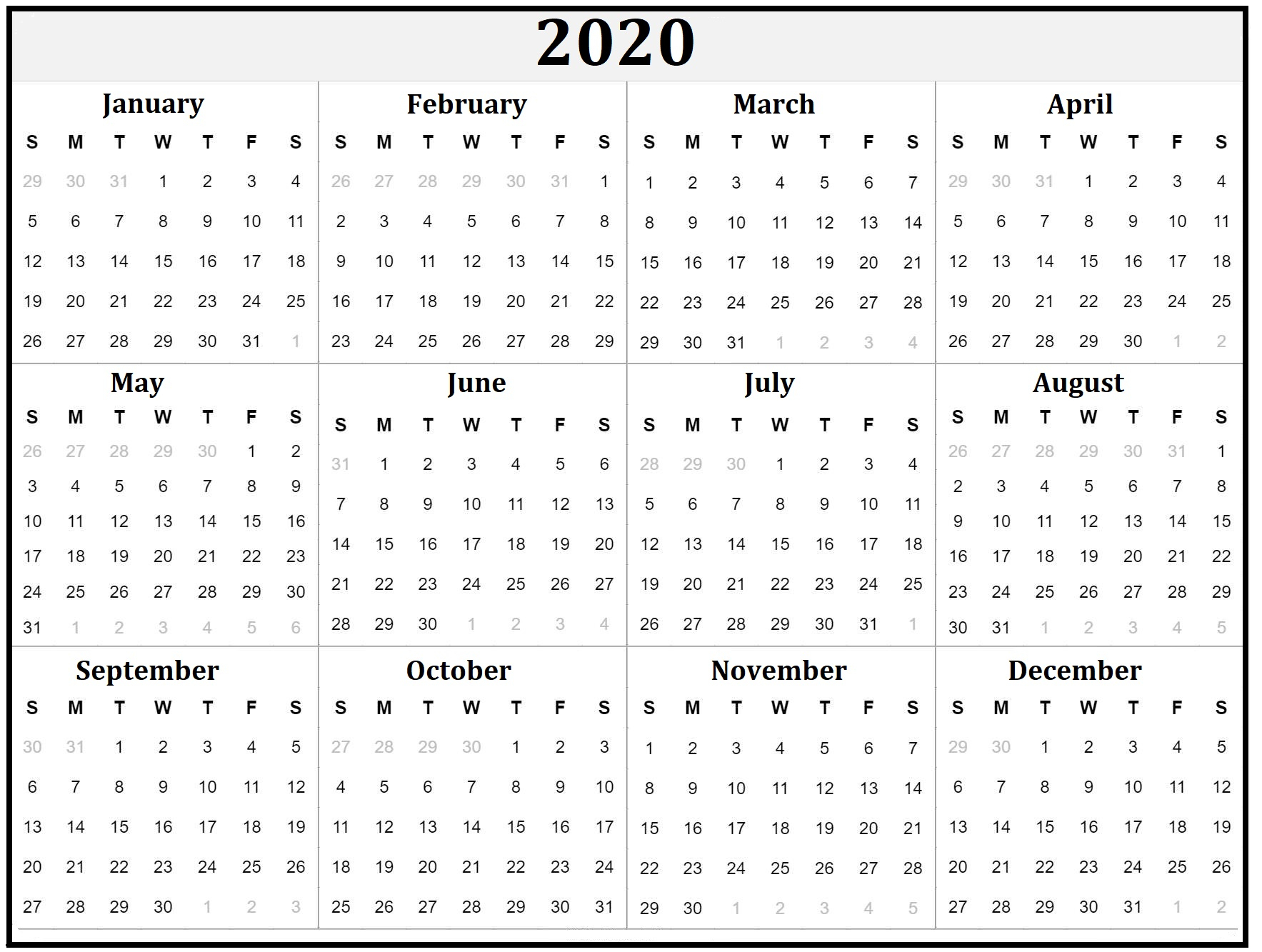

Calendar Year Filer - If you're a calendar year filer and your tax year ends on december 31, the due date for filing your federal individual income tax return is generally. A company that starts its fiscal year on january 1 and ends it on december 31 operates on a calendar year basis. This aligns with the gregorian. A calendar year runs from january 1 to december 31.

