Examples Of Liabilities In Balance Sheet - Most businesses will organize the liabilities on their balance sheet under two separate headings: What are the different types of liabilities on the balance sheet? On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. T he assets and liabilities are separated into two. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. On the balance sheet, the liabilities.

Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. What are the different types of liabilities on the balance sheet? T he assets and liabilities are separated into two. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. On the balance sheet, the liabilities. Most businesses will organize the liabilities on their balance sheet under two separate headings:

Most businesses will organize the liabilities on their balance sheet under two separate headings: What are the different types of liabilities on the balance sheet? T he assets and liabilities are separated into two. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. On the balance sheet, the liabilities.

How to Read & Prepare a Balance Sheet QuickBooks

On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. What are the different types of liabilities on the balance sheet? T he assets and liabilities are separated into two. On the balance sheet, the liabilities. Most businesses will organize the liabilities on their balance sheet under two separate headings:

Balance Sheet Explained Structure, Assets, Liabilities with Examples

On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. What are the different types of liabilities on the balance sheet? Most businesses will organize the liabilities on their balance sheet under two separate headings: On the balance sheet, the liabilities. Liabilities are settled over time through the transfer of economic benefits including money, goods, or.

Best Warranty Liabilities On Balance Sheet And Statement Example

Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. T he assets and liabilities are separated into two. What are the different types of liabilities on the balance sheet? Most businesses will organize the liabilities on their balance sheet under two separate headings: On the balance sheet, the liabilities.

Best Warranty Liabilities On Balance Sheet And Statement Example

Most businesses will organize the liabilities on their balance sheet under two separate headings: T he assets and liabilities are separated into two. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. On the balance sheet, the liabilities. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services.

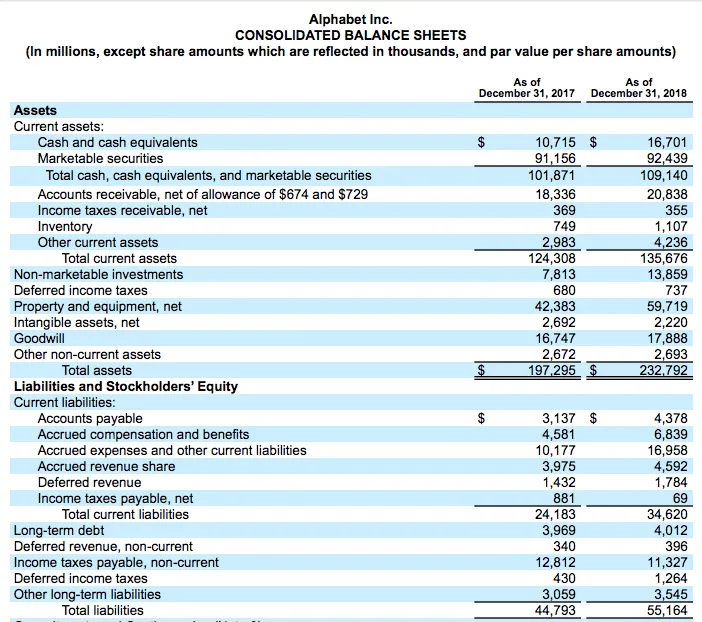

Balance Sheet Example and Definition—What Is a Balance Sheet?

Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. On the balance sheet, the liabilities. T he assets and liabilities are separated into two. What are the different types of liabilities on the balance sheet? Most businesses will organize the liabilities on their balance sheet under two separate headings:

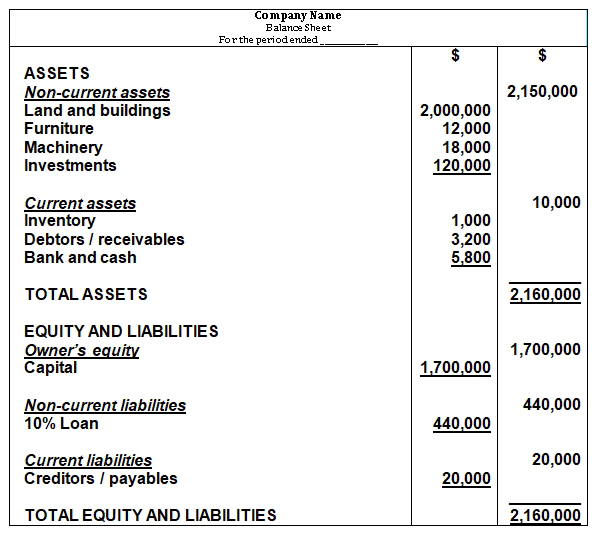

Balance sheet example track assets and liabilities

Most businesses will organize the liabilities on their balance sheet under two separate headings: On the balance sheet, the liabilities. What are the different types of liabilities on the balance sheet? Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. On the right side, the balance sheet outlines the company’s liabilities and shareholders’.

Balance Sheets 101 Understanding Assets, Liabilities and Equity HBX

Most businesses will organize the liabilities on their balance sheet under two separate headings: On the balance sheet, the liabilities. T he assets and liabilities are separated into two. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services.

Long Term Liabilities Balance Sheet

T he assets and liabilities are separated into two. On the balance sheet, the liabilities. Most businesses will organize the liabilities on their balance sheet under two separate headings: On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. What are the different types of liabilities on the balance sheet?

Liabilities How to classify, Track and calculate liabilities?

Most businesses will organize the liabilities on their balance sheet under two separate headings: Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. On the balance sheet, the liabilities. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. What are the different types of liabilities on the balance.

How to Read a Balance Sheet (Free Download) Poindexter Blog

Most businesses will organize the liabilities on their balance sheet under two separate headings: On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. On the balance sheet, the liabilities. What are the different types of liabilities on the balance.

T He Assets And Liabilities Are Separated Into Two.

On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. What are the different types of liabilities on the balance sheet? Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. Most businesses will organize the liabilities on their balance sheet under two separate headings:

/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)