Capital Lease Balance Sheet - Capital lease refers to a lease where all the rights related to the assets are transferred to the lessee, and the lessor only finances the. Learn about capital lease accounting including key differences from operating leases, impact on balance sheets,. Capital leases affect both the balance sheet and income statement. At the beginning of the lease, both the assets and.

Learn about capital lease accounting including key differences from operating leases, impact on balance sheets,. Capital lease refers to a lease where all the rights related to the assets are transferred to the lessee, and the lessor only finances the. At the beginning of the lease, both the assets and. Capital leases affect both the balance sheet and income statement.

At the beginning of the lease, both the assets and. Learn about capital lease accounting including key differences from operating leases, impact on balance sheets,. Capital leases affect both the balance sheet and income statement. Capital lease refers to a lease where all the rights related to the assets are transferred to the lessee, and the lessor only finances the.

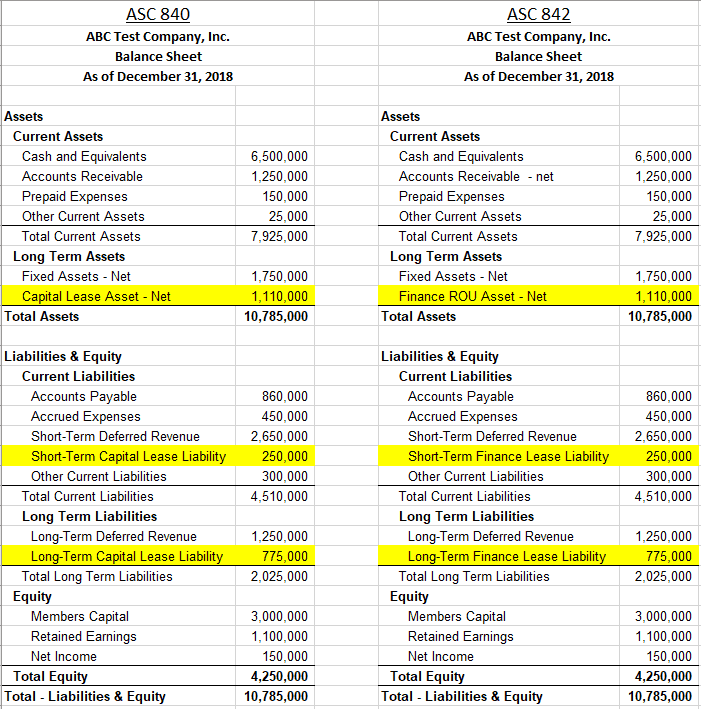

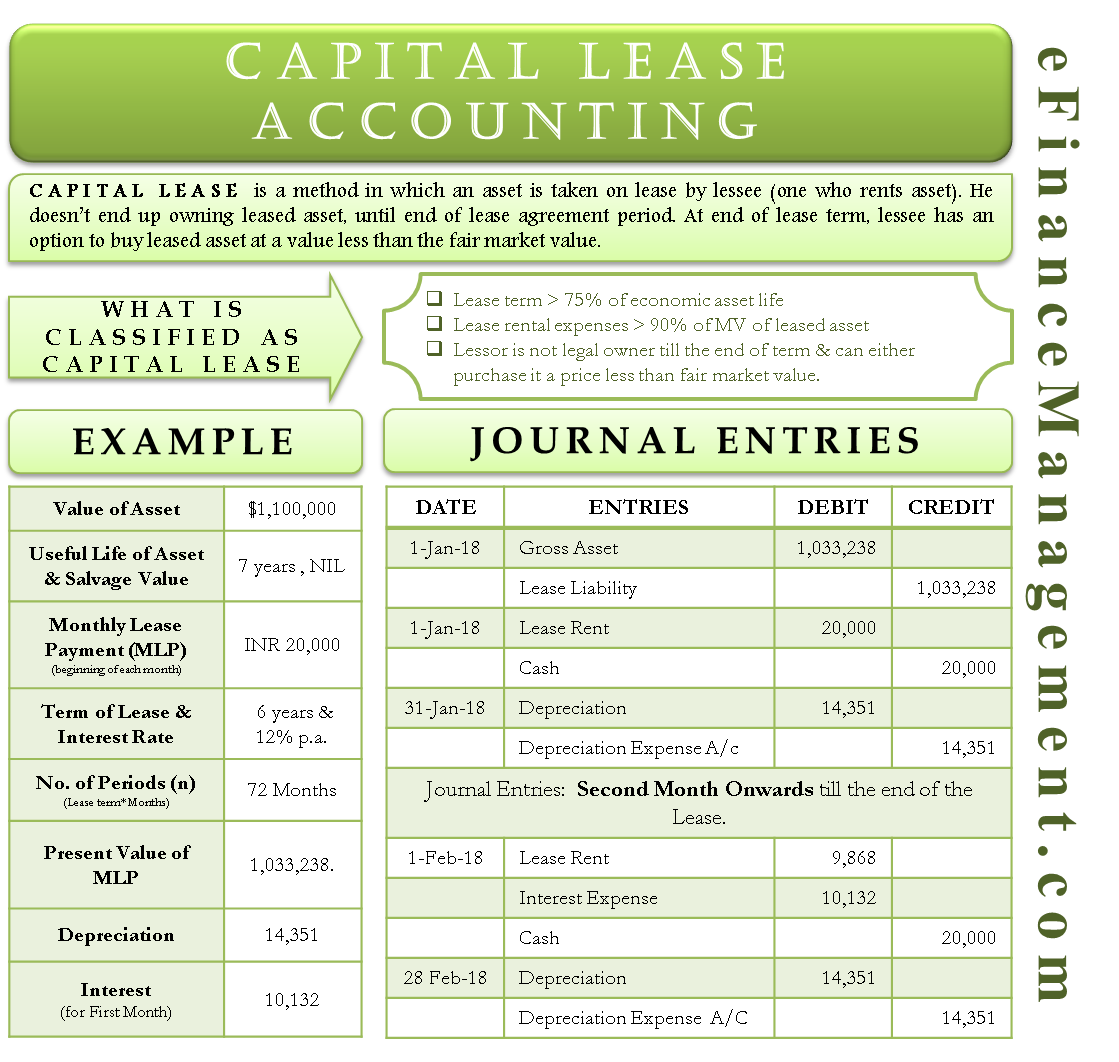

ASC 842 Balance Sheet Guide with Examples Visual Lease

Capital leases affect both the balance sheet and income statement. Learn about capital lease accounting including key differences from operating leases, impact on balance sheets,. Capital lease refers to a lease where all the rights related to the assets are transferred to the lessee, and the lessor only finances the. At the beginning of the lease, both the assets and.

15 Things to know about FASB ASC 842 ASC 842 basics

Capital lease refers to a lease where all the rights related to the assets are transferred to the lessee, and the lessor only finances the. Learn about capital lease accounting including key differences from operating leases, impact on balance sheets,. At the beginning of the lease, both the assets and. Capital leases affect both the balance sheet and income statement.

