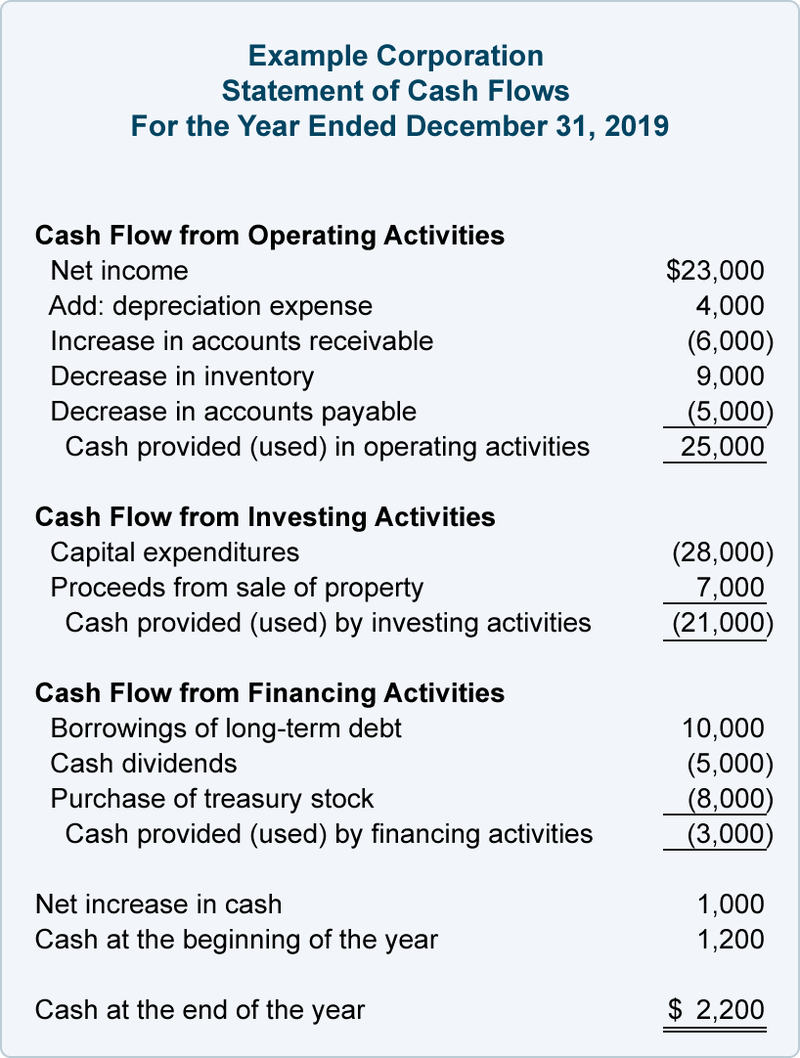

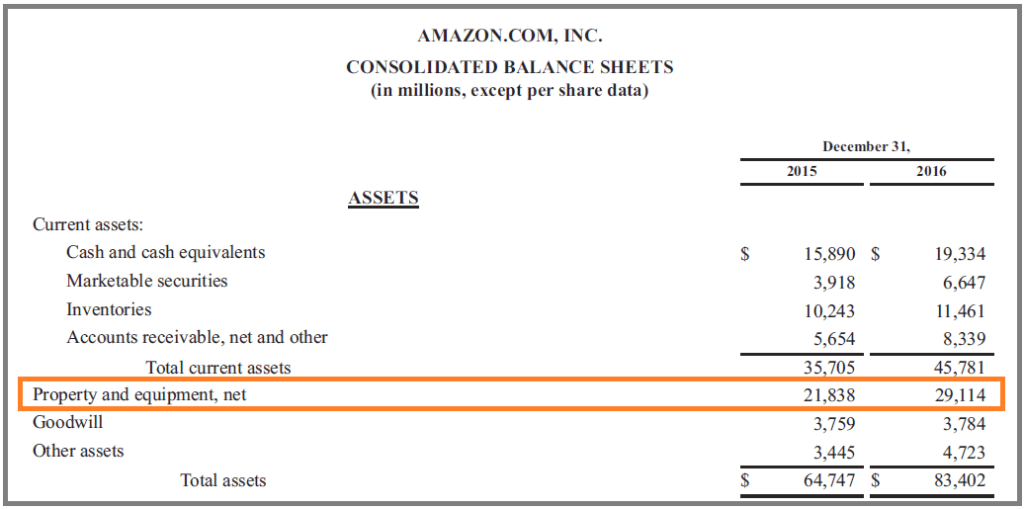

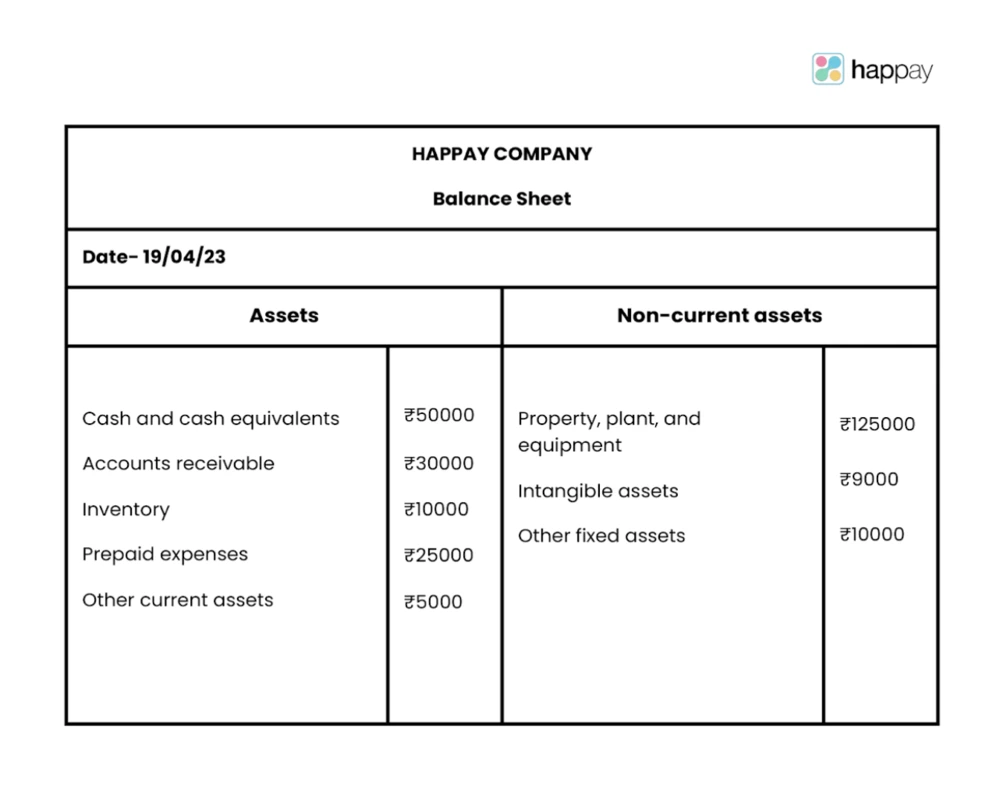

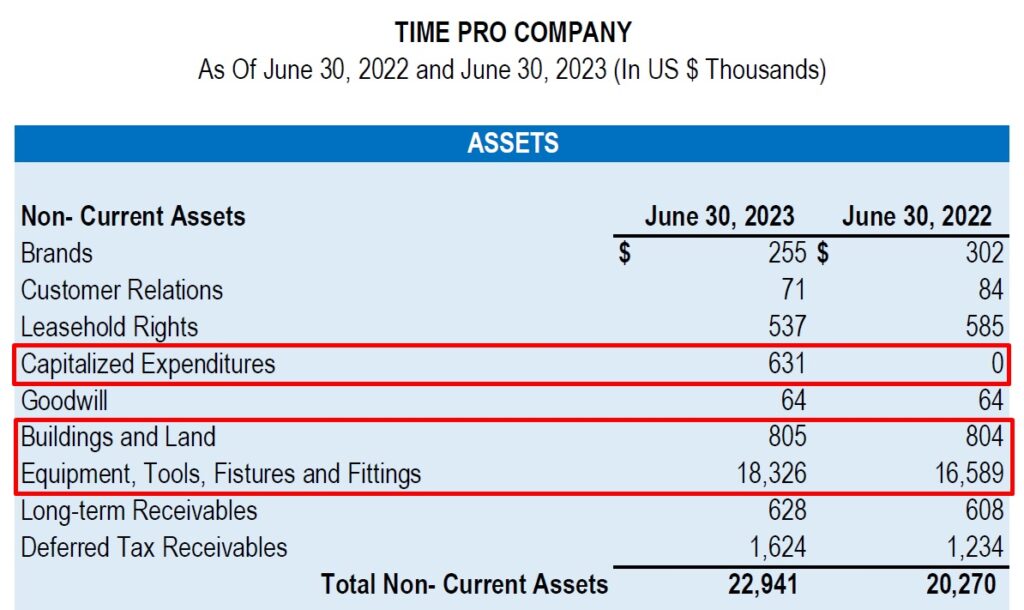

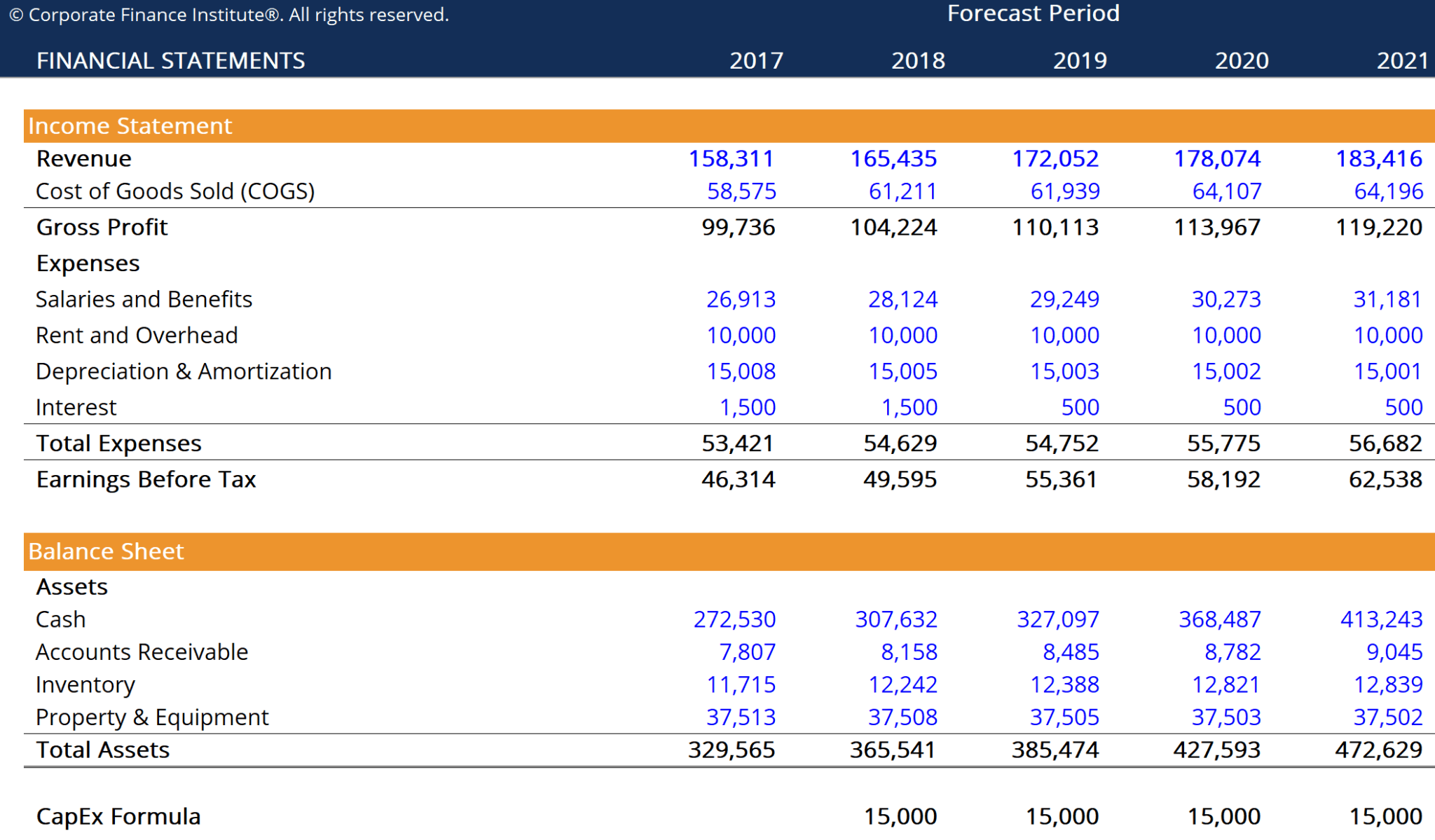

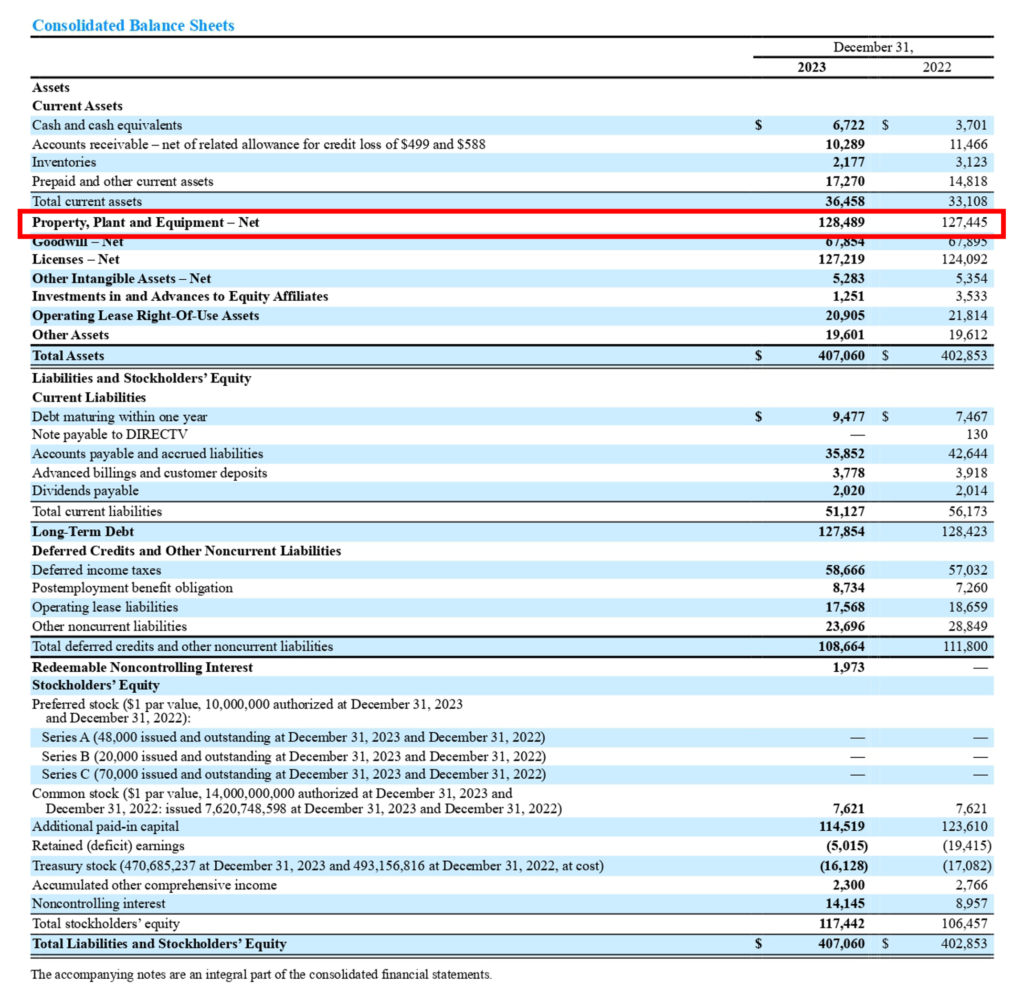

Capex Balance Sheet - This includes both tangible and intangible assets like machinery,. The capital expenditure (capex) of a company in a given period can be determined by tracking the changes in the company’s fixed assets (or pp&e) balances recorded on the. Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under property, plant, and equipment (pp&e). Capital expenditures are payments that are made for goods or services that are recorded or capitalized on a company's balance sheet rather than expensed on the income. Capital expenditure (capex) of a business is the total capital spent on buying, maintaining, and upgrading fixed assets.

Capital expenditure (capex) of a business is the total capital spent on buying, maintaining, and upgrading fixed assets. This includes both tangible and intangible assets like machinery,. The capital expenditure (capex) of a company in a given period can be determined by tracking the changes in the company’s fixed assets (or pp&e) balances recorded on the. Capital expenditures are payments that are made for goods or services that are recorded or capitalized on a company's balance sheet rather than expensed on the income. Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under property, plant, and equipment (pp&e).

