How To Calculate Ebit From Balance Sheet - Ebit or earnings before interest and taxes, also called operating income, is a profitability measurement that calculates the operating. There are two ways to calculate ebit, but each one is useful at a different time in the fiscal year. Ebit is a company's operating profitability in a given period once cogs and operating expenses are deducted. One way factors in total.

Ebit or earnings before interest and taxes, also called operating income, is a profitability measurement that calculates the operating. There are two ways to calculate ebit, but each one is useful at a different time in the fiscal year. One way factors in total. Ebit is a company's operating profitability in a given period once cogs and operating expenses are deducted.

There are two ways to calculate ebit, but each one is useful at a different time in the fiscal year. One way factors in total. Ebit or earnings before interest and taxes, also called operating income, is a profitability measurement that calculates the operating. Ebit is a company's operating profitability in a given period once cogs and operating expenses are deducted.

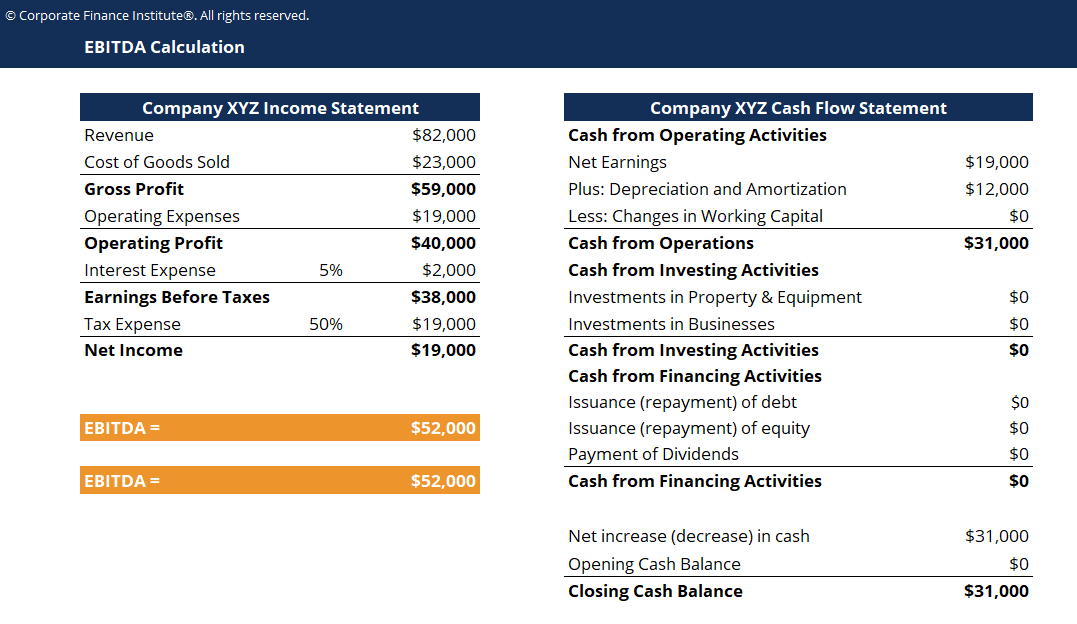

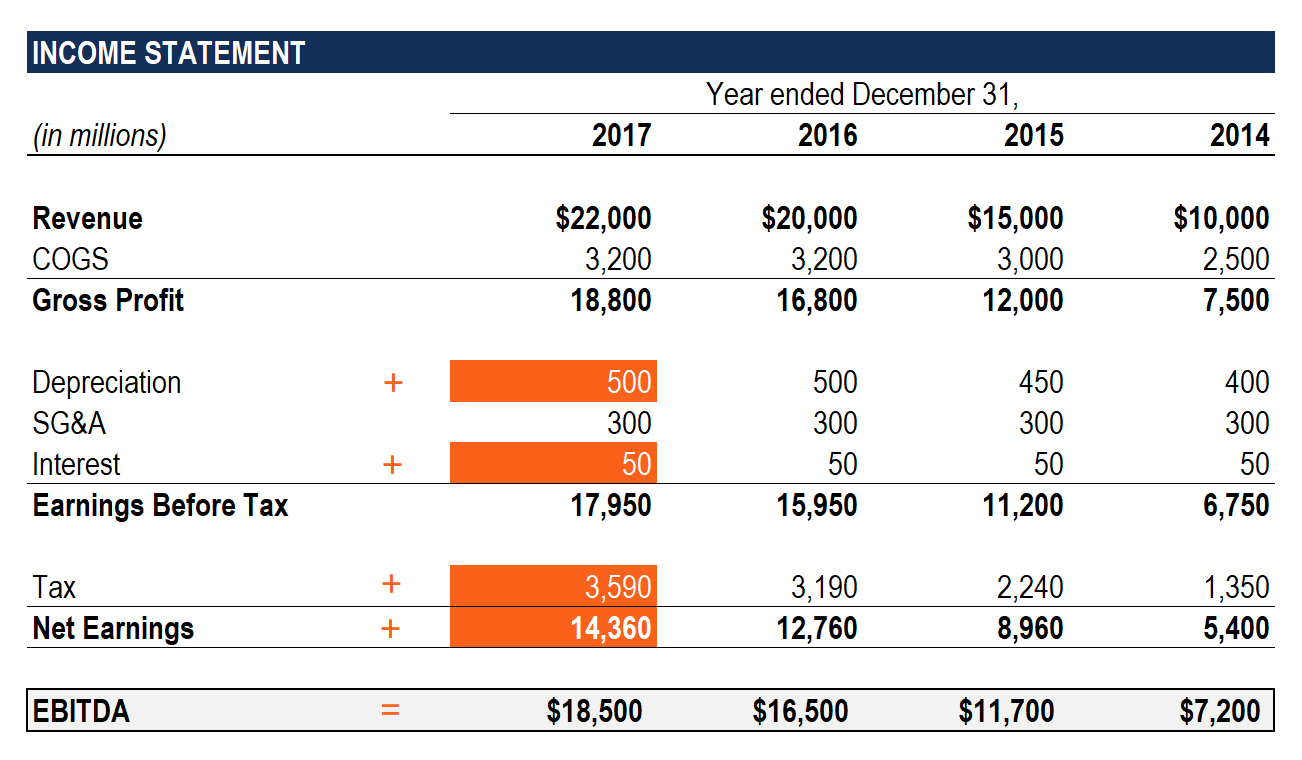

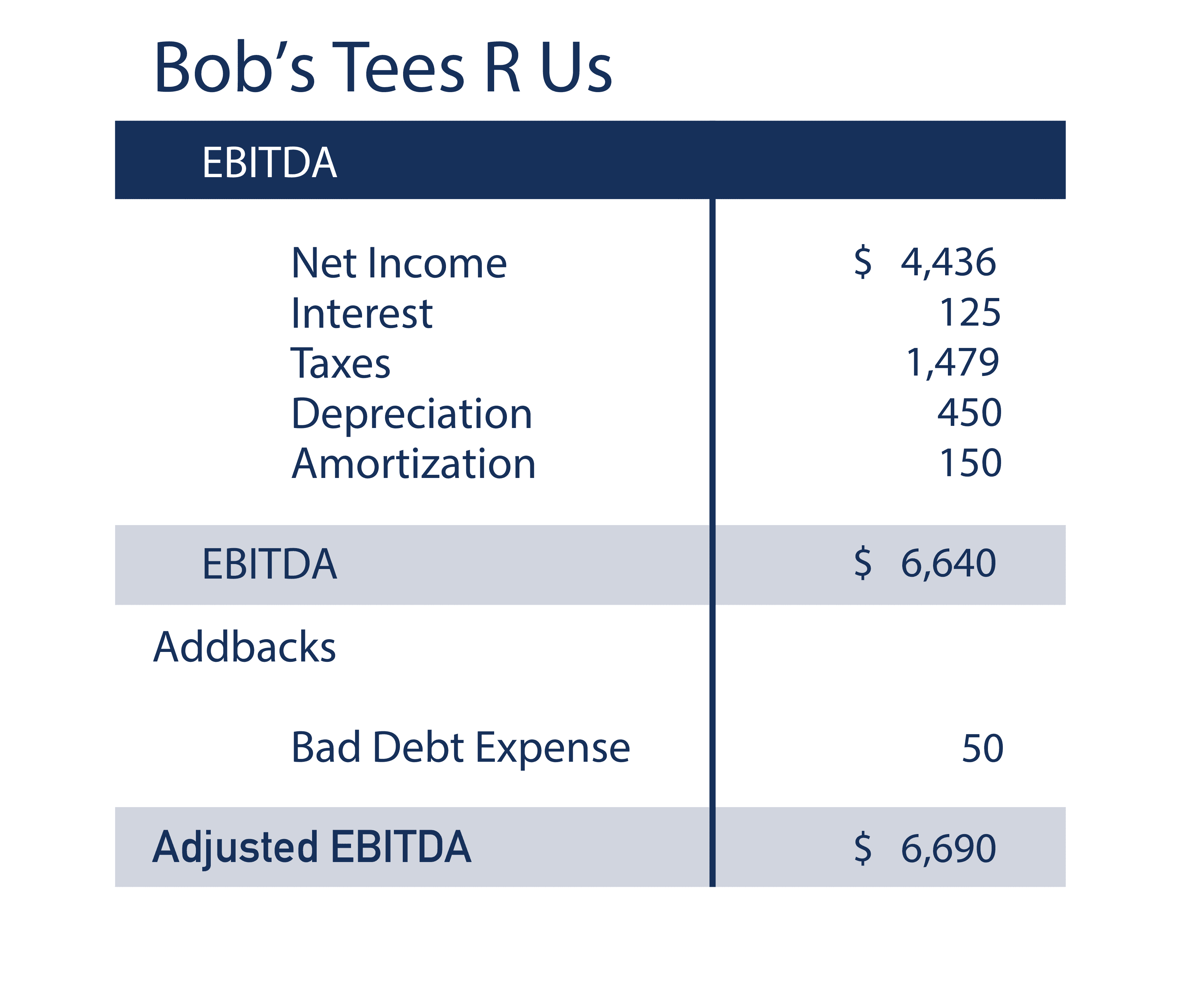

EBITDA Template Download Free Excel Template

Ebit is a company's operating profitability in a given period once cogs and operating expenses are deducted. Ebit or earnings before interest and taxes, also called operating income, is a profitability measurement that calculates the operating. One way factors in total. There are two ways to calculate ebit, but each one is useful at a different time in the fiscal.

