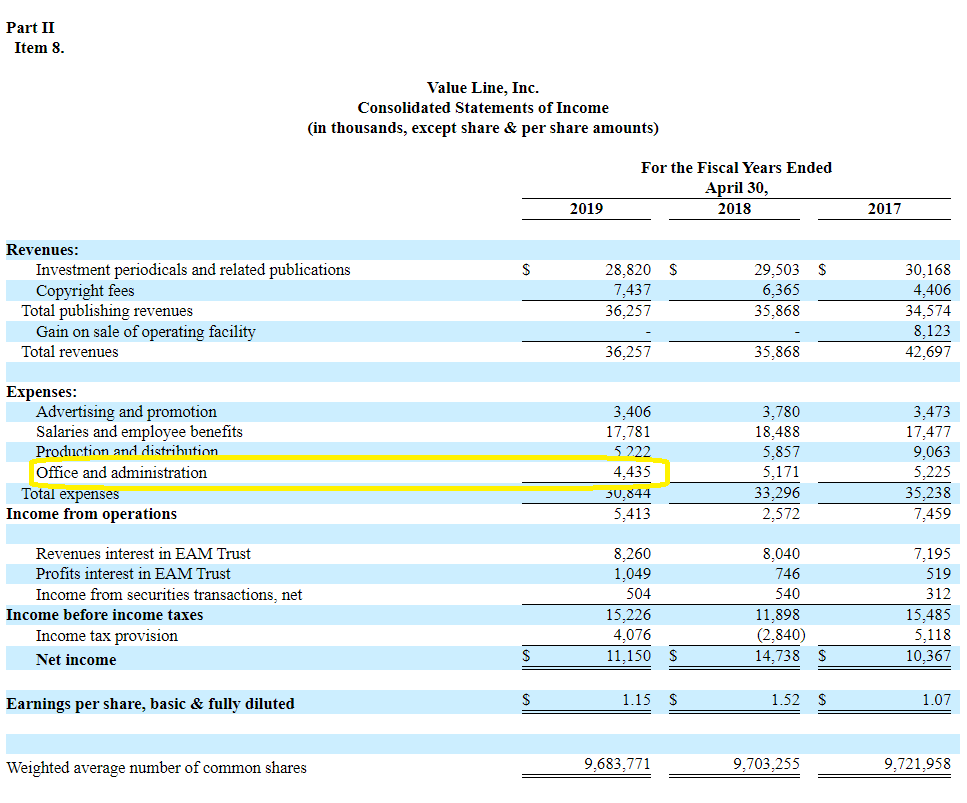

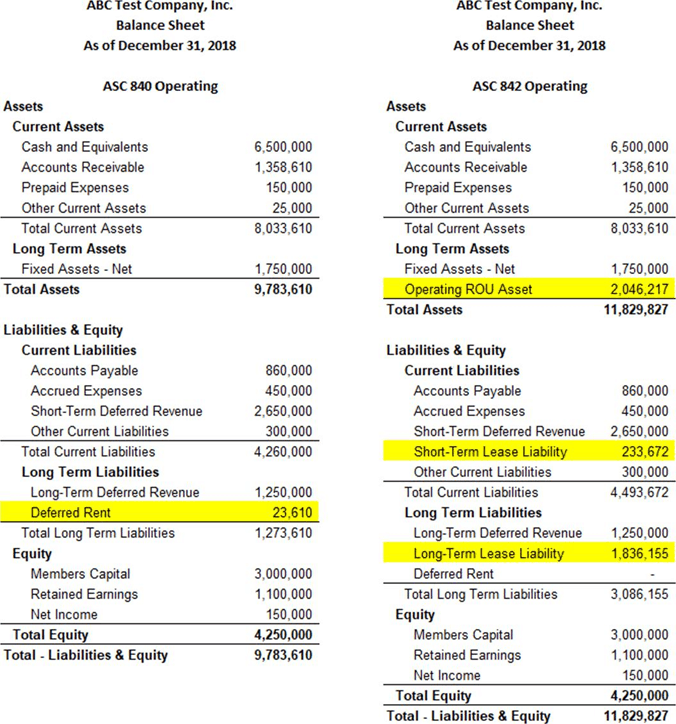

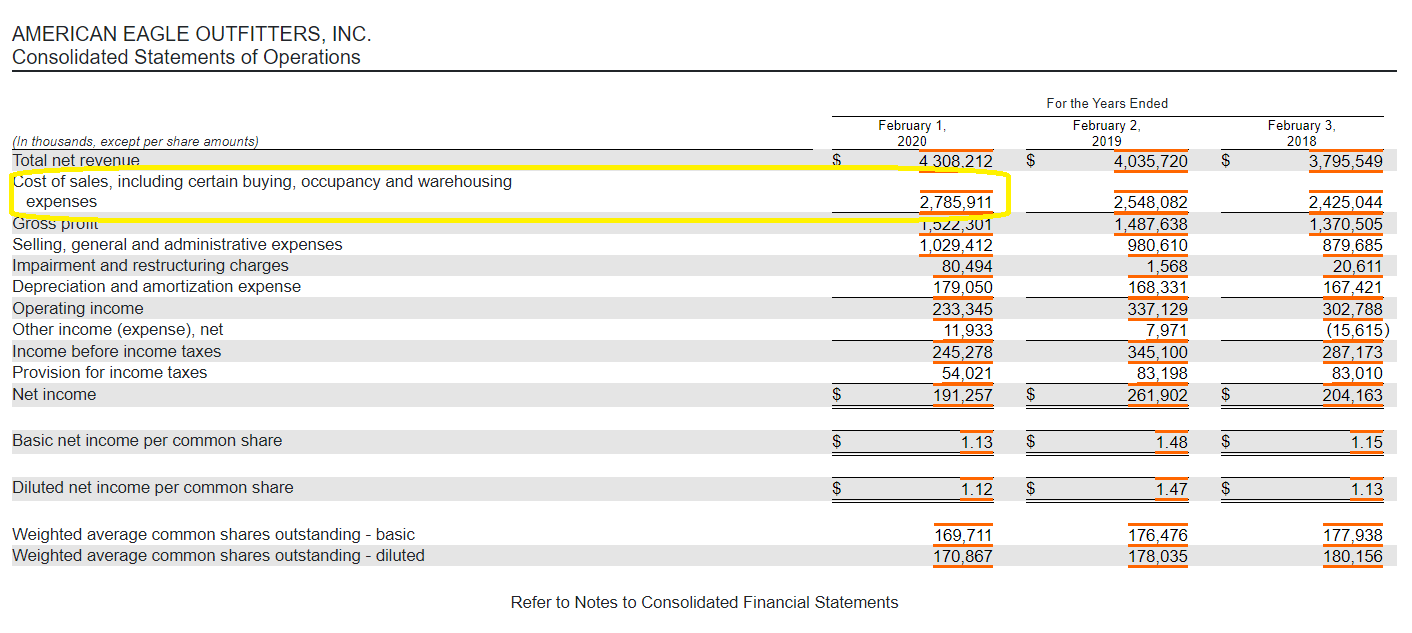

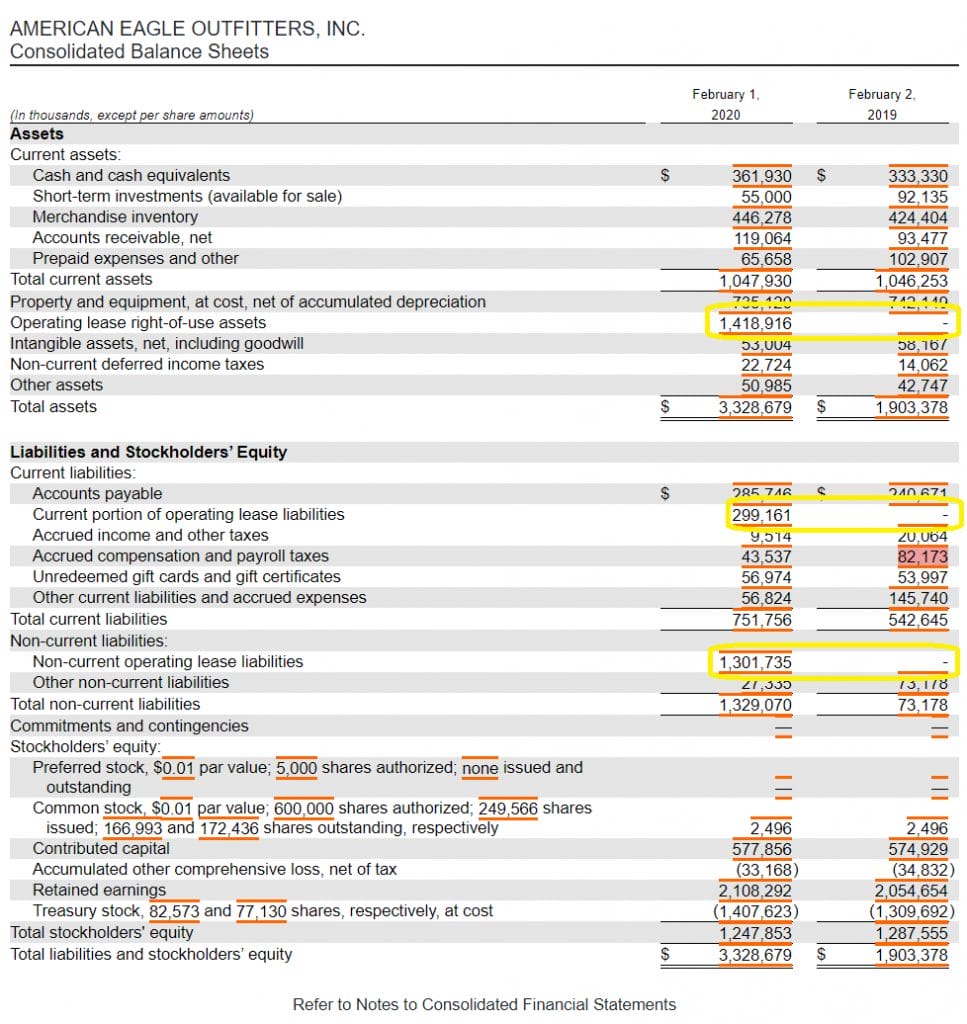

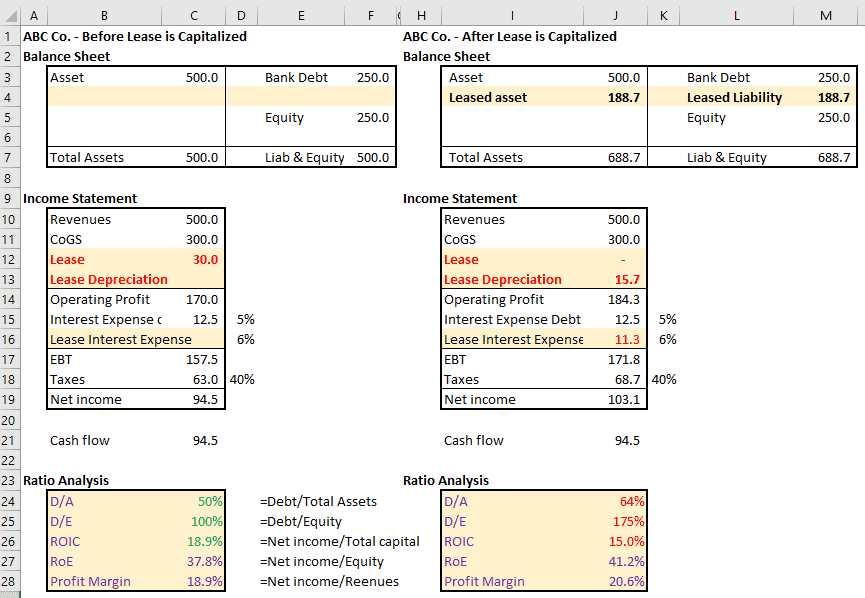

Lease Liability On Balance Sheet - Recently, accounting standards started requiring companies and businesses to show operating leases on their balance sheet. For leases, whether financial or operating, the assets and liabilities also reconcile. Because the company isn’t paying these. Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet.

Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet. Because the company isn’t paying these. For leases, whether financial or operating, the assets and liabilities also reconcile. Recently, accounting standards started requiring companies and businesses to show operating leases on their balance sheet.

For leases, whether financial or operating, the assets and liabilities also reconcile. Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet. Because the company isn’t paying these. Recently, accounting standards started requiring companies and businesses to show operating leases on their balance sheet.

Accounting for Operating Leases in the Balance Sheet Simply Explained

For leases, whether financial or operating, the assets and liabilities also reconcile. Because the company isn’t paying these. Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet. Recently, accounting standards started requiring companies and businesses to show operating leases on their balance sheet.