Capital Lease Accounting And Finance Lease Accounting A Full Example

Capital lease refers to a lease where all the rights related to the assets are transferred to the lessee, and the lessor only finances the. Capital leases affect both the balance sheet and income statement. At the beginning of the lease, both the assets and. Learn about capital lease accounting including key differences from operating leases, impact on balance sheets,.

Accounting for Leases Finance Lease vs. Capital Lease vs. Operating Lease

Capital leases affect both the balance sheet and income statement. Learn about capital lease accounting including key differences from operating leases, impact on balance sheets,. At the beginning of the lease, both the assets and. Capital lease refers to a lease where all the rights related to the assets are transferred to the lessee, and the lessor only finances the.

How to Account for a Capital Lease 8 Steps (with Pictures)

At the beginning of the lease, both the assets and. Capital lease refers to a lease where all the rights related to the assets are transferred to the lessee, and the lessor only finances the. Capital leases affect both the balance sheet and income statement. Learn about capital lease accounting including key differences from operating leases, impact on balance sheets,.

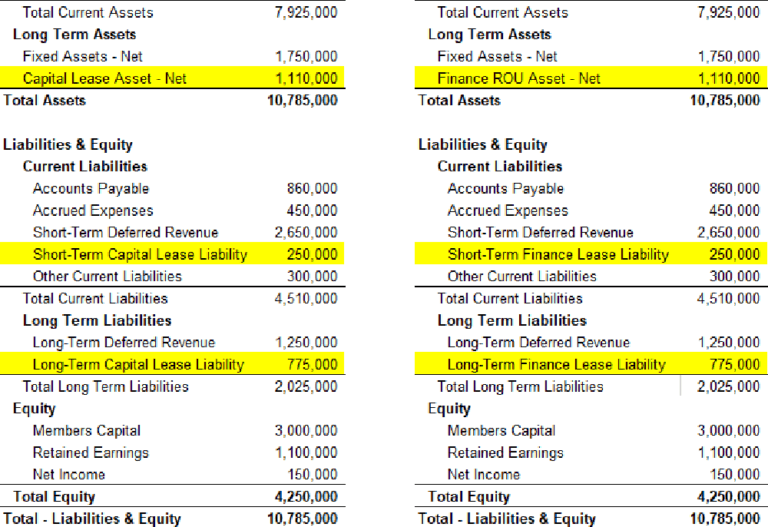

PPT Chapter 4 Asset Analysis PowerPoint Presentation, free download

Learn about capital lease accounting including key differences from operating leases, impact on balance sheets,. Capital lease refers to a lease where all the rights related to the assets are transferred to the lessee, and the lessor only finances the. Capital leases affect both the balance sheet and income statement. At the beginning of the lease, both the assets and.

