Payroll Liabilities Balance Sheet - Why is the reconciliation of payroll liabilities so important? If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities. Learn what the different types of payroll liabilities there are and how to record them. What do auditors want to see to provide assurance that payroll liability account.

Learn what the different types of payroll liabilities there are and how to record them. What do auditors want to see to provide assurance that payroll liability account. If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities. Why is the reconciliation of payroll liabilities so important?

Why is the reconciliation of payroll liabilities so important? If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities. Learn what the different types of payroll liabilities there are and how to record them. What do auditors want to see to provide assurance that payroll liability account.

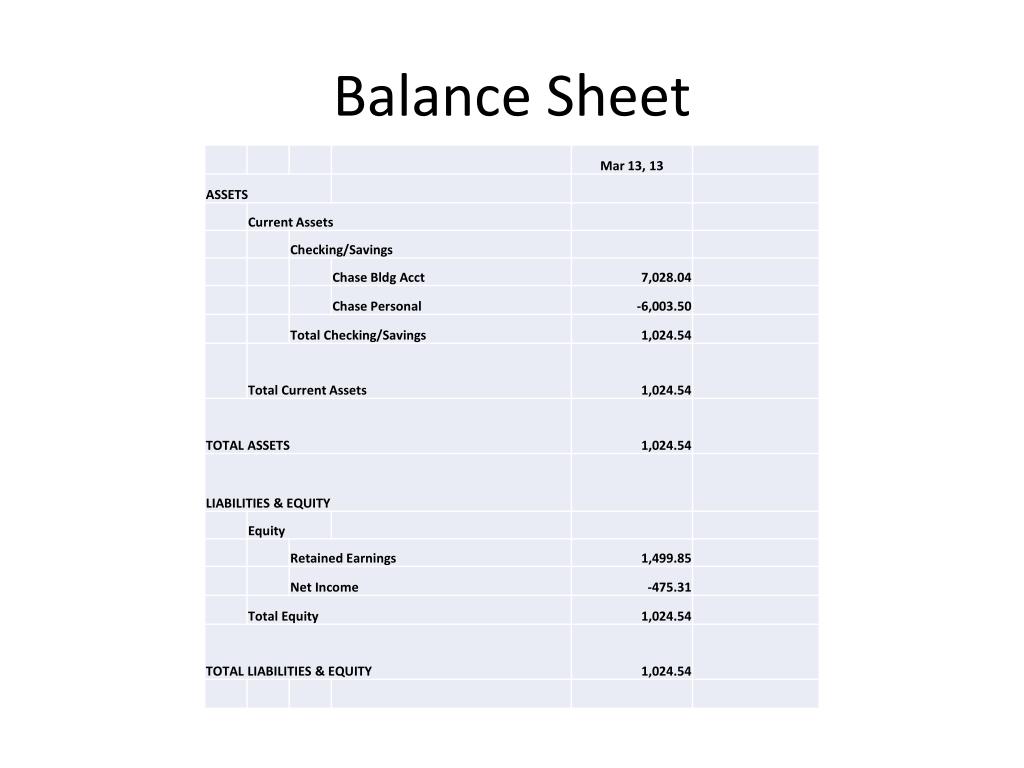

Payroll With Balance Sheet

What do auditors want to see to provide assurance that payroll liability account. If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities. Learn what the different types of payroll liabilities there are and how to record them. Why is the reconciliation of payroll liabilities so important?

