Book Value On Balance Sheet - The book value of a company is the difference in value between that company's total assets and total liabilities on its balance sheet. Book value can also refer to the amount that investors would theoretically receive if an entity liquidated, which could be. Learn how to calculate book value accurately by understanding key steps, formulas, and considerations for both tangible and. The book value figure is typically viewed in relation to the company’s stock value (market capitalization) and is determined by taking the.

The book value figure is typically viewed in relation to the company’s stock value (market capitalization) and is determined by taking the. The book value of a company is the difference in value between that company's total assets and total liabilities on its balance sheet. Book value can also refer to the amount that investors would theoretically receive if an entity liquidated, which could be. Learn how to calculate book value accurately by understanding key steps, formulas, and considerations for both tangible and.

Book value can also refer to the amount that investors would theoretically receive if an entity liquidated, which could be. The book value figure is typically viewed in relation to the company’s stock value (market capitalization) and is determined by taking the. The book value of a company is the difference in value between that company's total assets and total liabilities on its balance sheet. Learn how to calculate book value accurately by understanding key steps, formulas, and considerations for both tangible and.

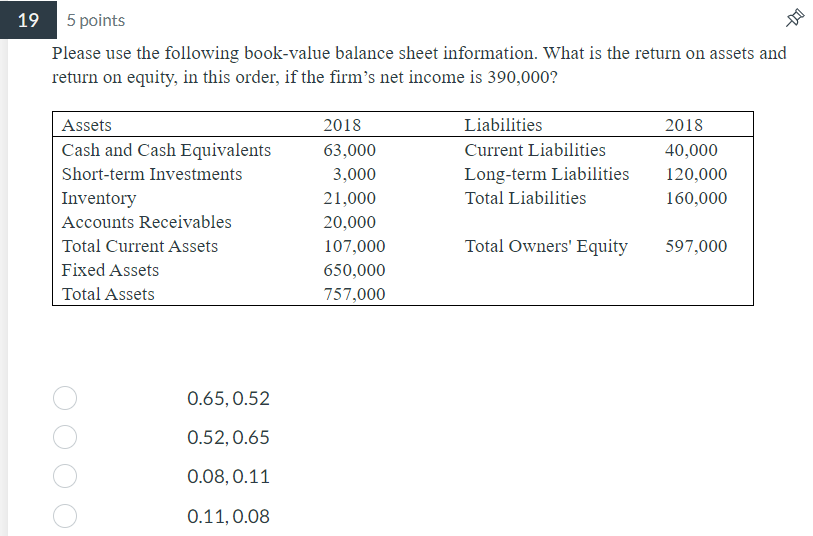

Solved Please use the following bookvalue balance sheet

The book value of a company is the difference in value between that company's total assets and total liabilities on its balance sheet. Book value can also refer to the amount that investors would theoretically receive if an entity liquidated, which could be. The book value figure is typically viewed in relation to the company’s stock value (market capitalization) and.

Lecture 82 PDF Book Value Balance Sheet

Learn how to calculate book value accurately by understanding key steps, formulas, and considerations for both tangible and. The book value figure is typically viewed in relation to the company’s stock value (market capitalization) and is determined by taking the. The book value of a company is the difference in value between that company's total assets and total liabilities on.

Book Value vs Market Value Balance Sheet Simple Example Using Excel

Book value can also refer to the amount that investors would theoretically receive if an entity liquidated, which could be. The book value figure is typically viewed in relation to the company’s stock value (market capitalization) and is determined by taking the. The book value of a company is the difference in value between that company's total assets and total.

Company Accounts Balance Sheet Format PDF Book Value Balance Sheet

Book value can also refer to the amount that investors would theoretically receive if an entity liquidated, which could be. The book value of a company is the difference in value between that company's total assets and total liabilities on its balance sheet. The book value figure is typically viewed in relation to the company’s stock value (market capitalization) and.