If you're a calendar year filer and your tax year ends on december 31, the due date for filing your federal individual income tax return is generally. A company that starts its fiscal year on january 1 and ends it on december 31 operates on a calendar year basis. This aligns with the gregorian. A calendar year runs from january 1 to december 31.

This aligns with the gregorian. A company that starts its fiscal year on january 1 and ends it on december 31 operates on a calendar year basis. A calendar year runs from january 1 to december 31. If you're a calendar year filer and your tax year ends on december 31, the due date for filing your federal individual income tax return is generally.

November 2024 Calendar, Calendar 2024, Calendar Year 2024, Monthly

A company that starts its fiscal year on january 1 and ends it on december 31 operates on a calendar year basis. This aligns with the gregorian. If you're a calendar year filer and your tax year ends on december 31, the due date for filing your federal individual income tax return is generally. A calendar year runs from january.

2024 Year at A Glance, INSTANT DOWNLOAD, Yearly Overview, Printable

A company that starts its fiscal year on january 1 and ends it on december 31 operates on a calendar year basis. A calendar year runs from january 1 to december 31. This aligns with the gregorian. If you're a calendar year filer and your tax year ends on december 31, the due date for filing your federal individual income.

Yearly Planner Printable, Printable Calendar PDF, Desk Calendar, Yearly

This aligns with the gregorian. A company that starts its fiscal year on january 1 and ends it on december 31 operates on a calendar year basis. If you're a calendar year filer and your tax year ends on december 31, the due date for filing your federal individual income tax return is generally. A calendar year runs from january.

Annual Calendars in Microsoft Excel Format 36 Templates

A company that starts its fiscal year on january 1 and ends it on december 31 operates on a calendar year basis. This aligns with the gregorian. If you're a calendar year filer and your tax year ends on december 31, the due date for filing your federal individual income tax return is generally. A calendar year runs from january.

Printable Calendar Free Printable Calendar Printable Monthly

This aligns with the gregorian. If you're a calendar year filer and your tax year ends on december 31, the due date for filing your federal individual income tax return is generally. A company that starts its fiscal year on january 1 and ends it on december 31 operates on a calendar year basis. A calendar year runs from january.

Horizontal Yearly Calendar Template in Excel, Google Sheets Download

A calendar year runs from january 1 to december 31. This aligns with the gregorian. A company that starts its fiscal year on january 1 and ends it on december 31 operates on a calendar year basis. If you're a calendar year filer and your tax year ends on december 31, the due date for filing your federal individual income.

2024 Yearly Calendar Printable, One Page Calendar, Yearly Overview

If you're a calendar year filer and your tax year ends on december 31, the due date for filing your federal individual income tax return is generally. A company that starts its fiscal year on january 1 and ends it on december 31 operates on a calendar year basis. This aligns with the gregorian. A calendar year runs from january.

Full Year Calendar, Yearly Planner on 1 Page, Yearly Wall Planner

If you're a calendar year filer and your tax year ends on december 31, the due date for filing your federal individual income tax return is generally. A company that starts its fiscal year on january 1 and ends it on december 31 operates on a calendar year basis. A calendar year runs from january 1 to december 31. This.

Free Annual Calendars in PDF Format 36 Templates

A calendar year runs from january 1 to december 31. A company that starts its fiscal year on january 1 and ends it on december 31 operates on a calendar year basis. This aligns with the gregorian. If you're a calendar year filer and your tax year ends on december 31, the due date for filing your federal individual income.

Yearly Blank Calendar Potrait Free Printable Templates

A calendar year runs from january 1 to december 31. If you're a calendar year filer and your tax year ends on december 31, the due date for filing your federal individual income tax return is generally. A company that starts its fiscal year on january 1 and ends it on december 31 operates on a calendar year basis. This.

A Company That Starts Its Fiscal Year On January 1 And Ends It On December 31 Operates On A Calendar Year Basis.

This aligns with the gregorian. A calendar year runs from january 1 to december 31. If you're a calendar year filer and your tax year ends on december 31, the due date for filing your federal individual income tax return is generally.