Balance Sheet Optimization - Our clients are constantly looking to optimise their balance sheets for profit, funding and risk. In the realm of finance, balance sheet optimization is a strategic approach that companies employ to manage their assets and. To achieve this, they refine asset and. There were attempts to treat institutions’ (and corporate) balance sheets as portfolios of assets, with balance sheet.

Our clients are constantly looking to optimise their balance sheets for profit, funding and risk. To achieve this, they refine asset and. There were attempts to treat institutions’ (and corporate) balance sheets as portfolios of assets, with balance sheet. In the realm of finance, balance sheet optimization is a strategic approach that companies employ to manage their assets and.

There were attempts to treat institutions’ (and corporate) balance sheets as portfolios of assets, with balance sheet. Our clients are constantly looking to optimise their balance sheets for profit, funding and risk. To achieve this, they refine asset and. In the realm of finance, balance sheet optimization is a strategic approach that companies employ to manage their assets and.

Balance Sheet Optimization A Study on Wesfarmers Limited

There were attempts to treat institutions’ (and corporate) balance sheets as portfolios of assets, with balance sheet. Our clients are constantly looking to optimise their balance sheets for profit, funding and risk. In the realm of finance, balance sheet optimization is a strategic approach that companies employ to manage their assets and. To achieve this, they refine asset and.

Balance Sheet Optimization Optimized Financial Systems

To achieve this, they refine asset and. In the realm of finance, balance sheet optimization is a strategic approach that companies employ to manage their assets and. Our clients are constantly looking to optimise their balance sheets for profit, funding and risk. There were attempts to treat institutions’ (and corporate) balance sheets as portfolios of assets, with balance sheet.

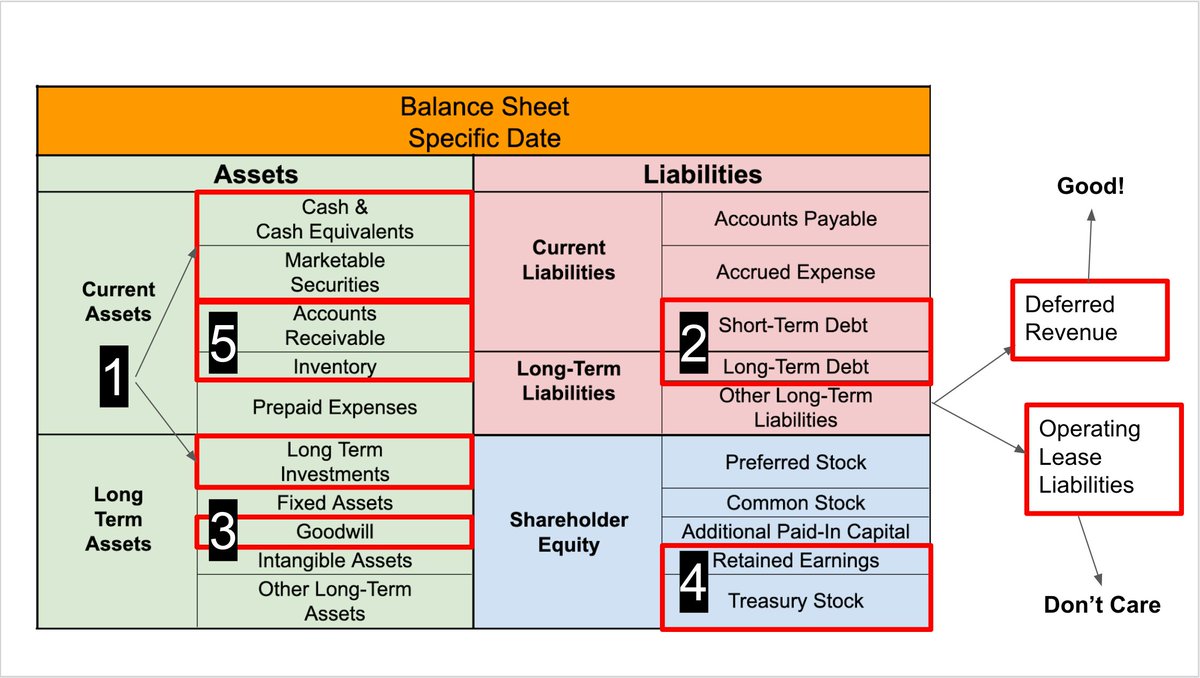

Brian Feroldi (🧠,📈) on Twitter "How to analyze a Balance Sheet in less

To achieve this, they refine asset and. There were attempts to treat institutions’ (and corporate) balance sheets as portfolios of assets, with balance sheet. Our clients are constantly looking to optimise their balance sheets for profit, funding and risk. In the realm of finance, balance sheet optimization is a strategic approach that companies employ to manage their assets and.

