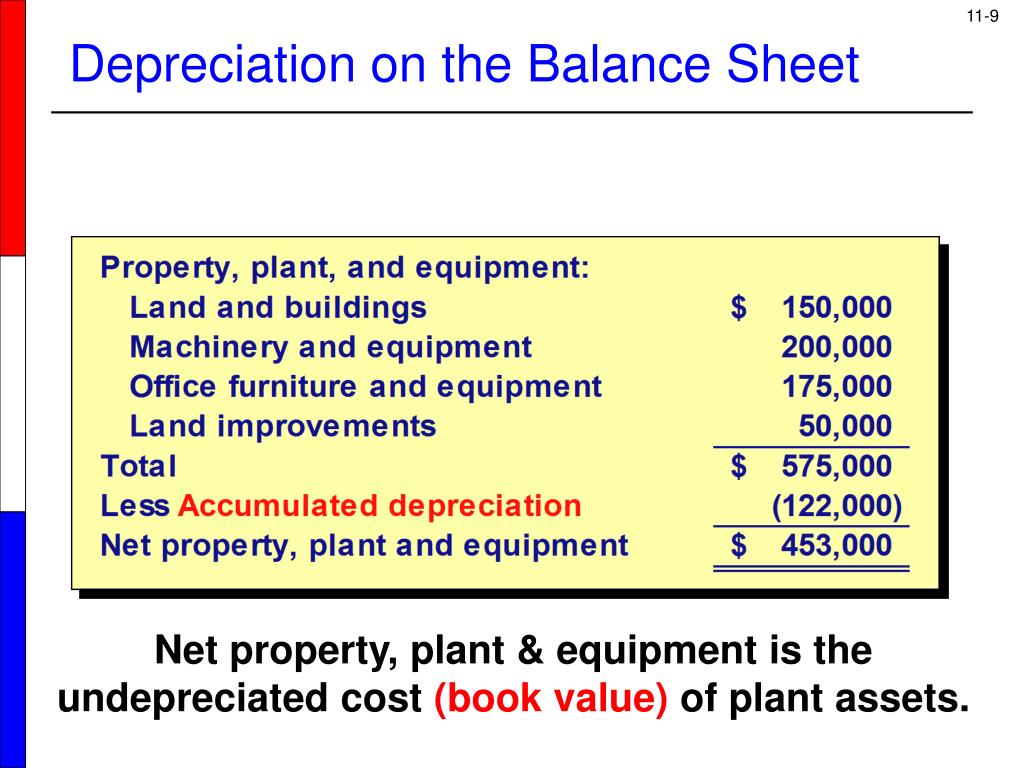

Depreciation Balance Sheet - Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where. Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life.

Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where.

Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where. Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life.

Depreciation

Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where. Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life.

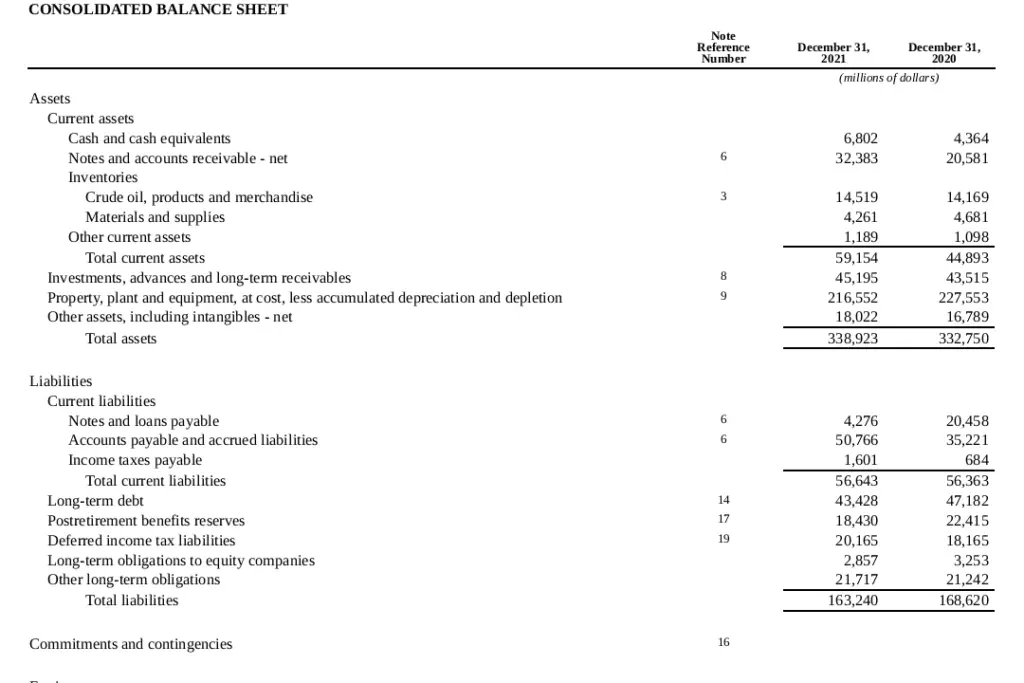

How is accumulated depreciation on a balance sheet? Leia aqui Is

Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where.