Capital expenditures are payments that are made for goods or services that are recorded or capitalized on a company's balance sheet rather than expensed on the income. This includes both tangible and intangible assets like machinery,. Capital expenditure (capex) of a business is the total capital spent on buying, maintaining, and upgrading fixed assets. The capital expenditure (capex) of a company in a given period can be determined by tracking the changes in the company’s fixed assets (or pp&e) balances recorded on the. Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under property, plant, and equipment (pp&e).

Capital Expenditure (CAPEX) Definition, Example, Formula

The capital expenditure (capex) of a company in a given period can be determined by tracking the changes in the company’s fixed assets (or pp&e) balances recorded on the. Capital expenditures are payments that are made for goods or services that are recorded or capitalized on a company's balance sheet rather than expensed on the income. This includes both tangible.

Capital Expenditure (CapEX) Meaning, Types, Examples, Formula

Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under property, plant, and equipment (pp&e). This includes both tangible and intangible assets like machinery,. The capital expenditure (capex) of a company in a given period can be determined by tracking the changes in the company’s fixed assets (or pp&e) balances recorded on.

What is CapEx? Solving Finance

Capital expenditure (capex) of a business is the total capital spent on buying, maintaining, and upgrading fixed assets. Capital expenditures are payments that are made for goods or services that are recorded or capitalized on a company's balance sheet rather than expensed on the income. Capital expenditures are recorded on cash flow statements under investing activities and on the balance.

CapEx (Capital Expenditure) Definition, Formula, and Examples

Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under property, plant, and equipment (pp&e). Capital expenditures are payments that are made for goods or services that are recorded or capitalized on a company's balance sheet rather than expensed on the income. Capital expenditure (capex) of a business is the total capital.

CapEx Formula Template Download Free Excel Template

Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under property, plant, and equipment (pp&e). Capital expenditure (capex) of a business is the total capital spent on buying, maintaining, and upgrading fixed assets. This includes both tangible and intangible assets like machinery,. Capital expenditures are payments that are made for goods or.

Capital Expenditure (Capex) how fast are you building them up

Capital expenditures are payments that are made for goods or services that are recorded or capitalized on a company's balance sheet rather than expensed on the income. Capital expenditure (capex) of a business is the total capital spent on buying, maintaining, and upgrading fixed assets. This includes both tangible and intangible assets like machinery,. Capital expenditures are recorded on cash.

What Are the Types of Capital Expenditures (CapEx)?

Capital expenditures are payments that are made for goods or services that are recorded or capitalized on a company's balance sheet rather than expensed on the income. The capital expenditure (capex) of a company in a given period can be determined by tracking the changes in the company’s fixed assets (or pp&e) balances recorded on the. Capital expenditures are recorded.

Capital Expenditure Excel Template

Capital expenditures are payments that are made for goods or services that are recorded or capitalized on a company's balance sheet rather than expensed on the income. Capital expenditure (capex) of a business is the total capital spent on buying, maintaining, and upgrading fixed assets. This includes both tangible and intangible assets like machinery,. The capital expenditure (capex) of a.

Capital Expenditure (CapEx) Types, Formula, And Calculation Geneva Lunch

Capital expenditure (capex) of a business is the total capital spent on buying, maintaining, and upgrading fixed assets. Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under property, plant, and equipment (pp&e). This includes both tangible and intangible assets like machinery,. Capital expenditures are payments that are made for goods or.

What is capex and how do you calculate it?

Capital expenditures are payments that are made for goods or services that are recorded or capitalized on a company's balance sheet rather than expensed on the income. Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under property, plant, and equipment (pp&e). The capital expenditure (capex) of a company in a given.

Capital Expenditures Are Recorded On Cash Flow Statements Under Investing Activities And On The Balance Sheet, Usually Under Property, Plant, And Equipment (Pp&E).

Capital expenditures are payments that are made for goods or services that are recorded or capitalized on a company's balance sheet rather than expensed on the income. This includes both tangible and intangible assets like machinery,. The capital expenditure (capex) of a company in a given period can be determined by tracking the changes in the company’s fixed assets (or pp&e) balances recorded on the. Capital expenditure (capex) of a business is the total capital spent on buying, maintaining, and upgrading fixed assets.

:max_bytes(150000):strip_icc()/tesla10k2021-e9efcb215b3248278ad49cc846ac3ec6.jpg)