Lisa Has Recently Bought A Fixed Annuity - The disadvantage of owning a fixed annuity, such as lisa's, is that during periods of inflation, she will experience a decrease in the purchasing. Study with quizlet and memorize flashcards containing terms like 1. During periods of inflation, annuitants will experience a decrease in purchasing power of their payments. A fixed annuity provides a predetermined, regular payment for the duration of the annuitant’s life (. The disadvantage of owning a fixed annuity is that during periods of inflation, annuitants will experience a decrease in purchasing power of. The disadvantage of owning a fixed annuity is that during periods of inflation, annuitants will experience a decrease in purchasing power of. The taxable portion of each annuity payment is calculated using. A fixed annuity is a type of financial product that pays a guaranteed amount of money over a set period of time or for the lifetime of. Study with quizlet and memorize flashcards containing terms like lisa has recently bought a fixed annuity. Which of these is considered to.

A fixed annuity is a type of financial product that pays a guaranteed amount of money over a set period of time or for the lifetime of. A fixed annuity provides a predetermined, regular payment for the duration of the annuitant’s life (. The disadvantage of owning a fixed annuity, such as lisa's, is that during periods of inflation, she will experience a decrease in the purchasing. The disadvantage of owning a fixed annuity is that during periods of inflation, annuitants will experience a decrease in purchasing power of. During periods of inflation, annuitants will experience a decrease in purchasing power of their payments. The disadvantage of owning a fixed annuity is that during periods of inflation, annuitants will experience a decrease in purchasing power of. The taxable portion of each annuity payment is calculated using. Study with quizlet and memorize flashcards containing terms like 1. Study with quizlet and memorize flashcards containing terms like lisa has recently bought a fixed annuity. Lisa has recently bought a.

The disadvantage of owning a fixed annuity is that during periods of inflation, annuitants will experience a decrease in purchasing power of. A fixed annuity is a type of financial product that pays a guaranteed amount of money over a set period of time or for the lifetime of. A fixed annuity provides a predetermined, regular payment for the duration of the annuitant’s life (. The disadvantage of owning a fixed annuity, such as lisa's, is that during periods of inflation, she will experience a decrease in the purchasing. The taxable portion of each annuity payment is calculated using. The disadvantage of owning a fixed annuity is that during periods of inflation, annuitants will experience a decrease in purchasing power of. Lisa has recently bought a. During periods of inflation, annuitants will experience a decrease in purchasing power of their payments. Which of these is considered to. Study with quizlet and memorize flashcards containing terms like lisa has recently bought a fixed annuity.

