Comp Sheet - Comparable company analysis is a relative valuation method in which a company’s value is derived from comparisons to the current stock prices of similar companies in the market. To value a company with cca, follow these steps: Enter your name and email in the form below and download the free template now! When used to gauge the performance of retail operations, comps is used in the context. Comparable company analysis is valuable for determining a company's fair value. Select an appropriate set of comparable public companies. Determine the metrics and multiples you want to use. It involves identifying similar companies, selecting appropriate valuation methods, and creating a. Comps are valuable metrics used by retailers to identify the profitability of a current store. Comparable company analysis (or “comps” for short) is a valuation methodology that looks at ratios of.

Comparable company analysis (or “comps” for short) is a valuation methodology that looks at ratios of. Comps are valuable metrics used by retailers to identify the profitability of a current store. Comparable company analysis is valuable for determining a company's fair value. Enter your name and email in the form below and download the free template now! To value a company with cca, follow these steps: Comparable company analysis is a relative valuation method in which a company’s value is derived from comparisons to the current stock prices of similar companies in the market. When used to gauge the performance of retail operations, comps is used in the context. Determine the metrics and multiples you want to use. It involves identifying similar companies, selecting appropriate valuation methods, and creating a. Select an appropriate set of comparable public companies.

Comparable company analysis is a relative valuation method in which a company’s value is derived from comparisons to the current stock prices of similar companies in the market. Enter your name and email in the form below and download the free template now! Comparable company analysis (or “comps” for short) is a valuation methodology that looks at ratios of. It involves identifying similar companies, selecting appropriate valuation methods, and creating a. To value a company with cca, follow these steps: Determine the metrics and multiples you want to use. Select an appropriate set of comparable public companies. When used to gauge the performance of retail operations, comps is used in the context. Comparable company analysis is valuable for determining a company's fair value. Comps are valuable metrics used by retailers to identify the profitability of a current store.