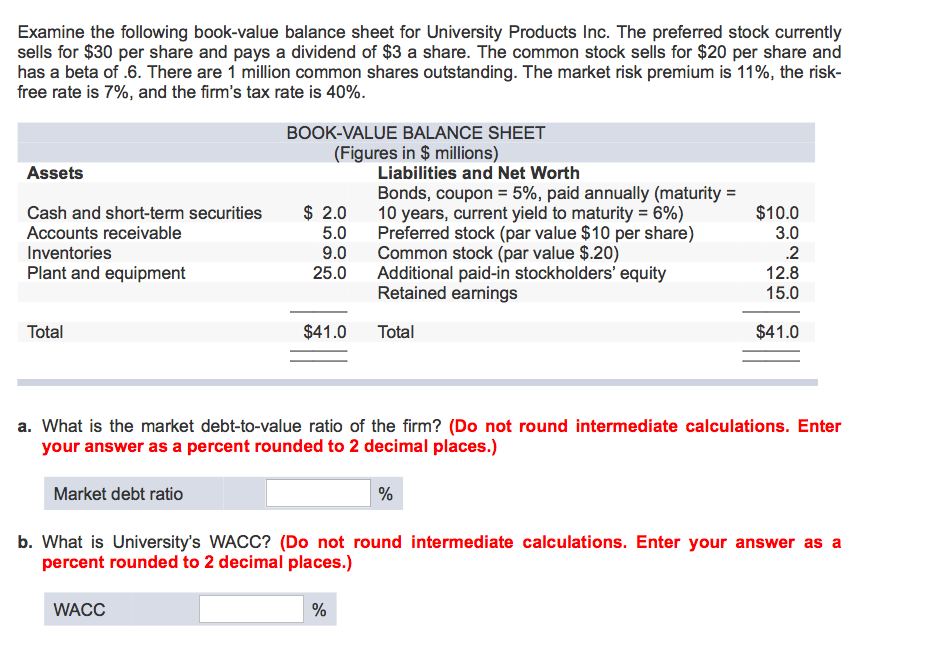

Solved Examine the following bookvalue balance sheet for

Learn how to calculate book value accurately by understanding key steps, formulas, and considerations for both tangible and. The book value figure is typically viewed in relation to the company’s stock value (market capitalization) and is determined by taking the. The book value of a company is the difference in value between that company's total assets and total liabilities on.

CH 04 PDF Book Value Balance Sheet

The book value of a company is the difference in value between that company's total assets and total liabilities on its balance sheet. The book value figure is typically viewed in relation to the company’s stock value (market capitalization) and is determined by taking the. Learn how to calculate book value accurately by understanding key steps, formulas, and considerations for.

Problem 1 PDF Book Value Balance Sheet

The book value of a company is the difference in value between that company's total assets and total liabilities on its balance sheet. Learn how to calculate book value accurately by understanding key steps, formulas, and considerations for both tangible and. The book value figure is typically viewed in relation to the company’s stock value (market capitalization) and is determined.

Acquisition Method PDF Book Value Balance Sheet

The book value of a company is the difference in value between that company's total assets and total liabilities on its balance sheet. Book value can also refer to the amount that investors would theoretically receive if an entity liquidated, which could be. The book value figure is typically viewed in relation to the company’s stock value (market capitalization) and.

What Is Book Value Per Share With Example at Richard Mckillip blog

Book value can also refer to the amount that investors would theoretically receive if an entity liquidated, which could be. Learn how to calculate book value accurately by understanding key steps, formulas, and considerations for both tangible and. The book value figure is typically viewed in relation to the company’s stock value (market capitalization) and is determined by taking the..

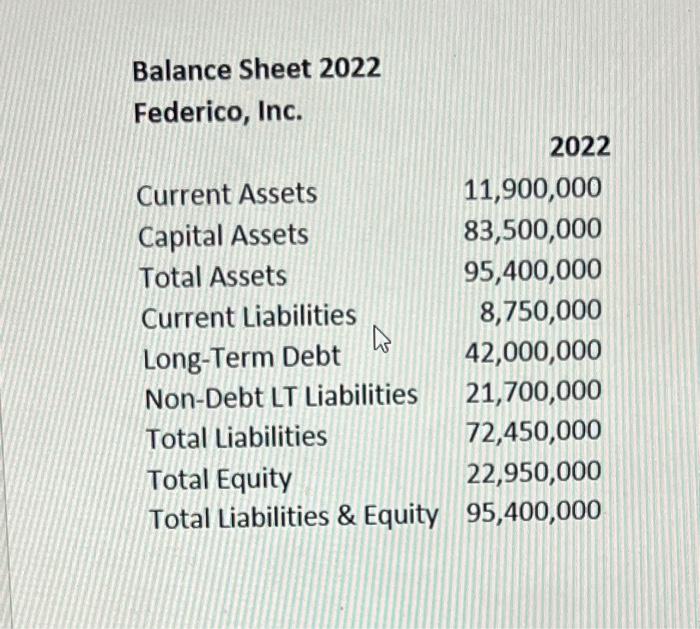

Solved Consider the attached bookvalue balance sheet for

Learn how to calculate book value accurately by understanding key steps, formulas, and considerations for both tangible and. The book value of a company is the difference in value between that company's total assets and total liabilities on its balance sheet. The book value figure is typically viewed in relation to the company’s stock value (market capitalization) and is determined.

The Book Value Of A Company Is The Difference In Value Between That Company's Total Assets And Total Liabilities On Its Balance Sheet.

Learn how to calculate book value accurately by understanding key steps, formulas, and considerations for both tangible and. The book value figure is typically viewed in relation to the company’s stock value (market capitalization) and is determined by taking the. Book value can also refer to the amount that investors would theoretically receive if an entity liquidated, which could be.