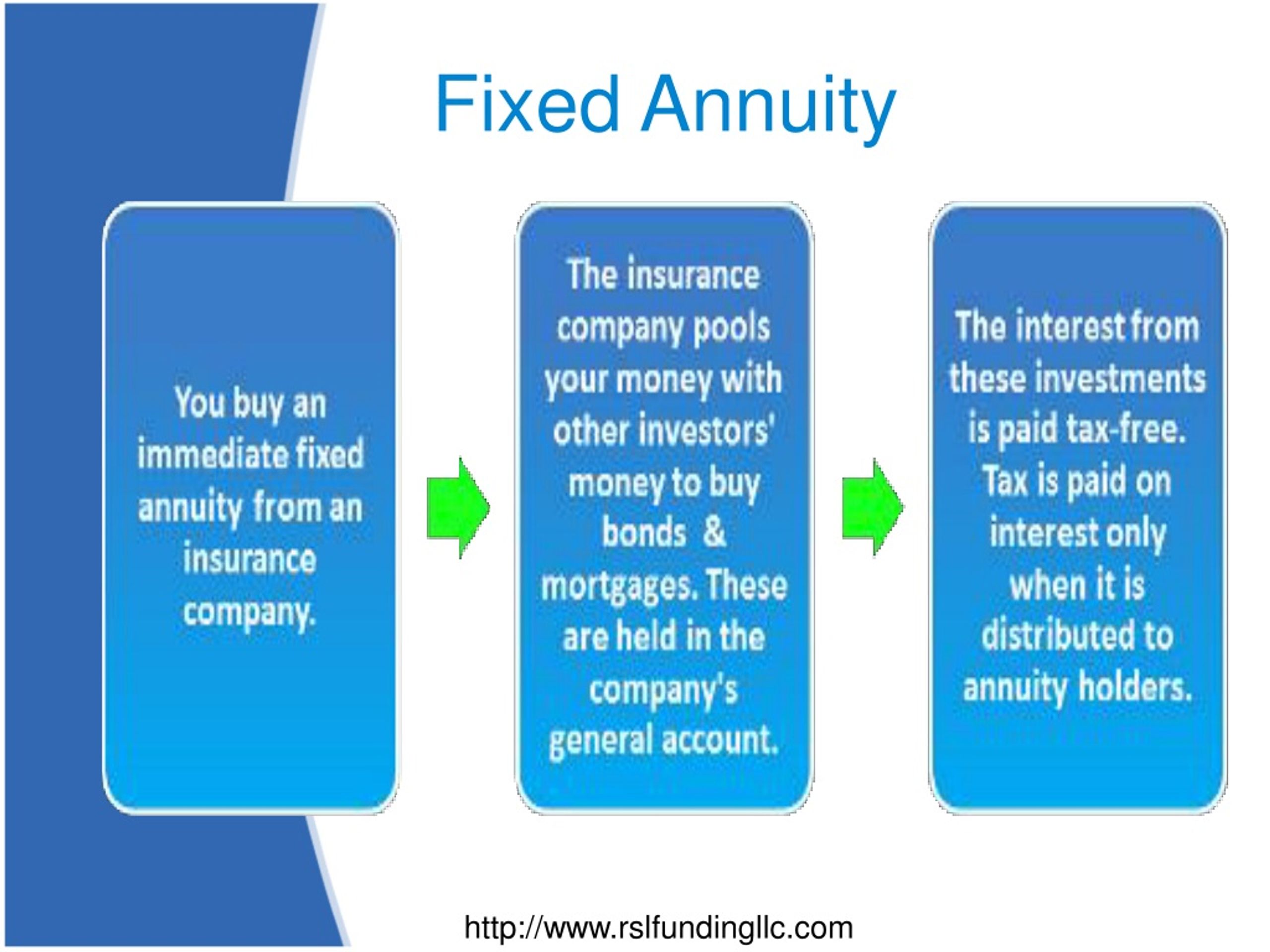

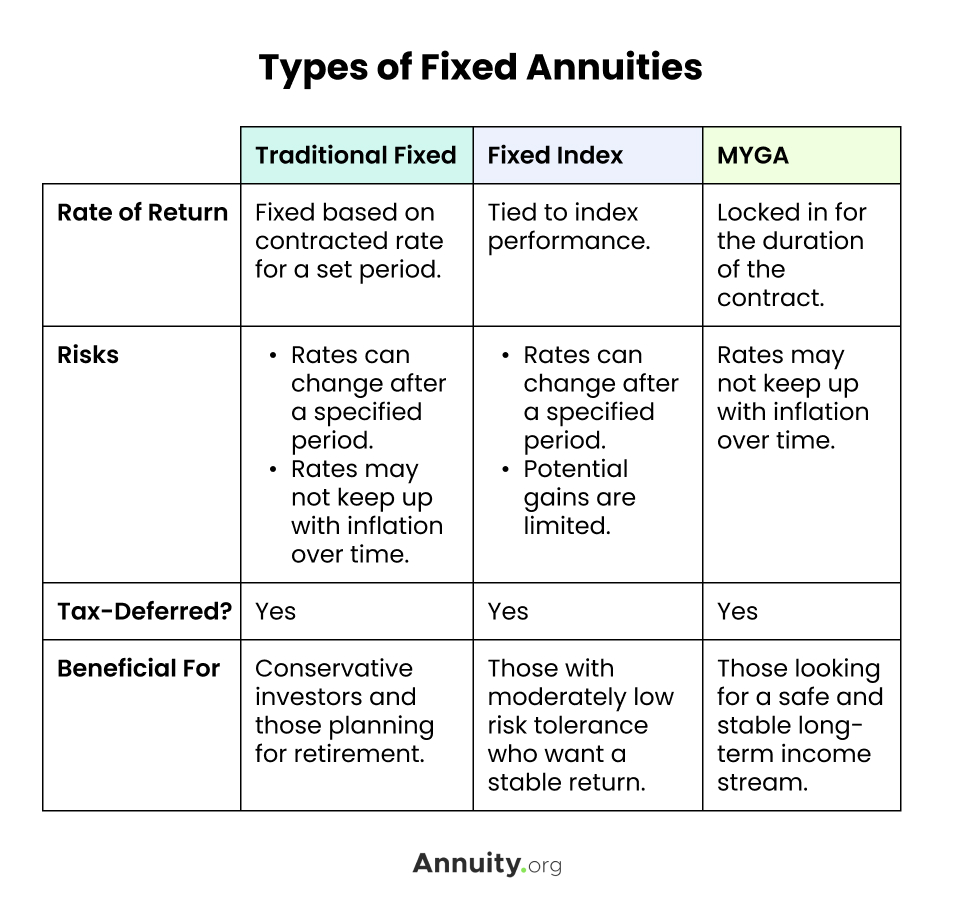

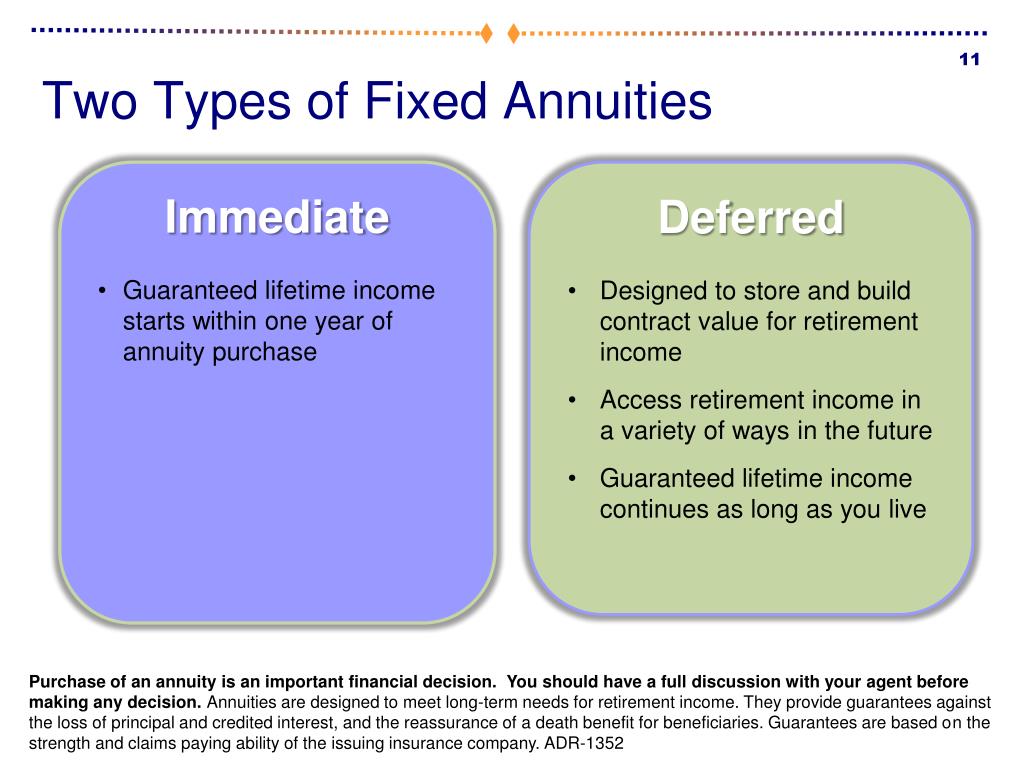

Fixed Annuities Introduction to Fixed Annuities

The disadvantage of owning a fixed annuity is that during periods of inflation, annuitants will experience a decrease in purchasing power