Depreciation Expense Balance Sheet - Depreciation is the reduction in the value of a fixed asset due to usage, wear and tear, the passage of time, or obsolescence. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its.

Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its. Depreciation is the reduction in the value of a fixed asset due to usage, wear and tear, the passage of time, or obsolescence.

Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where. Depreciation is the reduction in the value of a fixed asset due to usage, wear and tear, the passage of time, or obsolescence. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its.

balance sheet Expense Depreciation

Depreciation is the reduction in the value of a fixed asset due to usage, wear and tear, the passage of time, or obsolescence. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over.

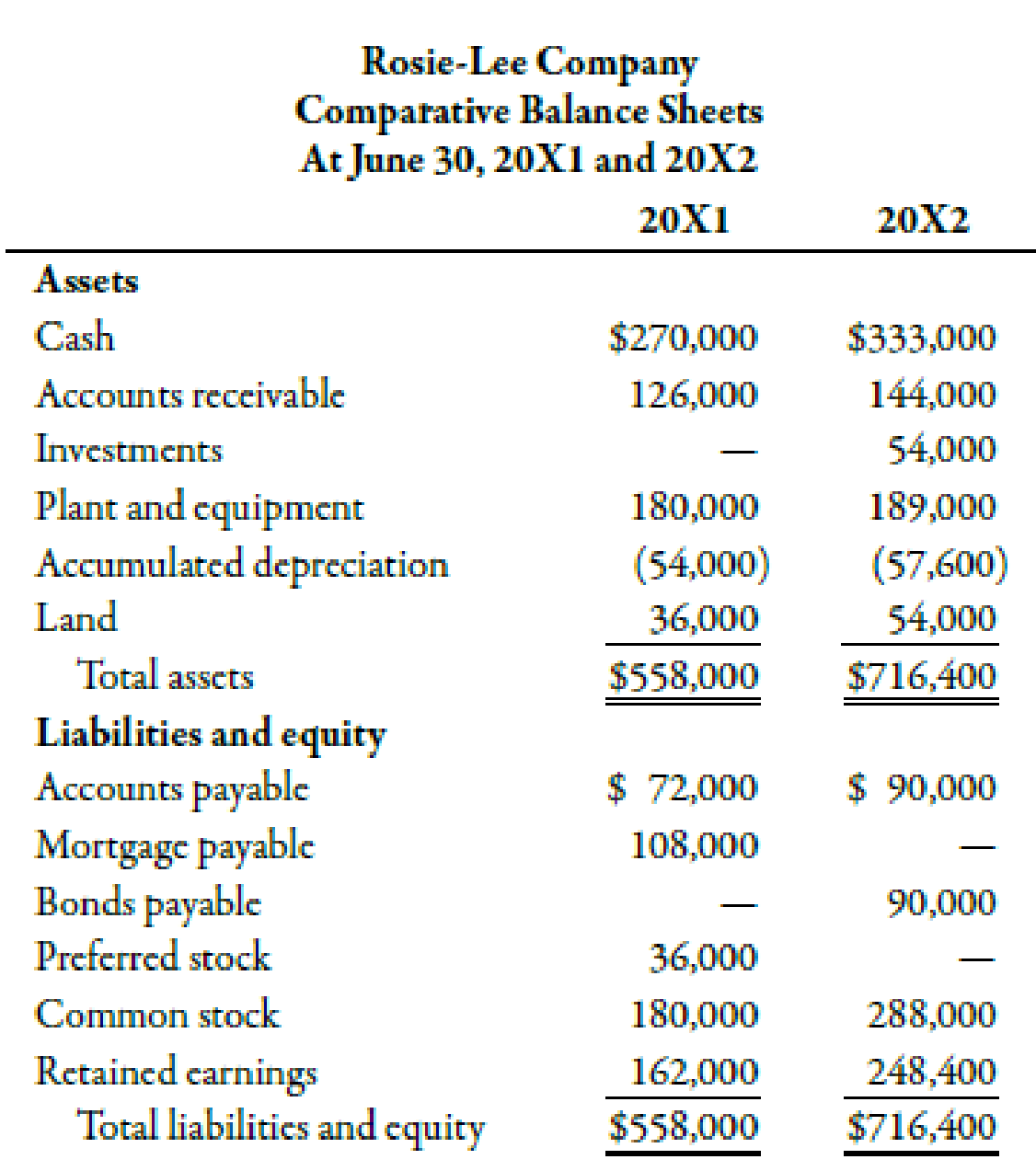

Balance Sheet Example With Depreciation

Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where. Depreciation is the reduction in the value of a fixed asset due to usage, wear and tear, the passage of time, or obsolescence. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over.

Balance Sheet Example With Depreciation

Depreciation is the reduction in the value of a fixed asset due to usage, wear and tear, the passage of time, or obsolescence. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement.

How is accumulated depreciation on a balance sheet? Leia aqui Is

Depreciation is the reduction in the value of a fixed asset due to usage, wear and tear, the passage of time, or obsolescence. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement.

Depreciation

Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its. Depreciation is the reduction in the value of a fixed asset due to usage, wear and tear, the passage of time, or.

Fixed Asset Depreciation Excel Spreadsheet for 013 Accounting Balance

Depreciation is the reduction in the value of a fixed asset due to usage, wear and tear, the passage of time, or obsolescence. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over.

Cash Flow Statement Depreciation Expense AccountingCoach

On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its. Depreciation is the reduction in the value of a fixed asset due to usage, wear and tear, the passage of time, or obsolescence. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement.

Where Does Depreciation Expense Go On A Balance Sheet LiveWell

Depreciation is the reduction in the value of a fixed asset due to usage, wear and tear, the passage of time, or obsolescence. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over.

How do you account for depreciation on a balance sheet? Leia aqui Is

Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its. Depreciation is the reduction in the value of a fixed asset due to usage, wear and tear, the passage of time, or.

Accumulated Depreciation Definition, Example, Sample

Depreciation is the reduction in the value of a fixed asset due to usage, wear and tear, the passage of time, or obsolescence. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement.

Depreciation Is The Reduction In The Value Of A Fixed Asset Due To Usage, Wear And Tear, The Passage Of Time, Or Obsolescence.

On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where.