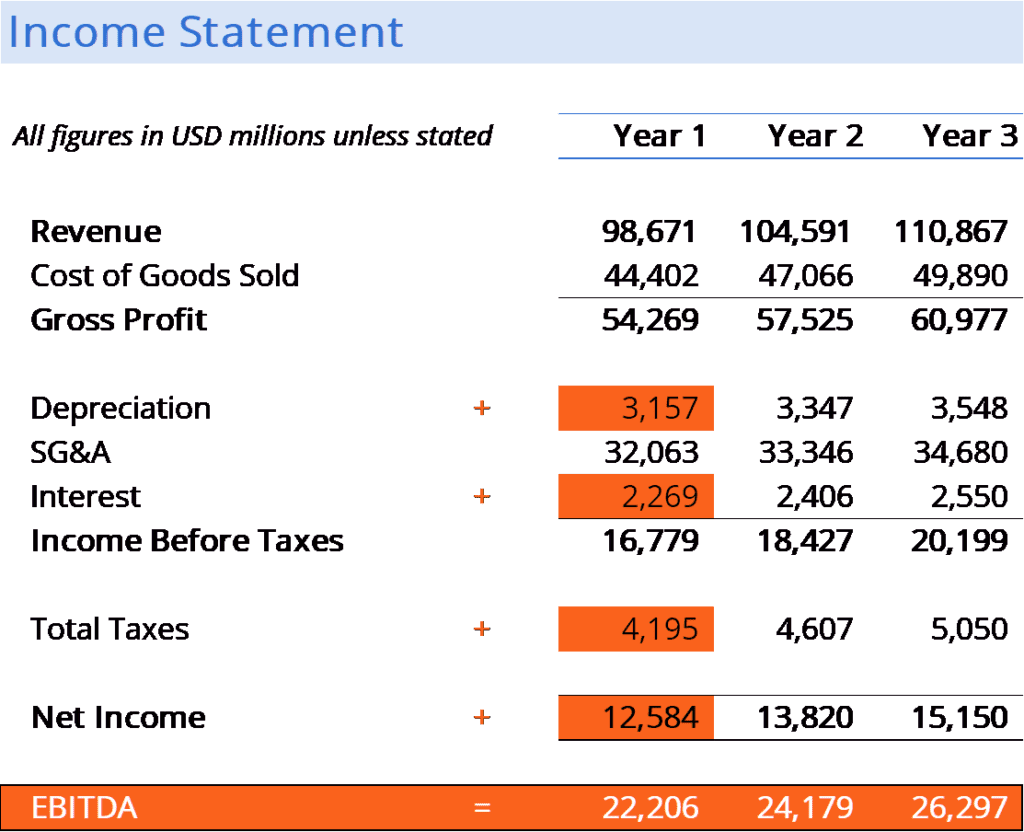

Ebit Calculation Step By Step Guide To Calculate Ebit With Examples

Ebit is a company's operating profitability in a given period once cogs and operating expenses are deducted. One way factors in total. Ebit or earnings before interest and taxes, also called operating income, is a profitability measurement that calculates the operating. There are two ways to calculate ebit, but each one is useful at a different time in the fiscal.

What is EBITDA Formula, Definition and Explanation

Ebit or earnings before interest and taxes, also called operating income, is a profitability measurement that calculates the operating. One way factors in total. There are two ways to calculate ebit, but each one is useful at a different time in the fiscal year. Ebit is a company's operating profitability in a given period once cogs and operating expenses are.