of. During periods of inflation, annuitants will experience a decrease in purchasing power of their payments. Lisa has recently bought a. A fixed annuity is a type of financial product that pays a guaranteed amount of money over a.

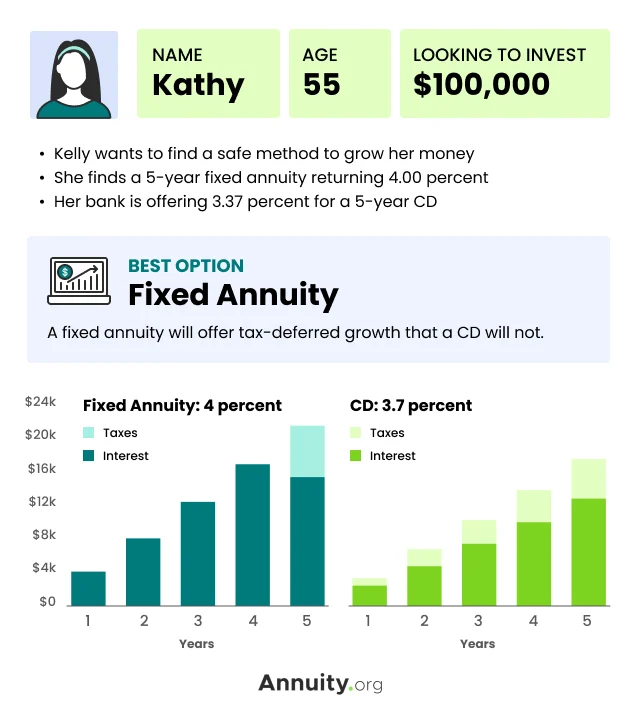

What Is a Fixed Annuity & How Does It Work?

