Interest Expense On The Balance Sheet - Interest expense is documented in the financial records when a company incurs costs related to borrowing money.

Interest expense is documented in the financial records when a company incurs costs related to borrowing money.

Interest expense is documented in the financial records when a company incurs costs related to borrowing money.

Where Is Interest Expense On Balance Sheet LiveWell

Interest expense is documented in the financial records when a company incurs costs related to borrowing money.

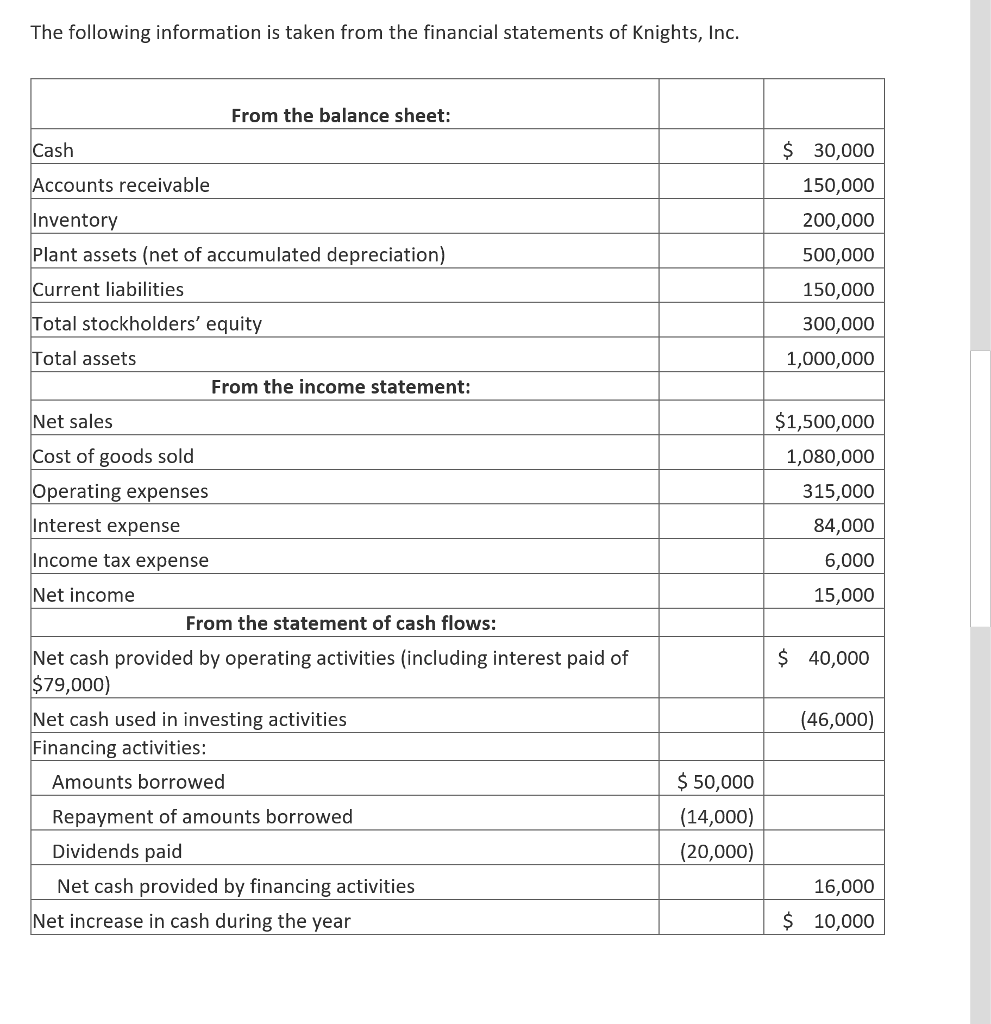

Solved Explain how the interest expense shown in the

Interest expense is documented in the financial records when a company incurs costs related to borrowing money.

Where Is Interest Expense On Balance Sheet LiveWell

Interest expense is documented in the financial records when a company incurs costs related to borrowing money.