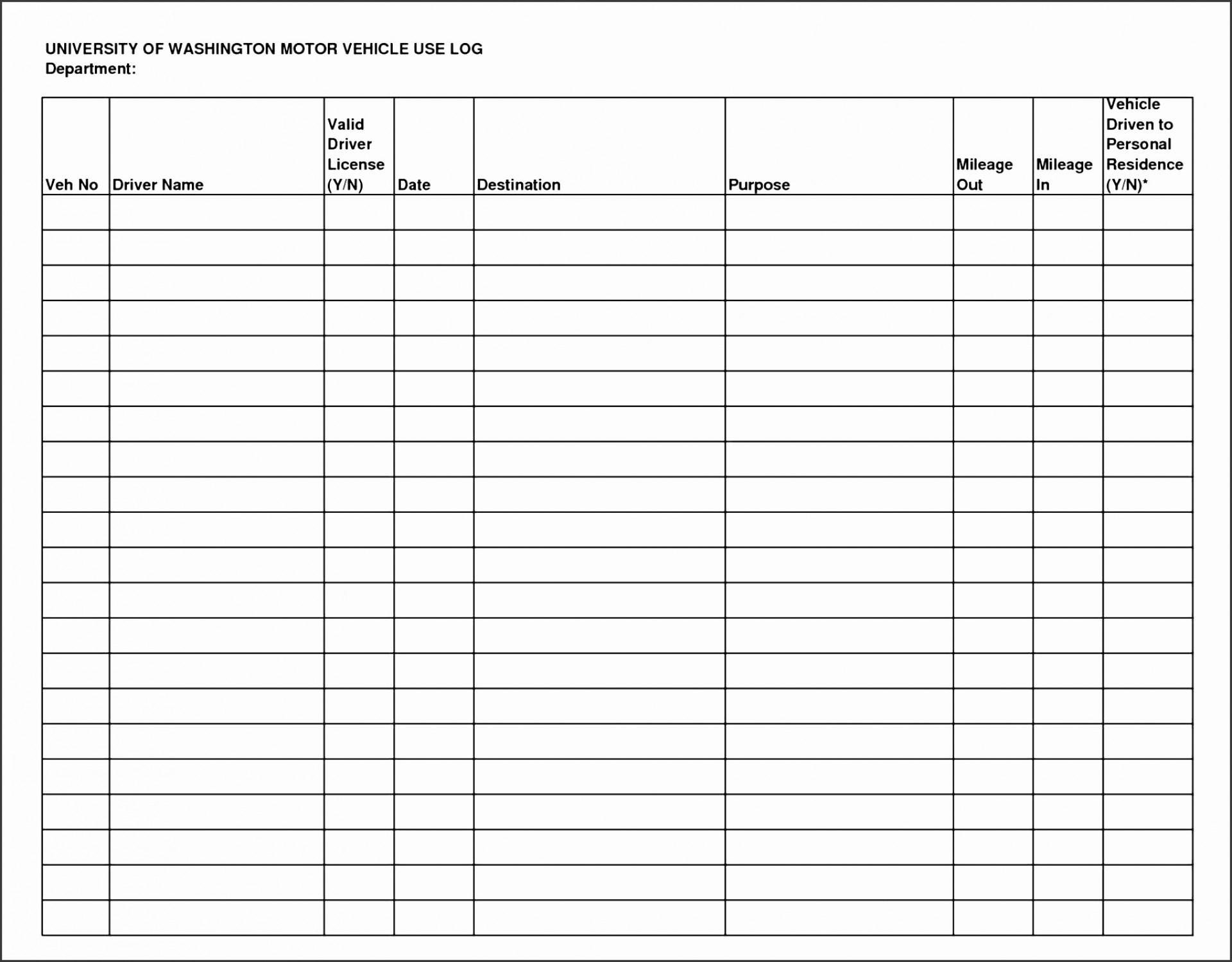

Workers Compensation Excel Spreadsheet —

Comparable company analysis is valuable for determining a company's fair value. Enter your name and email in the form below and download the free template now! Select an appropriate set of comparable public companies. When used to gauge the performance of retail operations, comps is used in the context. To value a company with cca, follow these steps:

Anatomy Of A Home Appraisal Report What Do The Differ vrogue.co

Comparable company analysis is valuable for determining a company's fair value. Comps are valuable metrics used by retailers to identify the profitability of a current store. Determine the metrics and multiples you want to use. Comparable company analysis is a relative valuation method in which a company’s value is derived from comparisons to the current stock prices of similar companies.

Blues comp Sheet music for Piano, Violin, Drum Set

Determine the metrics and multiples you want to use. Comparable company analysis (or “comps” for short) is a valuation methodology that looks at ratios of. Comps are valuable metrics used by retailers to identify the profitability of a current store. Comparable company analysis is a relative valuation method in which a company’s value is derived from comparisons to the current.

Comp Card Templates Free Beautiful Tracking Spreadsheet Time for

Comparable company analysis (or “comps” for short) is a valuation methodology that looks at ratios of. To value a company with cca, follow these steps: Enter your name and email in the form below and download the free template now! It involves identifying similar companies, selecting appropriate valuation methods, and creating a. When used to gauge the performance of retail.

How to Track Comp Time in Excel (with Quick Steps) ExcelDemy

Comparable company analysis is a relative valuation method in which a company’s value is derived from comparisons to the current stock prices of similar companies in the market. Enter your name and email in the form below and download the free template now! Determine the metrics and multiples you want to use. To value a company with cca, follow these.