During periods of inflation, annuitants will experience a decrease in purchasing power of their payments. A fixed annuity is a type of financial product that pays a guaranteed amount of money over a set period of time or for the lifetime of. The disadvantage of owning a fixed annuity is that during periods of inflation, annuitants will experience a decrease.

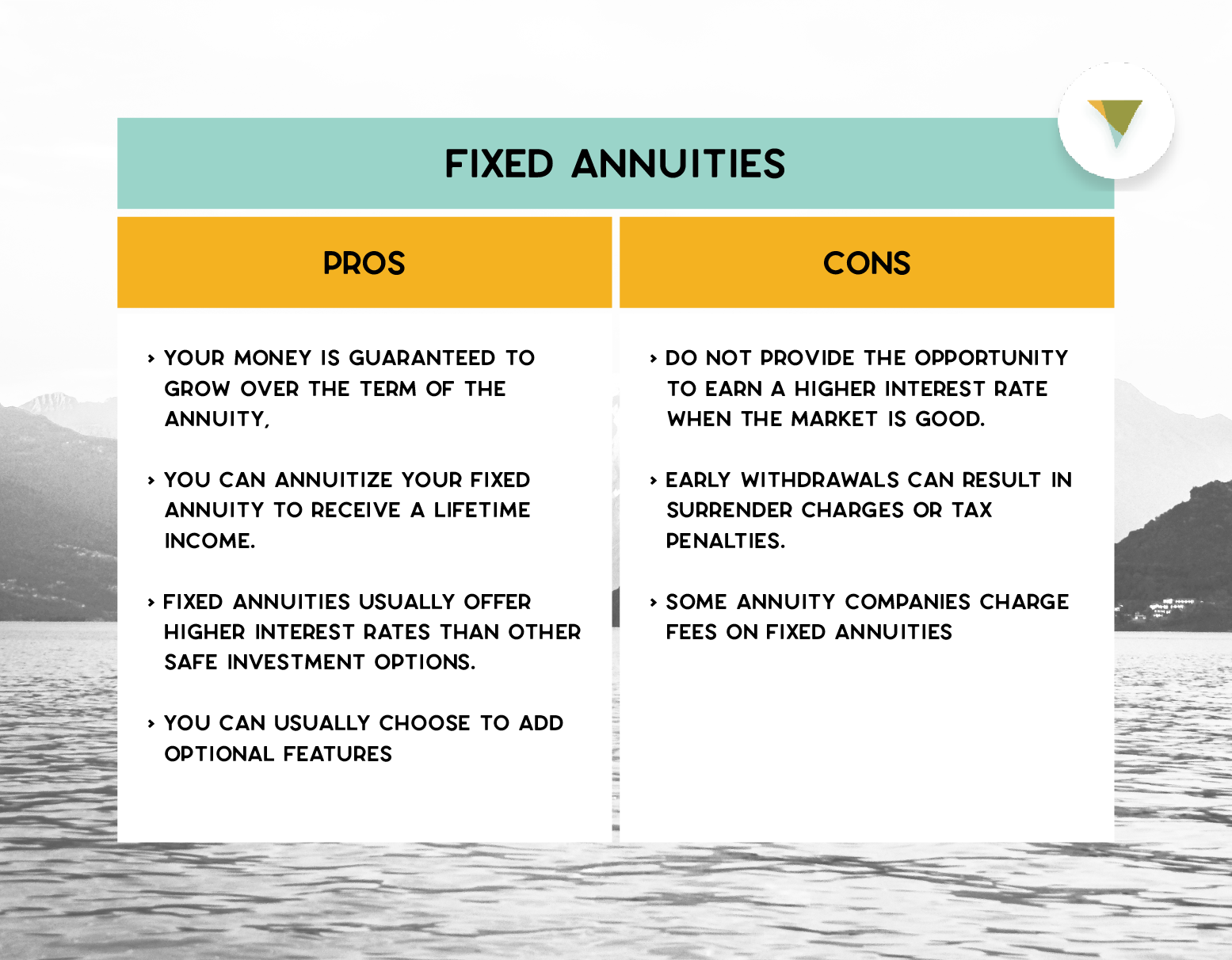

Fixed Annuities Definition, How It Works, Types, Pros, & Cons

The disadvantage of owning a fixed annuity, such as lisa's, is that during periods of inflation, she will experience a decrease in the purchasing. Study with quizlet and memorize flashcards containing terms like lisa has recently bought a fixed annuity. A fixed annuity is a type of financial product that pays a guaranteed amount of money over a set period.

PPT Annuity & Planing PowerPoint Presentation, free download ID886379