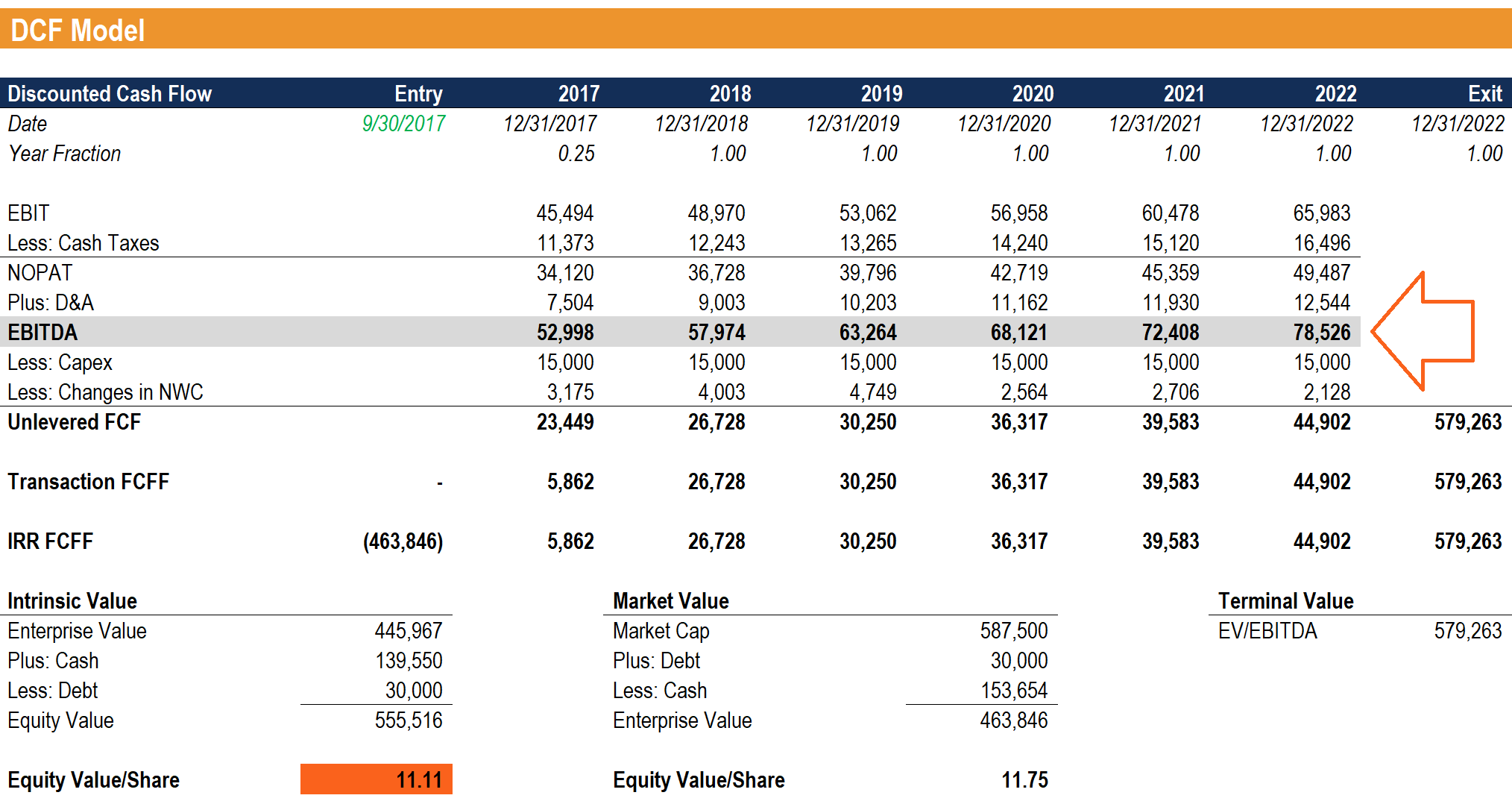

Full EBITDA Guide What is It & How Investors Use It (Formula)

Ebit is a company's operating profitability in a given period once cogs and operating expenses are deducted. Ebit or earnings before interest and taxes, also called operating income, is a profitability measurement that calculates the operating. There are two ways to calculate ebit, but each one is useful at a different time in the fiscal year. One way factors in.