How do you account for depreciation on a balance sheet? Leia aqui Is

Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where.

Why is accumulated depreciation a credit balance?

Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where.

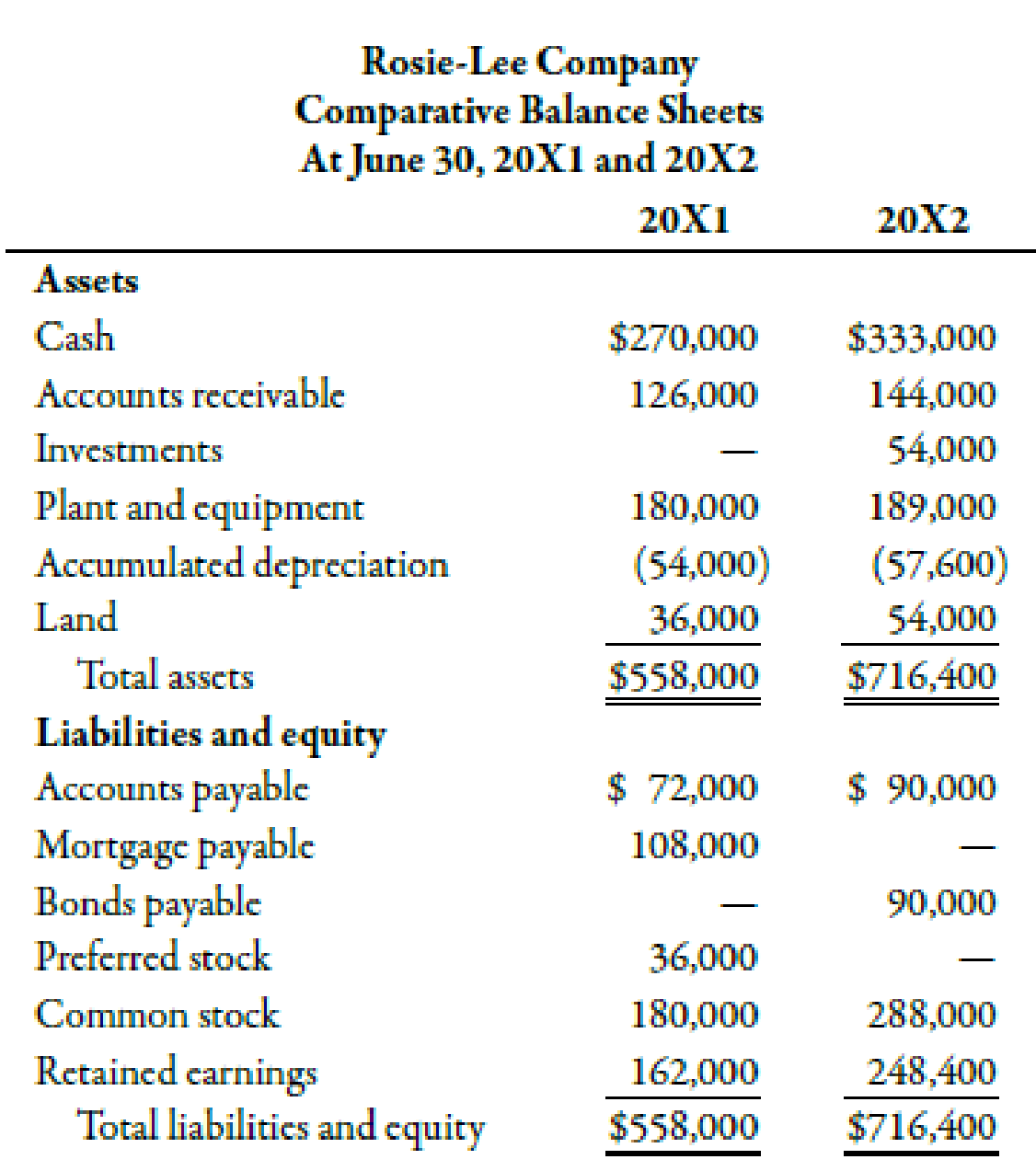

Balance Sheet Example With Depreciation

Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where. Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life.

PPT Operational Assets Utilization and Impairment PowerPoint

Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where. Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life.

Accumulated Depreciation

Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where. Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life.

Fixed Asset Depreciation Excel Spreadsheet for 013 Accounting Balance

Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where. Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life.

Where is accumulated depreciation on the balance sheet? Financial

Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where.

Depreciation Moves These Costs From The Company's Balance Sheet (Where Assets Are Recorded) To Its Income Statement (Where.

Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life.

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)