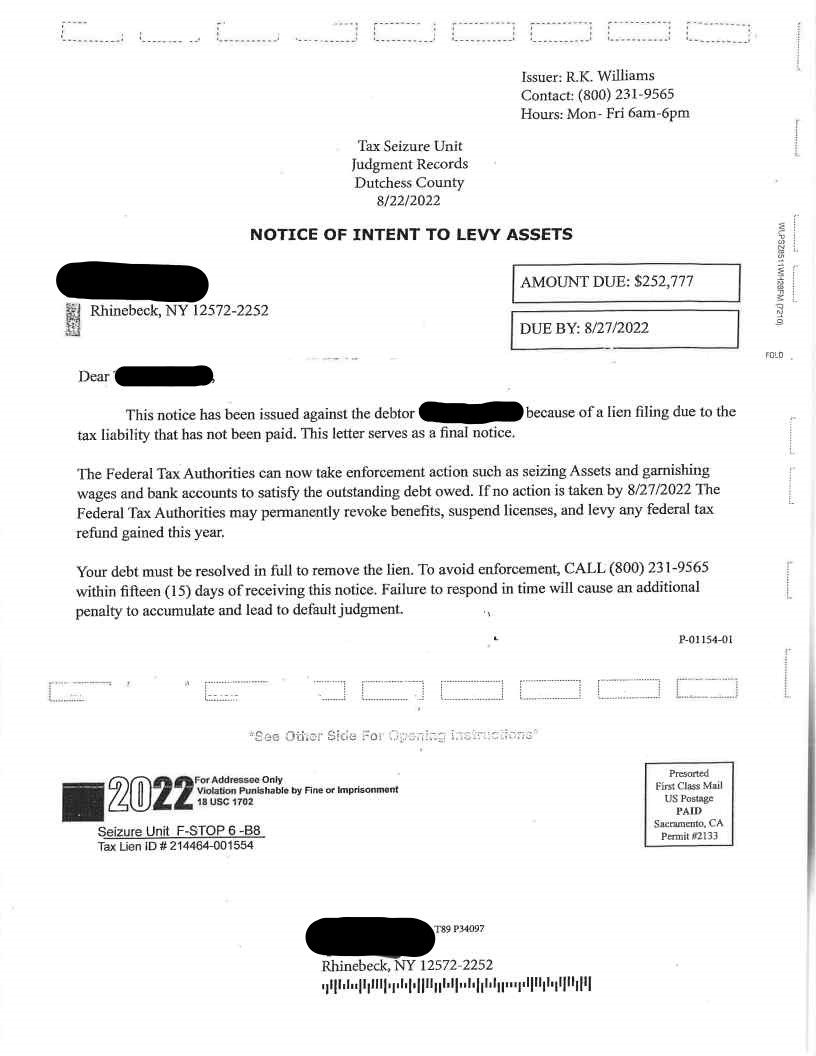

to Jefferson County, New York Scam Alerts

What is a state tax warrant? For information on a satisfied warrant, visit. We file a tax warrant with the appropriate new york state county clerk’s office and the new york state department of state,. A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your.

How to redeem California tax return warrants? Personal Finance

What is a state tax warrant? The indiana department of revenue (dor) offers the electronic exchange of tax warrants between the state of indiana and the county clerks,. If you fail to pay your state taxes or resolve the past due balance within a reasonable time, the tax bureau in your. We file a tax warrant with the appropriate new.

New York State Tax Collections When NYS Wants Back Due Tax Debt

For information on a satisfied warrant, visit. When a tax debt is paid in full, the warrant is satisfied and removed from our search tool. What is a state tax warrant? If you fail to pay your state taxes or resolve the past due balance within a reasonable time, the tax bureau in your. We file a tax warrant with.

We File A Tax Warrant With The Appropriate New York State County Clerk’s Office And The New York State Department Of State,.

The indiana department of revenue (dor) offers the electronic exchange of tax warrants between the state of indiana and the county clerks,. When a tax debt is paid in full, the warrant is satisfied and removed from our search tool. What is a state tax warrant? If you fail to pay your state taxes or resolve the past due balance within a reasonable time, the tax bureau in your.

For Information On A Satisfied Warrant, Visit.

A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes.

![New York State Tax Warrant? [ Beware Enforcement Tactics ] YouTube](https://i.ytimg.com/vi/zoggufKNL5c/maxresdefault.jpg)