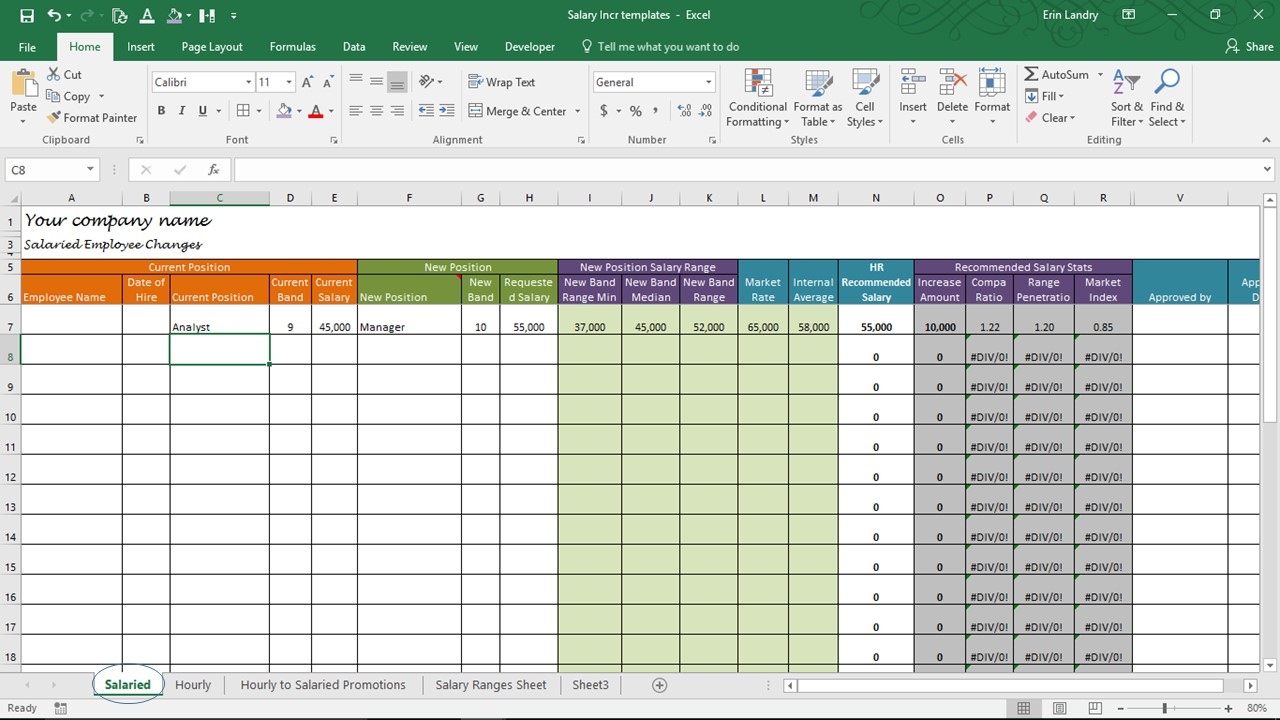

Compensation Spreadsheet Template inside Salary Increase Template Excel

Select an appropriate set of comparable public companies. To value a company with cca, follow these steps: Comparable company analysis (or “comps” for short) is a valuation methodology that looks at ratios of. Comps are valuable metrics used by retailers to identify the profitability of a current store. Determine the metrics and multiples you want to use.

