Depreciation Expense On Balance Sheet - Discover the role of depreciation expense in a balance sheet and its impact on finance. Accumulated depreciation is listed on the balance sheet. It is important to understand that the main purpose of depreciation is to move the cost of an asset (except the estimated salvage value) from a company’s balance sheet to depreciation. Depreciation expense is reported on the income statement along with other normal business expenses. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its estimated useful life. Gain insights into where depreciation expense is recorded with our comprehensive. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where expenses are tracked).

On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its estimated useful life. Accumulated depreciation is listed on the balance sheet. Depreciation expense is reported on the income statement along with other normal business expenses. Discover the role of depreciation expense in a balance sheet and its impact on finance. Gain insights into where depreciation expense is recorded with our comprehensive. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where expenses are tracked). It is important to understand that the main purpose of depreciation is to move the cost of an asset (except the estimated salvage value) from a company’s balance sheet to depreciation.

Discover the role of depreciation expense in a balance sheet and its impact on finance. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where expenses are tracked). Accumulated depreciation is listed on the balance sheet. Depreciation expense is reported on the income statement along with other normal business expenses. It is important to understand that the main purpose of depreciation is to move the cost of an asset (except the estimated salvage value) from a company’s balance sheet to depreciation. Gain insights into where depreciation expense is recorded with our comprehensive. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its estimated useful life.

How is accumulated depreciation on a balance sheet? Leia aqui Is

Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where expenses are tracked). It is important to understand that the main purpose of depreciation is to move the cost of an asset (except the estimated salvage value) from a company’s balance sheet to depreciation. Depreciation expense is reported on the income statement.