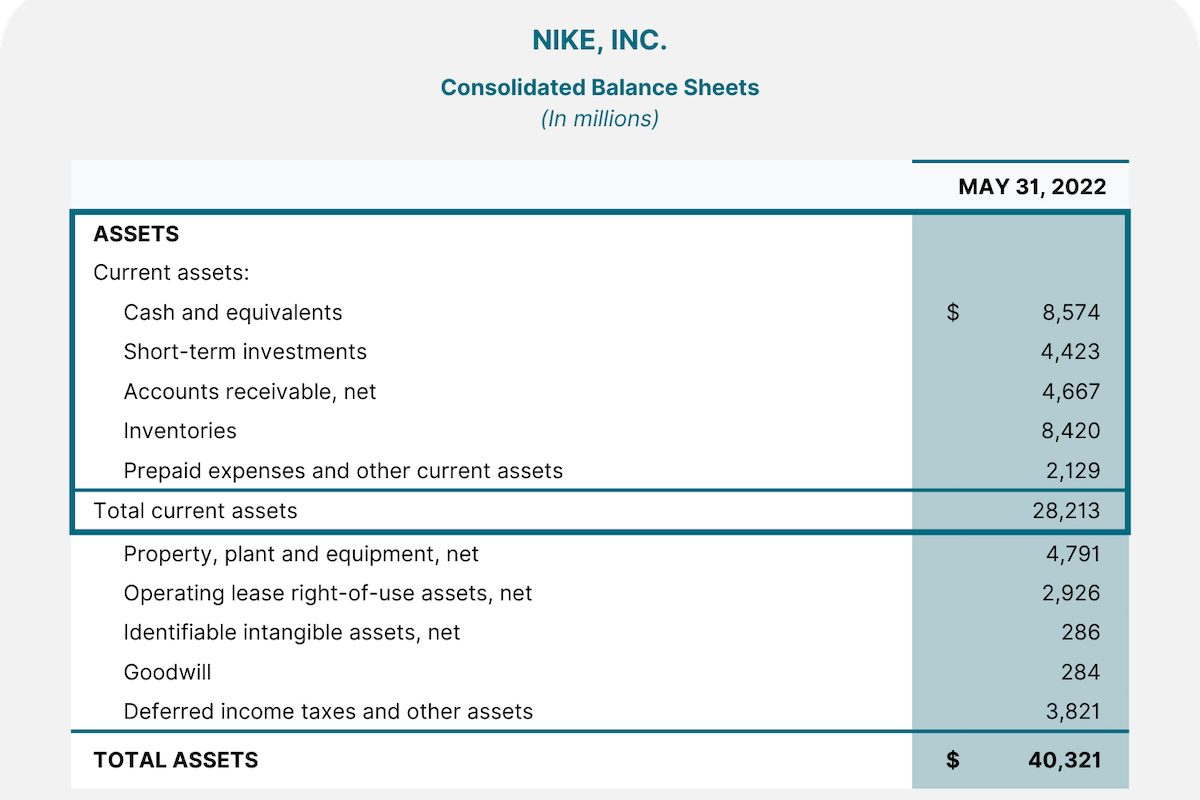

Balance Sheet Analysis with Examples Reading a Balance Sheet

To achieve this, they refine asset and. There were attempts to treat institutions’ (and corporate) balance sheets as portfolios of assets, with balance sheet. In the realm of finance, balance sheet optimization is a strategic approach that companies employ to manage their assets and. Our clients are constantly looking to optimise their balance sheets for profit, funding and risk.

Understanding Balance Sheets A Comprehensive Guide

To achieve this, they refine asset and. There were attempts to treat institutions’ (and corporate) balance sheets as portfolios of assets, with balance sheet. In the realm of finance, balance sheet optimization is a strategic approach that companies employ to manage their assets and. Our clients are constantly looking to optimise their balance sheets for profit, funding and risk.

GRAPHIC

Our clients are constantly looking to optimise their balance sheets for profit, funding and risk. There were attempts to treat institutions’ (and corporate) balance sheets as portfolios of assets, with balance sheet. To achieve this, they refine asset and. In the realm of finance, balance sheet optimization is a strategic approach that companies employ to manage their assets and.

Balance Sheet Optimization PDF Market Liquidity Leverage (Finance)

There were attempts to treat institutions’ (and corporate) balance sheets as portfolios of assets, with balance sheet. In the realm of finance, balance sheet optimization is a strategic approach that companies employ to manage their assets and. To achieve this, they refine asset and. Our clients are constantly looking to optimise their balance sheets for profit, funding and risk.

Balance Sheet Optimization With LGIS LGIS Group

There were attempts to treat institutions’ (and corporate) balance sheets as portfolios of assets, with balance sheet. Our clients are constantly looking to optimise their balance sheets for profit, funding and risk. In the realm of finance, balance sheet optimization is a strategic approach that companies employ to manage their assets and. To achieve this, they refine asset and.

Advanced Strategy Balance Sheet Management & Profitability

Our clients are constantly looking to optimise their balance sheets for profit, funding and risk. There were attempts to treat institutions’ (and corporate) balance sheets as portfolios of assets, with balance sheet. In the realm of finance, balance sheet optimization is a strategic approach that companies employ to manage their assets and. To achieve this, they refine asset and.

Align Your Focus on Consumer Experience with Balance Sheet Optimization

To achieve this, they refine asset and. Our clients are constantly looking to optimise their balance sheets for profit, funding and risk. There were attempts to treat institutions’ (and corporate) balance sheets as portfolios of assets, with balance sheet. In the realm of finance, balance sheet optimization is a strategic approach that companies employ to manage their assets and.

To Achieve This, They Refine Asset And.

Our clients are constantly looking to optimise their balance sheets for profit, funding and risk. In the realm of finance, balance sheet optimization is a strategic approach that companies employ to manage their assets and. There were attempts to treat institutions’ (and corporate) balance sheets as portfolios of assets, with balance sheet.