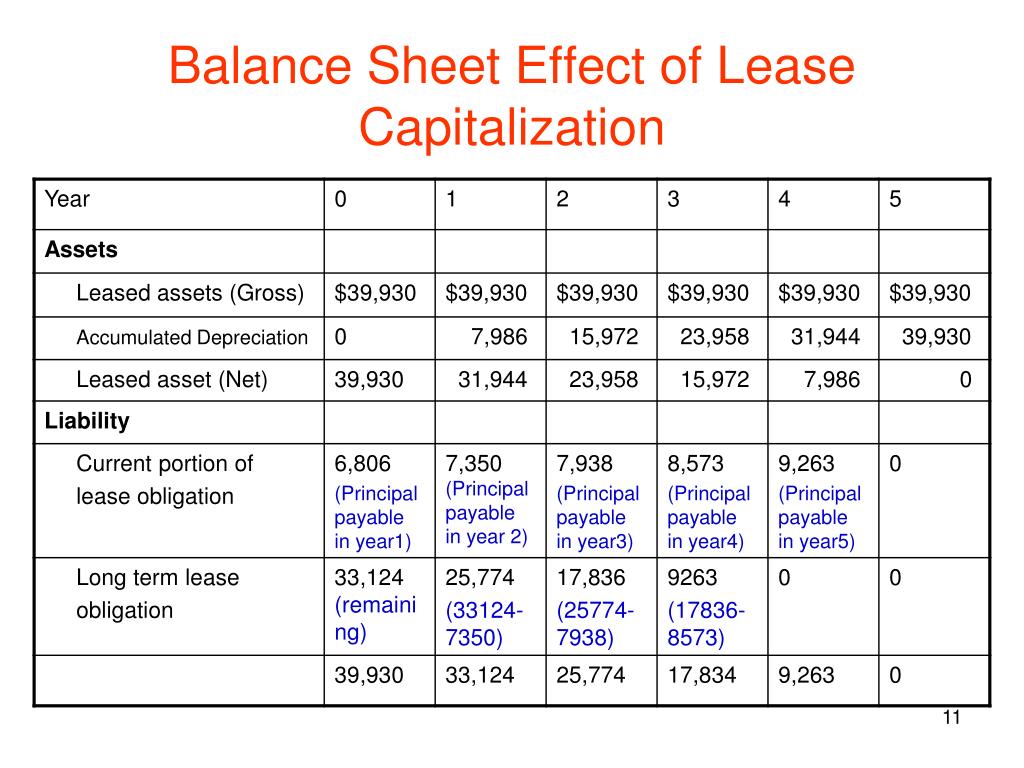

Capital Lease Accounting With Example and Journal Entries

At the beginning of the lease, both the assets and. Capital leases affect both the balance sheet and income statement. Capital lease refers to a lease where all the rights related to the assets are transferred to the lessee, and the lessor only finances the. Learn about capital lease accounting including key differences from operating leases, impact on balance sheets,.

How to Account for a Capital Lease 8 Steps (with Pictures)

At the beginning of the lease, both the assets and. Capital lease refers to a lease where all the rights related to the assets are transferred to the lessee, and the lessor only finances the. Learn about capital lease accounting including key differences from operating leases, impact on balance sheets,. Capital leases affect both the balance sheet and income statement.

Accounting for Capital Leases Calculator Double Entry Bookkeeping

Capital lease refers to a lease where all the rights related to the assets are transferred to the lessee, and the lessor only finances the. Learn about capital lease accounting including key differences from operating leases, impact on balance sheets,. Capital leases affect both the balance sheet and income statement. At the beginning of the lease, both the assets and.

PPT Accounting for a Capital Lease PowerPoint Presentation, free

Capital lease refers to a lease where all the rights related to the assets are transferred to the lessee, and the lessor only finances the. Capital leases affect both the balance sheet and income statement. At the beginning of the lease, both the assets and. Learn about capital lease accounting including key differences from operating leases, impact on balance sheets,.

At The Beginning Of The Lease, Both The Assets And.

Learn about capital lease accounting including key differences from operating leases, impact on balance sheets,. Capital lease refers to a lease where all the rights related to the assets are transferred to the lessee, and the lessor only finances the. Capital leases affect both the balance sheet and income statement.