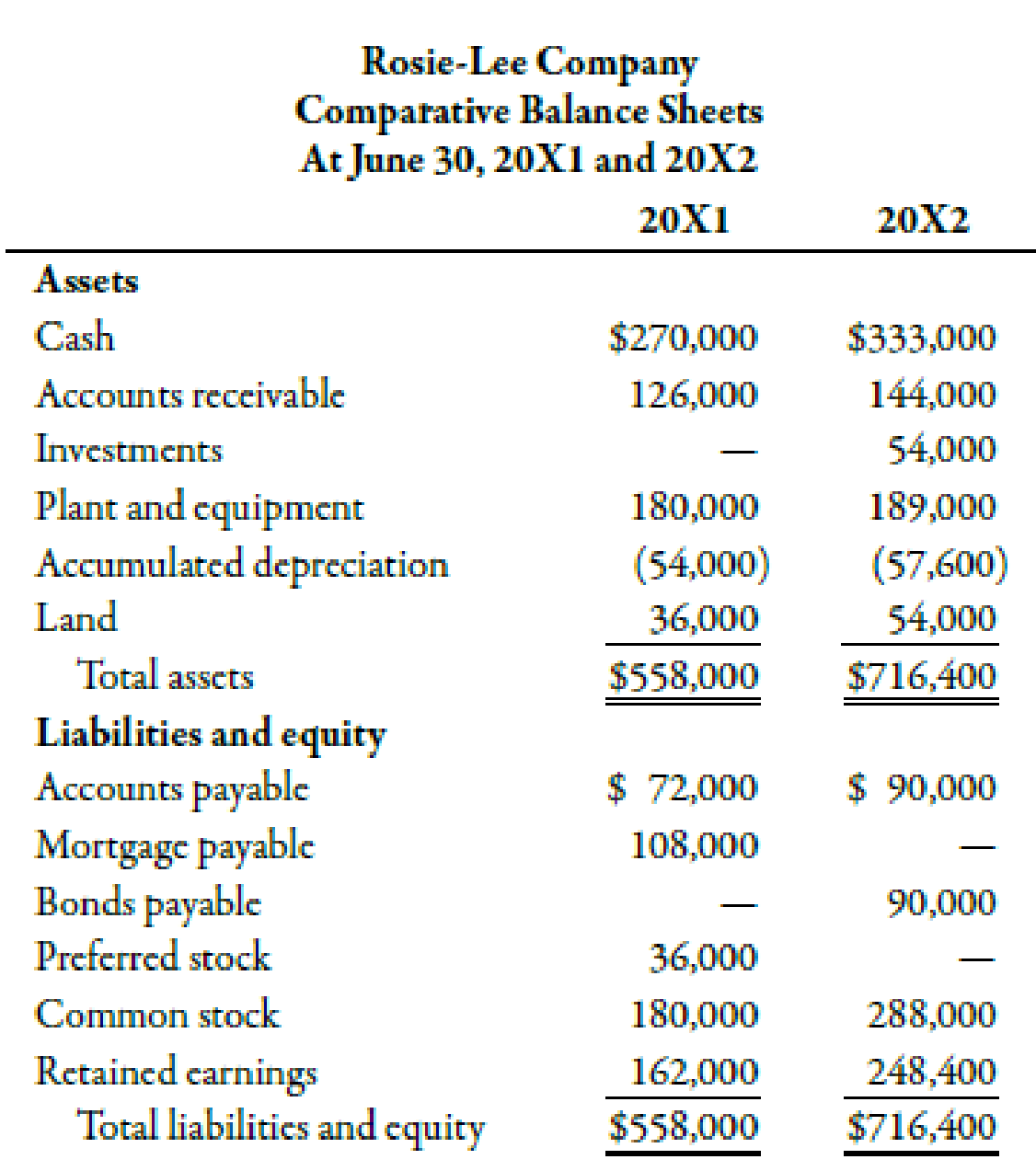

Balance Sheet Example With Depreciation

It is important to understand that the main purpose of depreciation is to move the cost of an asset (except the estimated salvage value) from a company’s balance sheet to depreciation. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its estimated useful life. Depreciation expense is reported on the.

Fixed Asset Depreciation Excel Spreadsheet for 013 Accounting Balance

Gain insights into where depreciation expense is recorded with our comprehensive. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where expenses are tracked). Discover the role of depreciation expense in a balance sheet and its impact on finance. It is important to understand that the main purpose of depreciation is to.

Balance Sheet Example With Depreciation

Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where expenses are tracked). Depreciation expense is reported on the income statement along with other normal business expenses. Gain insights into where depreciation expense is recorded with our comprehensive. Accumulated depreciation is listed on the balance sheet. Discover the role of depreciation expense.

Balance Sheet Depreciation Understanding Depreciation

Discover the role of depreciation expense in a balance sheet and its impact on finance. Gain insights into where depreciation expense is recorded with our comprehensive. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where expenses are tracked). Accumulated depreciation is listed on the balance sheet. Depreciation expense is reported on.

Describing the Depreciation Methods Used in the Financial Statements

It is important to understand that the main purpose of depreciation is to move the cost of an asset (except the estimated salvage value) from a company’s balance sheet to depreciation. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where expenses are tracked). On the balance sheet, depreciation expense reduces the.

Why is accumulated depreciation a credit balance?

Depreciation expense is reported on the income statement along with other normal business expenses. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where expenses are tracked). Discover the role of depreciation expense in a balance sheet and its impact on finance. Gain insights into where depreciation expense is recorded with our.

Depreciation Expense Depreciation AccountingCoach

It is important to understand that the main purpose of depreciation is to move the cost of an asset (except the estimated salvage value) from a company’s balance sheet to depreciation. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its estimated useful life. Accumulated depreciation is listed on the.

How do you account for depreciation on a balance sheet? Leia aqui Is

Depreciation expense is reported on the income statement along with other normal business expenses. Discover the role of depreciation expense in a balance sheet and its impact on finance. It is important to understand that the main purpose of depreciation is to move the cost of an asset (except the estimated salvage value) from a company’s balance sheet to depreciation..

Depreciation Expenses Formula Examples with Excel Template

Gain insights into where depreciation expense is recorded with our comprehensive. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where expenses are tracked). On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its estimated useful life. It is important to understand.

Gain Insights Into Where Depreciation Expense Is Recorded With Our Comprehensive.

Accumulated depreciation is listed on the balance sheet. It is important to understand that the main purpose of depreciation is to move the cost of an asset (except the estimated salvage value) from a company’s balance sheet to depreciation. Discover the role of depreciation expense in a balance sheet and its impact on finance. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where expenses are tracked).

On The Balance Sheet, Depreciation Expense Reduces The Book Value Of A Company’s Property, Plant And Equipment (Pp&E) Over Its Estimated Useful Life.

Depreciation expense is reported on the income statement along with other normal business expenses.

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)