Lease Liabilities The True Impact on the Balance Sheet

For leases, whether financial or operating, the assets and liabilities also reconcile. Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet. Because the company isn’t paying these. Recently, accounting standards started requiring companies and businesses to show operating leases on their balance sheet.

Accounting for Operating Leases in the Balance Sheet Simply Explained

Because the company isn’t paying these. Recently, accounting standards started requiring companies and businesses to show operating leases on their balance sheet. Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet. For leases, whether financial or operating, the assets and liabilities also reconcile.

ASC 842 Balance Sheet Guide with Examples Visual Lease

Recently, accounting standards started requiring companies and businesses to show operating leases on their balance sheet. For leases, whether financial or operating, the assets and liabilities also reconcile. Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet. Because the company isn’t paying these.

Accounting for Operating Leases in the Balance Sheet Simply Explained

Because the company isn’t paying these. For leases, whether financial or operating, the assets and liabilities also reconcile. Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet. Recently, accounting standards started requiring companies and businesses to show operating leases on their balance sheet.

Lease Liabilities The balance sheet impact Occupier

Recently, accounting standards started requiring companies and businesses to show operating leases on their balance sheet. For leases, whether financial or operating, the assets and liabilities also reconcile. Because the company isn’t paying these. Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet.

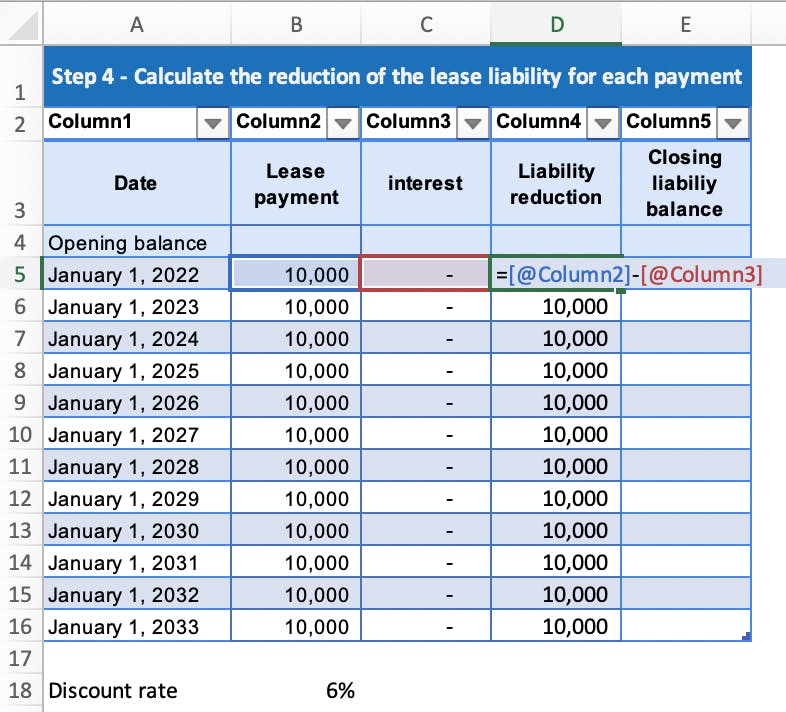

How to Calculate a Lease Liability using Excel

For leases, whether financial or operating, the assets and liabilities also reconcile. Recently, accounting standards started requiring companies and businesses to show operating leases on their balance sheet. Because the company isn’t paying these. Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet.

Accounting for Operating Leases in the Balance Sheet Simply Explained

Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet. Because the company isn’t paying these. For leases, whether financial or operating, the assets and liabilities also reconcile. Recently, accounting standards started requiring companies and businesses to show operating leases on their balance sheet.

RightofUse Assets and Lease Liabilities Defined Under ASC 842

Because the company isn’t paying these. Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet. Recently, accounting standards started requiring companies and businesses to show operating leases on their balance sheet. For leases, whether financial or operating, the assets and liabilities also reconcile.

Accounting for Leases Finance Lease vs. Capital Lease vs. Operating Lease

For leases, whether financial or operating, the assets and liabilities also reconcile. Because the company isn’t paying these. Recently, accounting standards started requiring companies and businesses to show operating leases on their balance sheet. Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet.

Because The Company Isn’t Paying These.

For leases, whether financial or operating, the assets and liabilities also reconcile. Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet. Recently, accounting standards started requiring companies and businesses to show operating leases on their balance sheet.