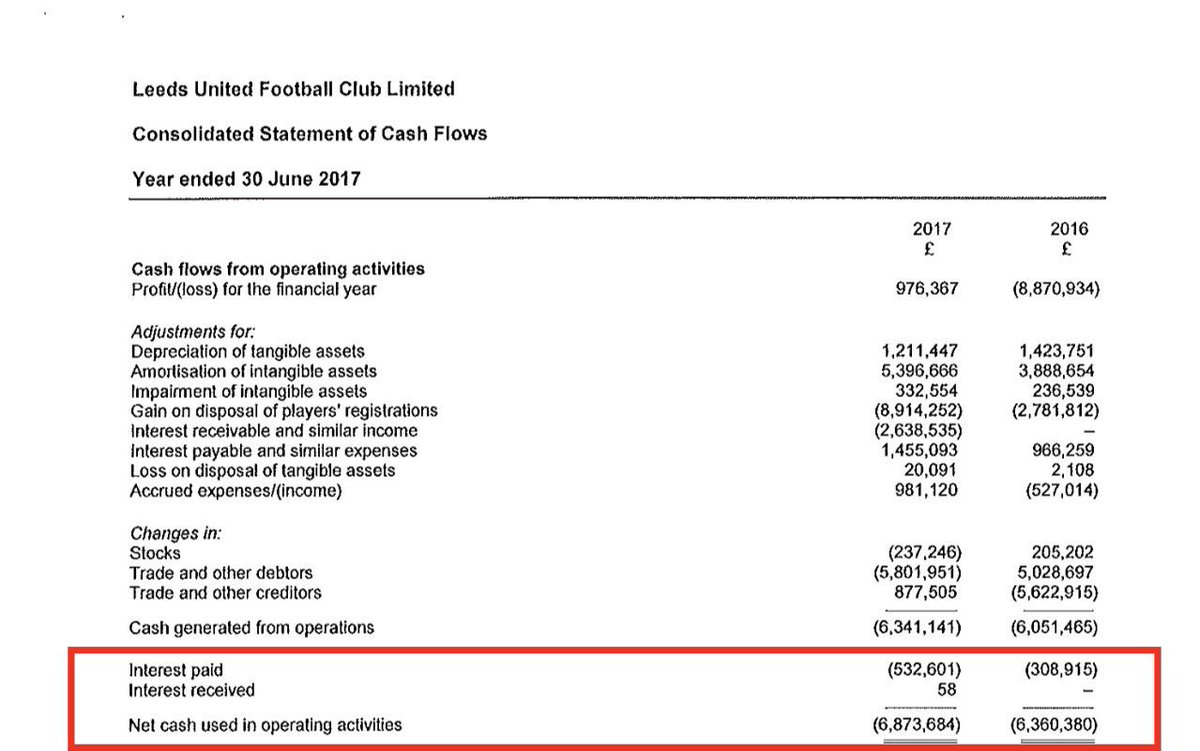

Interest Expense in a Monthly Financial Model (Cash Interest vs

Interest expense is documented in the financial records when a company incurs costs related to borrowing money.

Interest Expense Calculate, Formula, How it Works

Interest expense is documented in the financial records when a company incurs costs related to borrowing money.