Study with quizlet and memorize flashcards containing terms like 1. Study with quizlet and memorize flashcards containing terms like lisa has recently bought a fixed annuity. During periods of inflation, annuitants will experience a decrease in purchasing power of their payments. A fixed annuity provides a predetermined, regular payment for the duration of the annuitant’s life (. The disadvantage of.

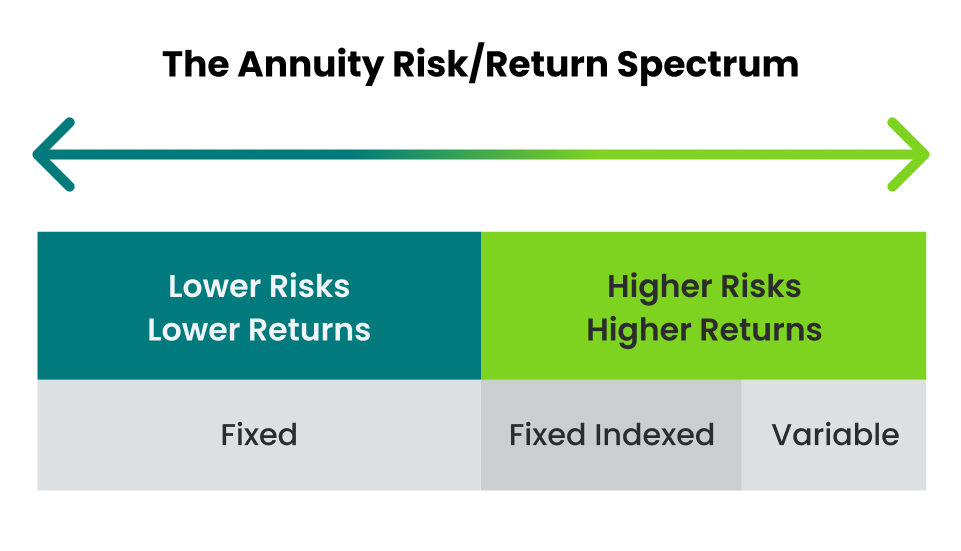

How Does An Indexed Annuity Differ From A Fixed Annuity?

Which of these is considered to. A fixed annuity provides a predetermined, regular payment for the duration of the annuitant’s life (. The disadvantage of owning a fixed annuity, such as lisa's, is that during periods of inflation, she will experience a decrease in the purchasing. The disadvantage of owning a fixed annuity is that during periods of inflation, annuitants.