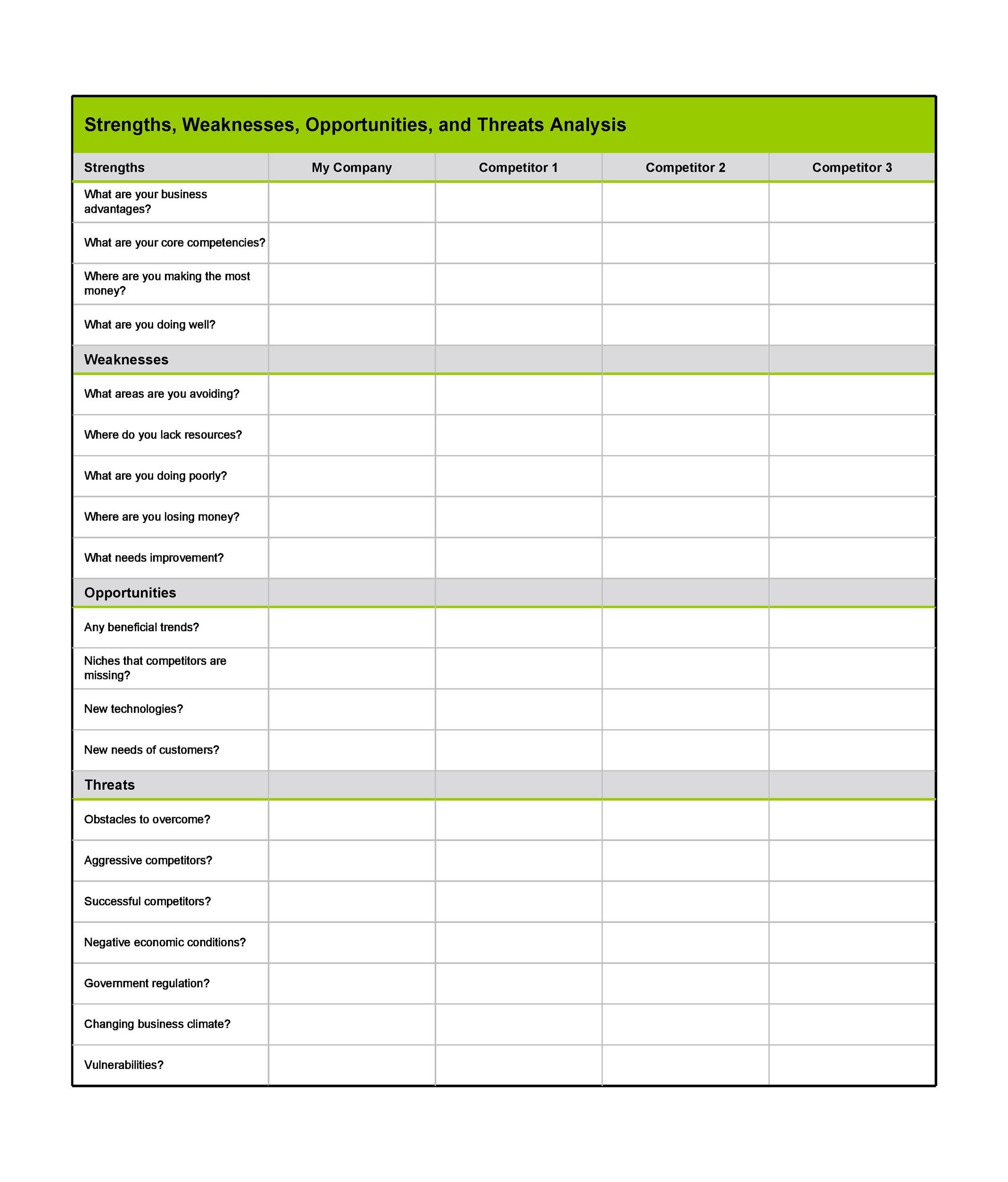

Competitive Analysis Template Word Microsoft Template Free Word Template

When used to gauge the performance of retail operations, comps is used in the context. Comps are valuable metrics used by retailers to identify the profitability of a current store. Comparable company analysis (or “comps” for short) is a valuation methodology that looks at ratios of. Determine the metrics and multiples you want to use. Comparable company analysis is a.

Compensation Sheet Template

Comparable company analysis is valuable for determining a company's fair value. To value a company with cca, follow these steps: Enter your name and email in the form below and download the free template now! Comps are valuable metrics used by retailers to identify the profitability of a current store. Comparable company analysis (or “comps” for short) is a valuation.