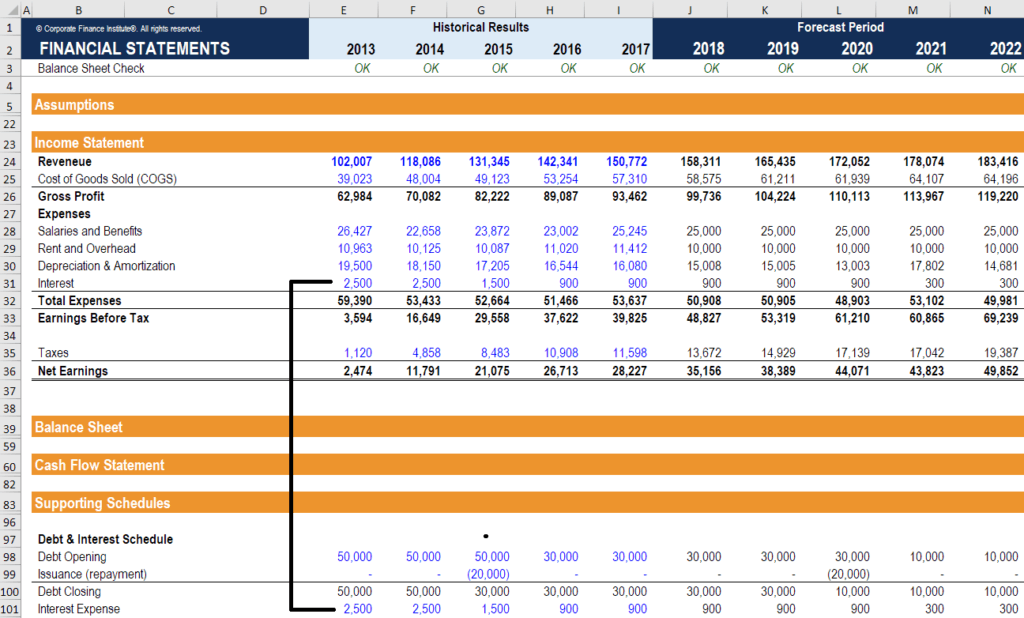

Interest Expense in a Monthly Financial Model (Cash Interest vs

Interest expense is documented in the financial records when a company incurs costs related to borrowing money.

Interest Expense in a Monthly Financial Model (Cash Interest vs

Interest expense is documented in the financial records when a company incurs costs related to borrowing money.

