Spx Options Calendar Spread - In this case study, i want to share a recent spx options trade in which i combined calendar and diagonal spreads. I trade a lot of calendar spreads, and was looking to build a trade setup using 0dte calendar spreads in spx for daily trades. Spx 15 day calendar spread. A calendar spread is an options strategy that involves buying and selling options on the same underlying security with the same strike price.

In this case study, i want to share a recent spx options trade in which i combined calendar and diagonal spreads. Spx 15 day calendar spread. A calendar spread is an options strategy that involves buying and selling options on the same underlying security with the same strike price. I trade a lot of calendar spreads, and was looking to build a trade setup using 0dte calendar spreads in spx for daily trades.

Spx 15 day calendar spread. A calendar spread is an options strategy that involves buying and selling options on the same underlying security with the same strike price. In this case study, i want to share a recent spx options trade in which i combined calendar and diagonal spreads. I trade a lot of calendar spreads, and was looking to build a trade setup using 0dte calendar spreads in spx for daily trades.

Combining Calendar Spreads with Butterfly Spreads SPX Options YouTube

A calendar spread is an options strategy that involves buying and selling options on the same underlying security with the same strike price. Spx 15 day calendar spread. In this case study, i want to share a recent spx options trade in which i combined calendar and diagonal spreads. I trade a lot of calendar spreads, and was looking to.

Double calendar spread SPX r/options

In this case study, i want to share a recent spx options trade in which i combined calendar and diagonal spreads. I trade a lot of calendar spreads, and was looking to build a trade setup using 0dte calendar spreads in spx for daily trades. Spx 15 day calendar spread. A calendar spread is an options strategy that involves buying.

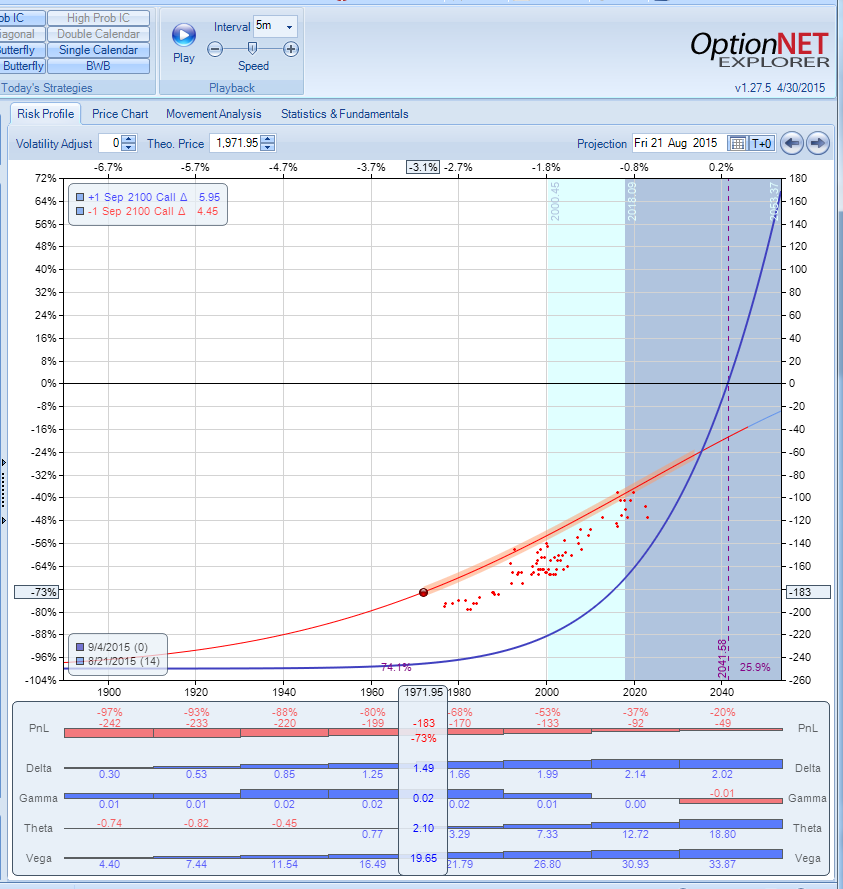

How to Trade SPX Options SPX Calendar Spread Example

A calendar spread is an options strategy that involves buying and selling options on the same underlying security with the same strike price. I trade a lot of calendar spreads, and was looking to build a trade setup using 0dte calendar spreads in spx for daily trades. In this case study, i want to share a recent spx options trade.

Holding Calendar Spreads for Swing Trading SPX Options YouTube

I trade a lot of calendar spreads, and was looking to build a trade setup using 0dte calendar spreads in spx for daily trades. Spx 15 day calendar spread. A calendar spread is an options strategy that involves buying and selling options on the same underlying security with the same strike price. In this case study, i want to share.

Calendar Spread Options Strategy Forex Systems, Research, And Reviews

I trade a lot of calendar spreads, and was looking to build a trade setup using 0dte calendar spreads in spx for daily trades. A calendar spread is an options strategy that involves buying and selling options on the same underlying security with the same strike price. Spx 15 day calendar spread. In this case study, i want to share.

Selecting an option strategy and an SPX directional calendar spread

A calendar spread is an options strategy that involves buying and selling options on the same underlying security with the same strike price. I trade a lot of calendar spreads, and was looking to build a trade setup using 0dte calendar spreads in spx for daily trades. Spx 15 day calendar spread. In this case study, i want to share.

Short Term Calendars in SPX Dan Sheridan YouTube

A calendar spread is an options strategy that involves buying and selling options on the same underlying security with the same strike price. Spx 15 day calendar spread. I trade a lot of calendar spreads, and was looking to build a trade setup using 0dte calendar spreads in spx for daily trades. In this case study, i want to share.

Calendar Call Option Spread [SPX] YouTube

A calendar spread is an options strategy that involves buying and selling options on the same underlying security with the same strike price. In this case study, i want to share a recent spx options trade in which i combined calendar and diagonal spreads. I trade a lot of calendar spreads, and was looking to build a trade setup using.

SPX Calendar Spread How I Made a 540 Profit with Options Trading

I trade a lot of calendar spreads, and was looking to build a trade setup using 0dte calendar spreads in spx for daily trades. In this case study, i want to share a recent spx options trade in which i combined calendar and diagonal spreads. A calendar spread is an options strategy that involves buying and selling options on the.

SPX calendar spread YouTube

Spx 15 day calendar spread. In this case study, i want to share a recent spx options trade in which i combined calendar and diagonal spreads. A calendar spread is an options strategy that involves buying and selling options on the same underlying security with the same strike price. I trade a lot of calendar spreads, and was looking to.

A Calendar Spread Is An Options Strategy That Involves Buying And Selling Options On The Same Underlying Security With The Same Strike Price.

In this case study, i want to share a recent spx options trade in which i combined calendar and diagonal spreads. Spx 15 day calendar spread. I trade a lot of calendar spreads, and was looking to build a trade setup using 0dte calendar spreads in spx for daily trades.

![Calendar Call Option Spread [SPX] YouTube](https://i.ytimg.com/vi/em03gM2jnxs/maxresdefault.jpg)