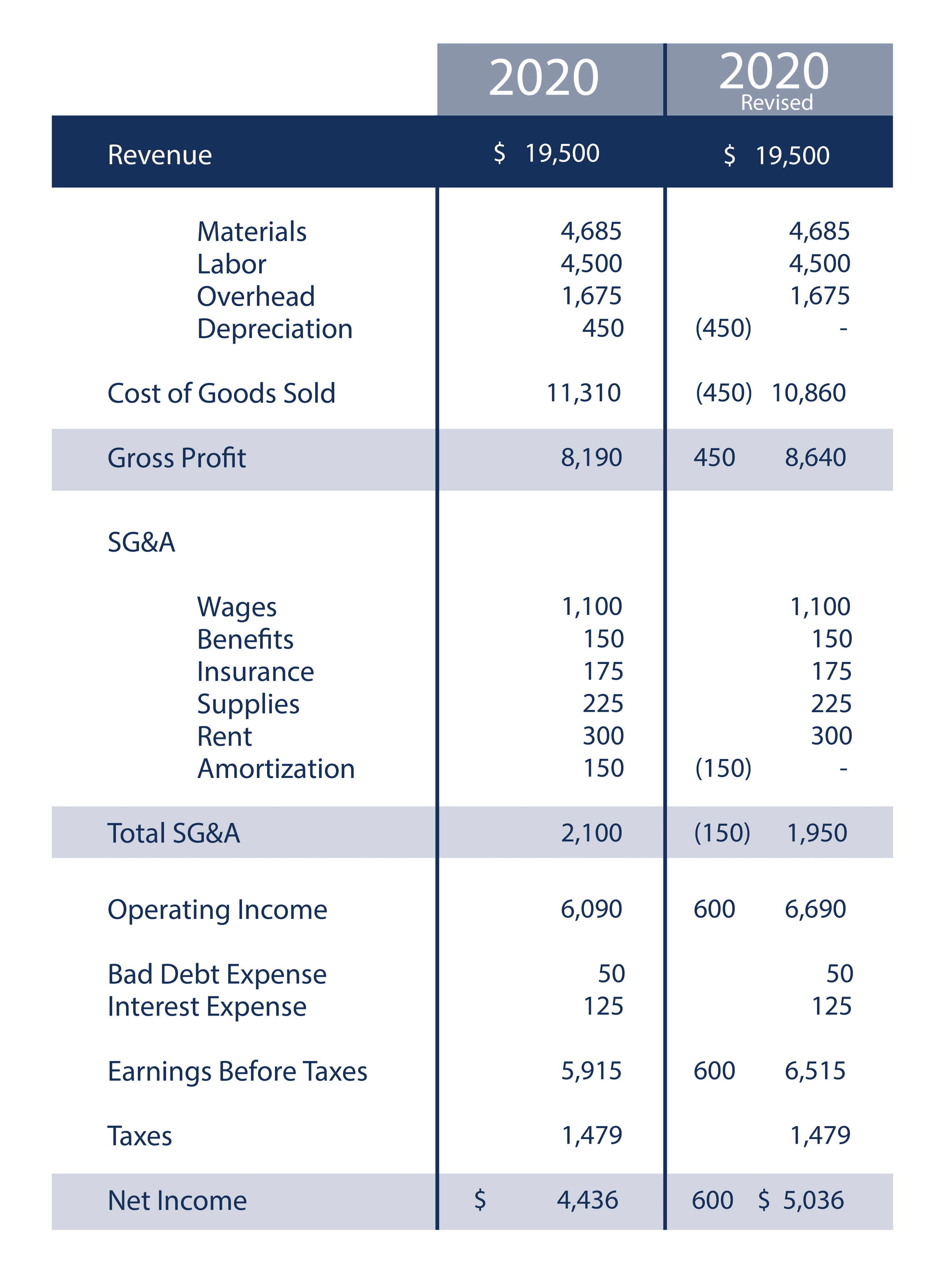

How to Calculate EBITDA (with Calculator) wikiHow

There are two ways to calculate ebit, but each one is useful at a different time in the fiscal year. One way factors in total. Ebit is a company's operating profitability in a given period once cogs and operating expenses are deducted. Ebit or earnings before interest and taxes, also called operating income, is a profitability measurement that calculates the.

What is EBITDA Formula, Definition and Explanation

Ebit or earnings before interest and taxes, also called operating income, is a profitability measurement that calculates the operating. There are two ways to calculate ebit, but each one is useful at a different time in the fiscal year. One way factors in total. Ebit is a company's operating profitability in a given period once cogs and operating expenses are.

What is EBITDA Formula, Definition and Explanation

There are two ways to calculate ebit, but each one is useful at a different time in the fiscal year. Ebit or earnings before interest and taxes, also called operating income, is a profitability measurement that calculates the operating. Ebit is a company's operating profitability in a given period once cogs and operating expenses are deducted. One way factors in.

Full EBITDA Guide What is It & How Investors Use It (Formula)

There are two ways to calculate ebit, but each one is useful at a different time in the fiscal year. Ebit is a company's operating profitability in a given period once cogs and operating expenses are deducted. Ebit or earnings before interest and taxes, also called operating income, is a profitability measurement that calculates the operating. One way factors in.

How to Calculate EBITDA (With Examples) Layer Blog

Ebit or earnings before interest and taxes, also called operating income, is a profitability measurement that calculates the operating. Ebit is a company's operating profitability in a given period once cogs and operating expenses are deducted. There are two ways to calculate ebit, but each one is useful at a different time in the fiscal year. One way factors in.

Ebitda Template

One way factors in total. Ebit or earnings before interest and taxes, also called operating income, is a profitability measurement that calculates the operating. Ebit is a company's operating profitability in a given period once cogs and operating expenses are deducted. There are two ways to calculate ebit, but each one is useful at a different time in the fiscal.

Ebit Or Earnings Before Interest And Taxes, Also Called Operating Income, Is A Profitability Measurement That Calculates The Operating.

There are two ways to calculate ebit, but each one is useful at a different time in the fiscal year. Ebit is a company's operating profitability in a given period once cogs and operating expenses are deducted. One way factors in total.