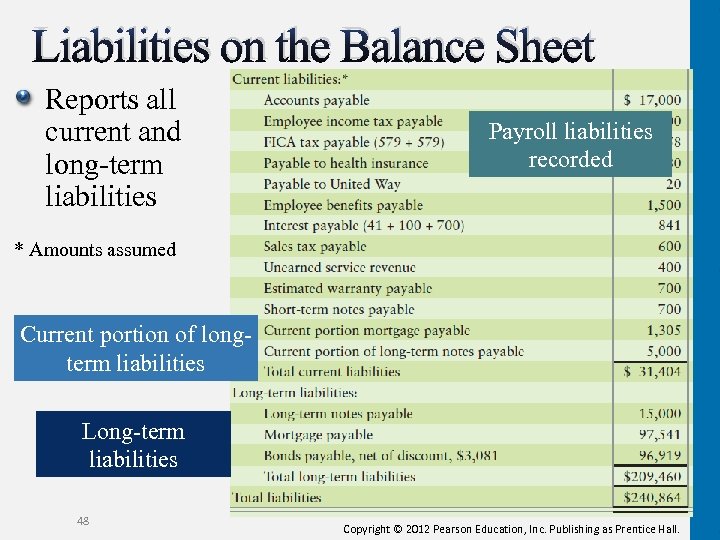

Understanding Liabilities Reading a Balance Sheet

If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities. Why is the reconciliation of payroll liabilities so important? Learn what the different types of payroll liabilities there are and how to record them. What do auditors want to see to provide assurance that payroll liability account.

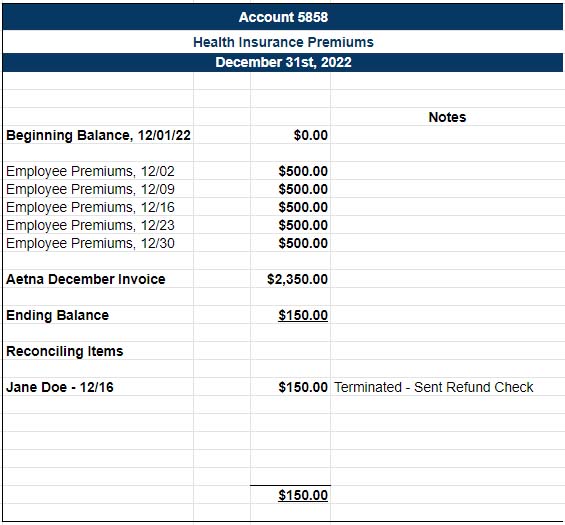

How to Do Payroll Reconciliation for Small Businesses

What do auditors want to see to provide assurance that payroll liability account. If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities. Learn what the different types of payroll liabilities there are and how to record them. Why is the reconciliation of payroll liabilities so important?

How to Read a Balance Sheet (Free Download) Poindexter Blog

If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities. Why is the reconciliation of payroll liabilities so important? Learn what the different types of payroll liabilities there are and how to record them. What do auditors want to see to provide assurance that payroll liability account.

What is the Difference Between Payroll Expenses and Payroll Liabilities

If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities. Learn what the different types of payroll liabilities there are and how to record them. What do auditors want to see to provide assurance that payroll liability account. Why is the reconciliation of payroll liabilities so important?

PPT PAYROLL ACCOUNTING Chapter 11 2013 CPP REVIEW CLASS CHAPTER 11

If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities. Why is the reconciliation of payroll liabilities so important? Learn what the different types of payroll liabilities there are and how to record them. What do auditors want to see to provide assurance that payroll liability account.

LongTerm Liabilities Bonds Payable and Classification of Liabilities

What do auditors want to see to provide assurance that payroll liability account. If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities. Why is the reconciliation of payroll liabilities so important? Learn what the different types of payroll liabilities there are and how to record them.

Liabilities Side of Balance Sheet

Why is the reconciliation of payroll liabilities so important? If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities. Learn what the different types of payroll liabilities there are and how to record them. What do auditors want to see to provide assurance that payroll liability account.

38 Free Balance Sheet Templates & Examples ᐅ TemplateLab

Learn what the different types of payroll liabilities there are and how to record them. If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities. What do auditors want to see to provide assurance that payroll liability account. Why is the reconciliation of payroll liabilities so important?

Balance sheet example track assets and liabilities

If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities. What do auditors want to see to provide assurance that payroll liability account. Learn what the different types of payroll liabilities there are and how to record them. Why is the reconciliation of payroll liabilities so important?

Learn What The Different Types Of Payroll Liabilities There Are And How To Record Them.

Why is the reconciliation of payroll liabilities so important? If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities. What do auditors want to see to provide assurance that payroll liability account.