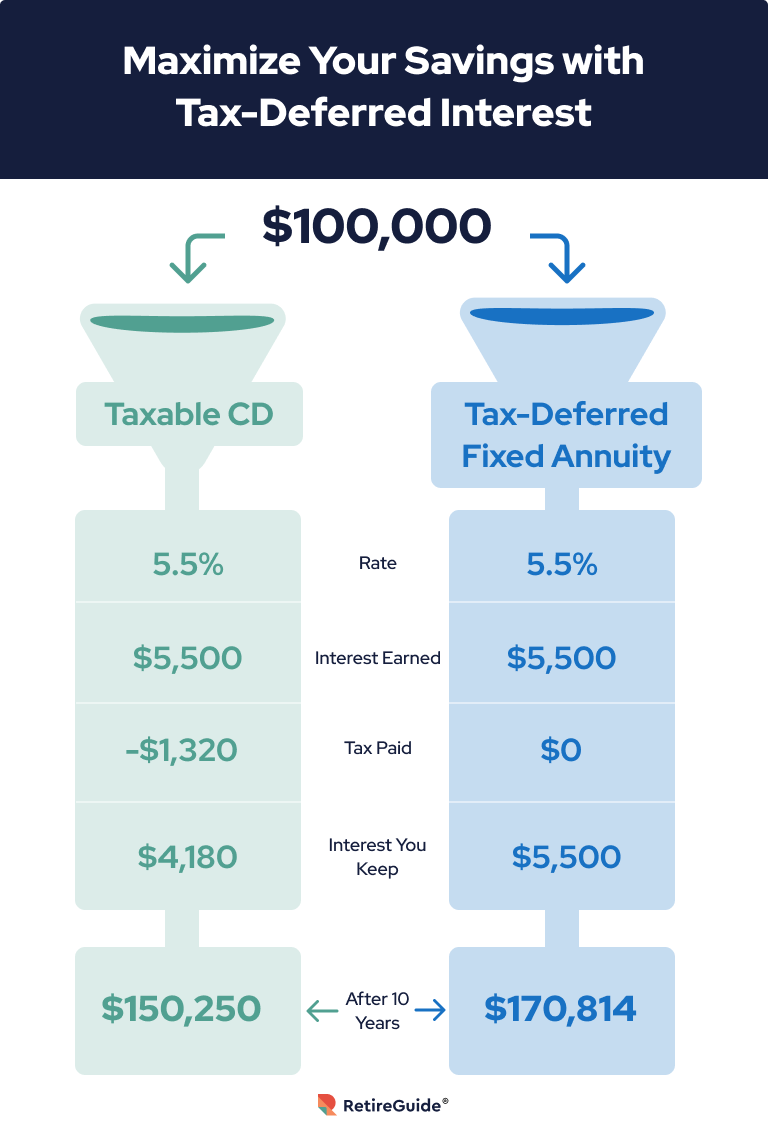

Fixed Annuities LowRisk Product, Guaranteed Returns

Study with quizlet and memorize flashcards containing terms like lisa has recently bought a fixed annuity. The disadvantage of owning a fixed annuity, such as lisa's, is that during periods of inflation, she will experience a decrease in the purchasing. Study with quizlet and memorize flashcards containing terms like 1. A fixed annuity provides a predetermined, regular payment for the.

Fixed Annuity What are Fixed Annuities & How Do They Work?

A fixed annuity is a type of financial product that pays a guaranteed amount of money over a set period of time or for the lifetime of. Study with quizlet and memorize flashcards containing terms like 1. The disadvantage of owning a fixed annuity is that during periods of inflation, annuitants will experience a decrease in purchasing power of. The.

Best Current Fixed Annuity Rates May 2025

The disadvantage of owning a fixed annuity, such as lisa's, is that during periods of inflation, she will experience a decrease in the purchasing. The disadvantage of owning a fixed annuity is that during periods of inflation, annuitants will experience a decrease in purchasing power of. Which of these is considered to. The disadvantage of owning a fixed annuity is.

PPT A Closer Look at Fixed Annuities PowerPoint Presentation, free

A fixed annuity provides a predetermined, regular payment for the duration of the annuitant’s life (. A fixed annuity is a type of financial product that pays a guaranteed amount of money over a set period of time or for the lifetime of. Study with quizlet and memorize flashcards containing terms like lisa has recently bought a fixed annuity. The.

What Is a Fixed Annuity? Liberty Group, LLC

Study with quizlet and memorize flashcards containing terms like lisa has recently bought a fixed annuity. Study with quizlet and memorize flashcards containing terms like 1. The disadvantage of owning a fixed annuity is that during periods of inflation, annuitants will experience a decrease in purchasing power of. The taxable portion of each annuity payment is calculated using. Which of.

The Disadvantage Of Owning A Fixed Annuity Is That During Periods Of Inflation, Annuitants Will Experience A Decrease In Purchasing Power Of.

Which of these is considered to. Study with quizlet and memorize flashcards containing terms like lisa has recently bought a fixed annuity. Study with quizlet and memorize flashcards containing terms like 1. The disadvantage of owning a fixed annuity, such as lisa's, is that during periods of inflation, she will experience a decrease in the purchasing.

During Periods Of Inflation, Annuitants Will Experience A Decrease In Purchasing Power Of Their Payments.

The disadvantage of owning a fixed annuity is that during periods of inflation, annuitants will experience a decrease in purchasing power of. Lisa has recently bought a. A fixed annuity provides a predetermined, regular payment for the duration of the annuitant’s life (. A fixed annuity is a type of financial product that pays a guaranteed amount of money over a set period of time or for the lifetime of.