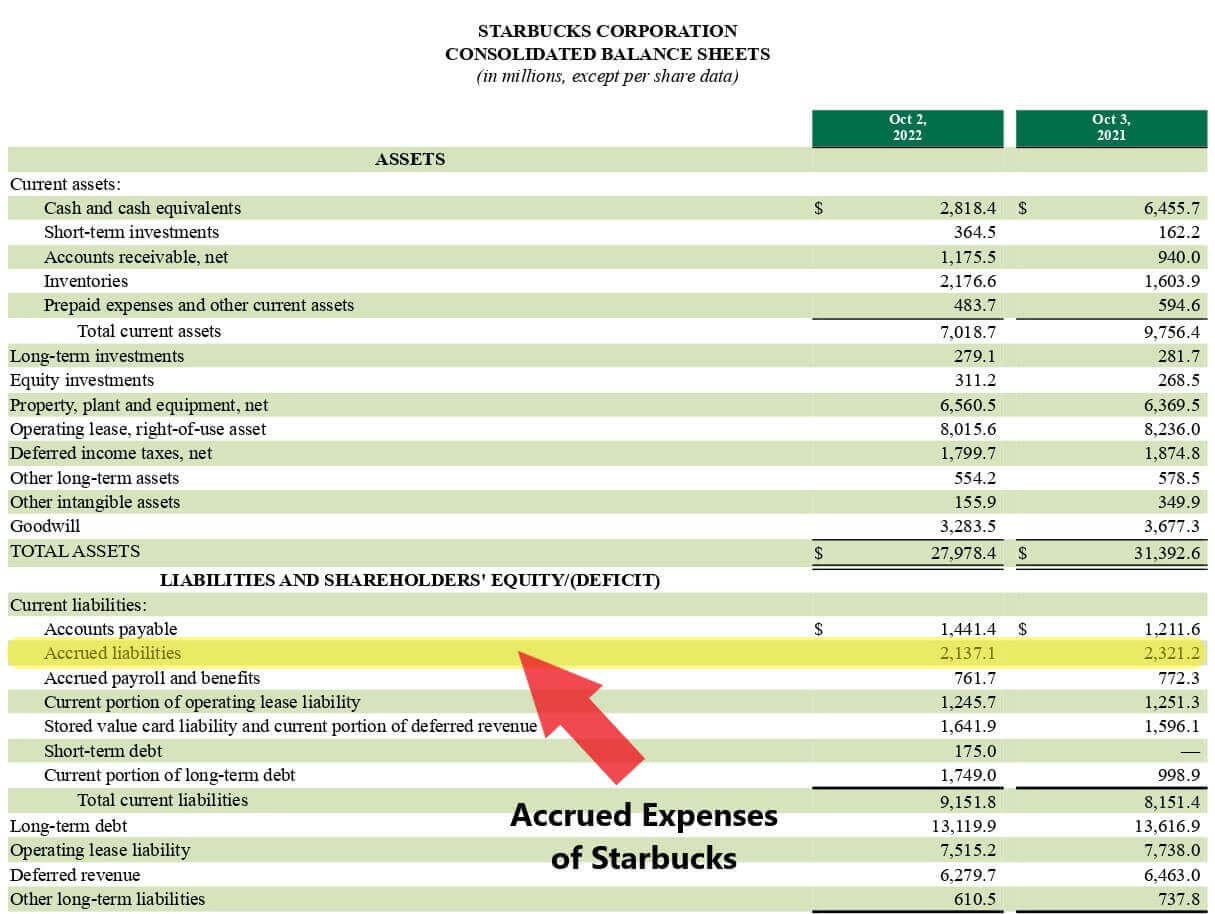

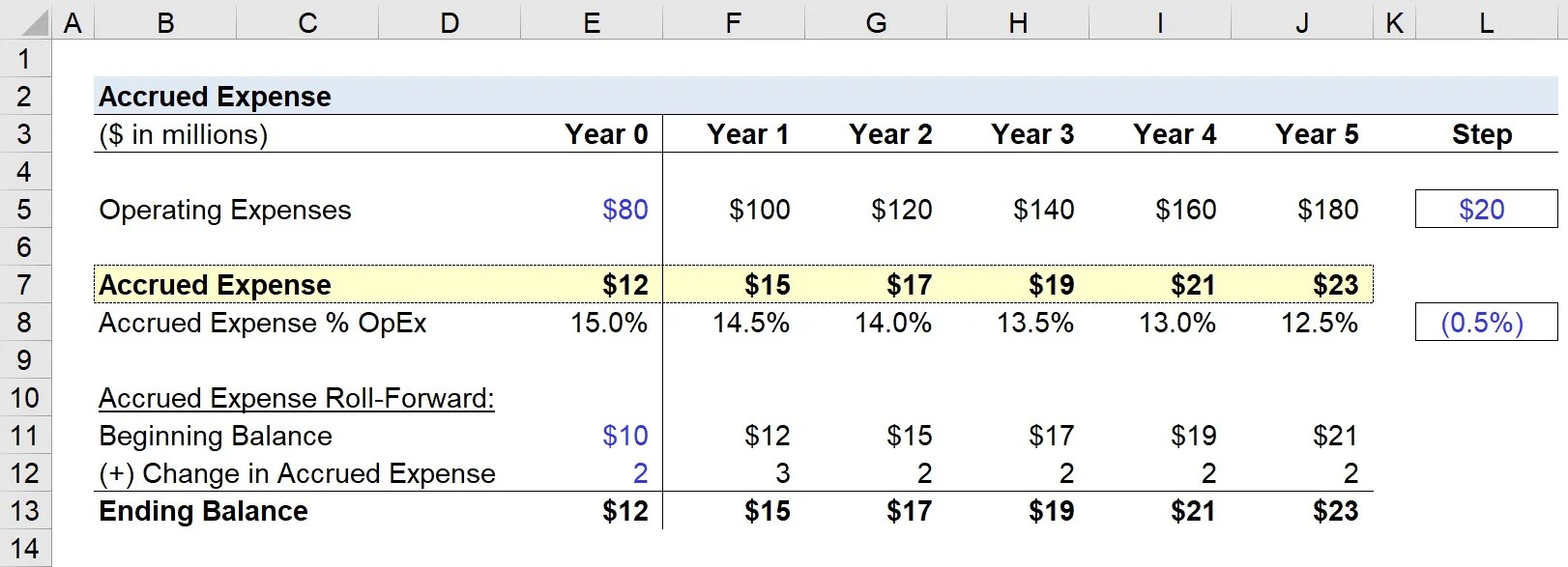

Accrued Expense Examples of Accrued Expenses

Interest expense is documented in the financial records when a company incurs costs related to borrowing money.

Where Is Interest Expense On Balance Sheet LiveWell

Interest expense is documented in the financial records when a company incurs costs related to borrowing money.