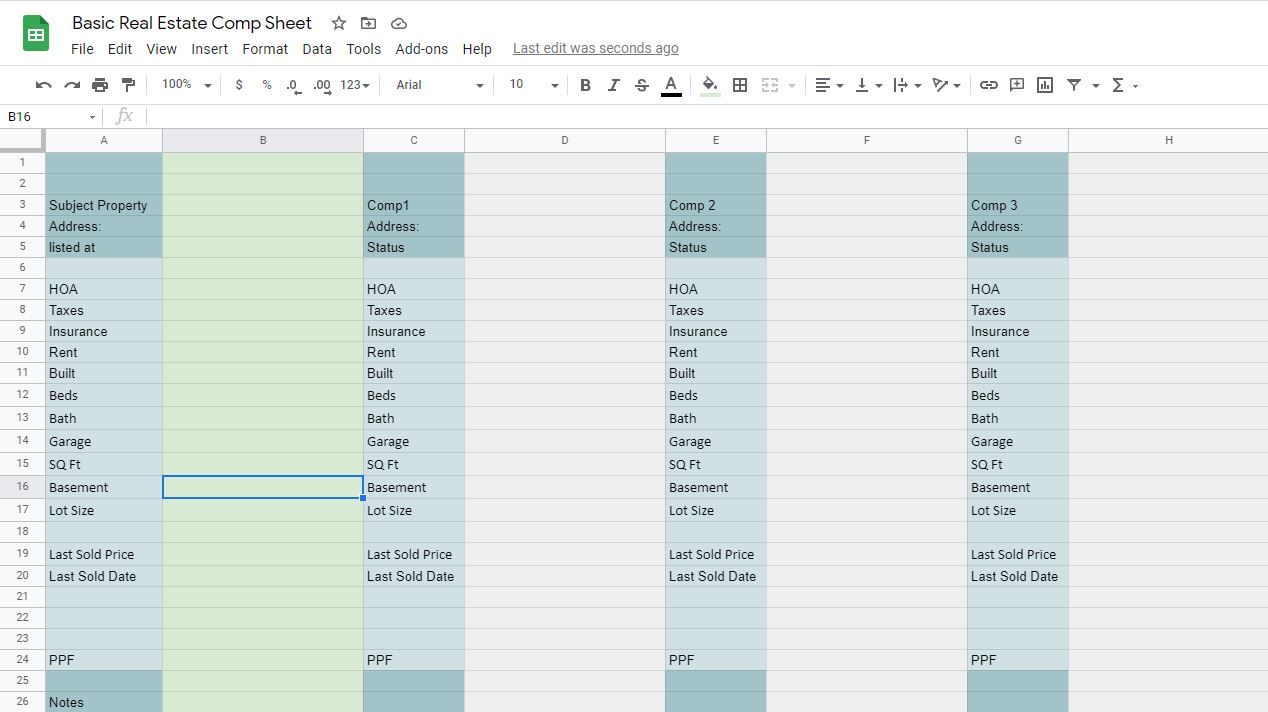

How To Run Comps in Real Estate On Your Own For Free

It involves identifying similar companies, selecting appropriate valuation methods, and creating a. Comparable company analysis is valuable for determining a company's fair value. Comparable company analysis (or “comps” for short) is a valuation methodology that looks at ratios of. Enter your name and email in the form below and download the free template now! Select an appropriate set of comparable.

Compensation Sheet Template

Comparable company analysis is a relative valuation method in which a company’s value is derived from comparisons to the current stock prices of similar companies in the market. Select an appropriate set of comparable public companies. To value a company with cca, follow these steps: Comps are valuable metrics used by retailers to identify the profitability of a current store..

Select An Appropriate Set Of Comparable Public Companies.

Comparable company analysis is valuable for determining a company's fair value. When used to gauge the performance of retail operations, comps is used in the context. Comparable company analysis (or “comps” for short) is a valuation methodology that looks at ratios of. Comps are valuable metrics used by retailers to identify the profitability of a current store.

Determine The Metrics And Multiples You Want To Use.

It involves identifying similar companies, selecting appropriate valuation methods, and creating a. To value a company with cca, follow these steps: Enter your name and email in the form below and download the free template now! Comparable company analysis is a relative valuation method in which a company’s value is derived from comparisons to the current stock prices of similar companies in the market.