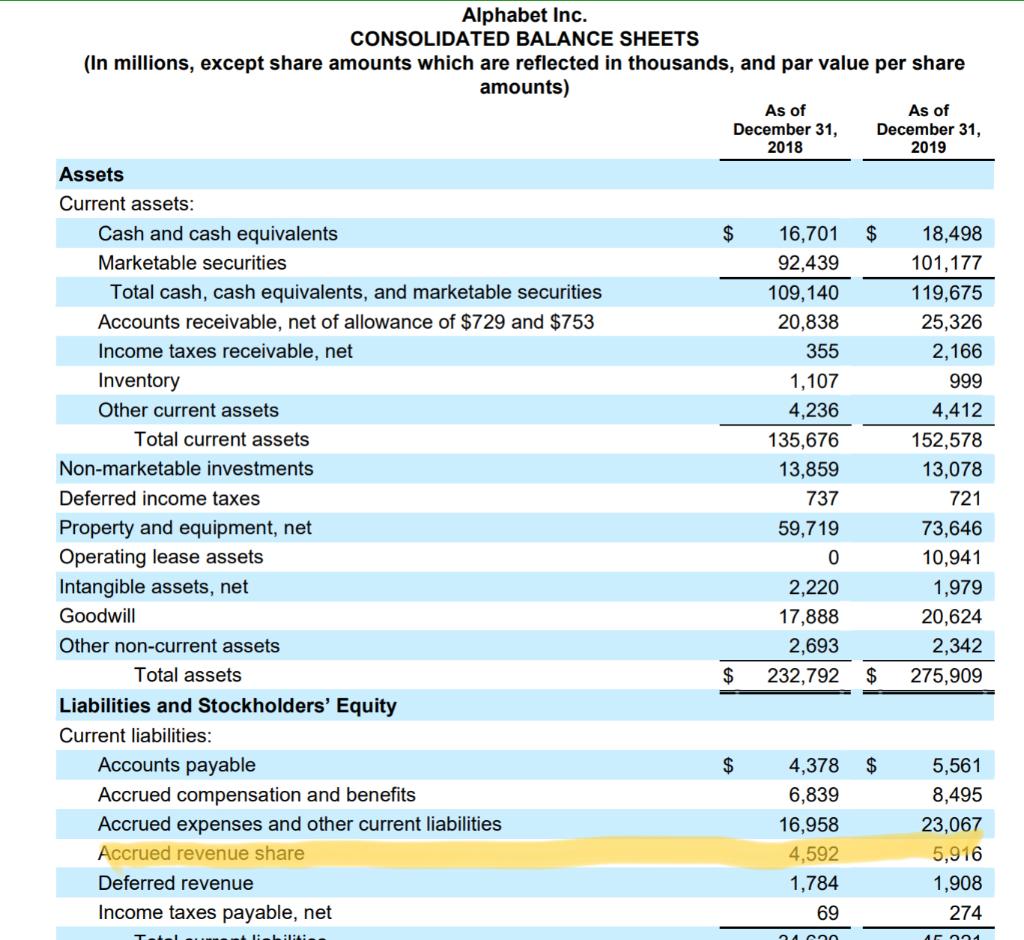

Accrued Revenue Balance Sheet - On the income statement, it increases revenue, which. Accrued revenue affects both the income statement and the balance sheet. Accrued revenue is the revenue that the company already earned through providing goods or services to the customer, but the company has. Thus, the offsets to accruals in. The unbilled revenue account should appear in the current assets portion of the balance sheet. Accrued revenue is income earned for goods or services sold but not yet paid, recorded as an asset on the balance sheet until.

The unbilled revenue account should appear in the current assets portion of the balance sheet. Thus, the offsets to accruals in. On the income statement, it increases revenue, which. Accrued revenue affects both the income statement and the balance sheet. Accrued revenue is income earned for goods or services sold but not yet paid, recorded as an asset on the balance sheet until. Accrued revenue is the revenue that the company already earned through providing goods or services to the customer, but the company has.

Thus, the offsets to accruals in. Accrued revenue is income earned for goods or services sold but not yet paid, recorded as an asset on the balance sheet until. The unbilled revenue account should appear in the current assets portion of the balance sheet. On the income statement, it increases revenue, which. Accrued revenue is the revenue that the company already earned through providing goods or services to the customer, but the company has. Accrued revenue affects both the income statement and the balance sheet.

Solved Accrued revenue is an asset. But, on the balance

Accrued revenue is the revenue that the company already earned through providing goods or services to the customer, but the company has. Accrued revenue is income earned for goods or services sold but not yet paid, recorded as an asset on the balance sheet until. Thus, the offsets to accruals in. On the income statement, it increases revenue, which. The.

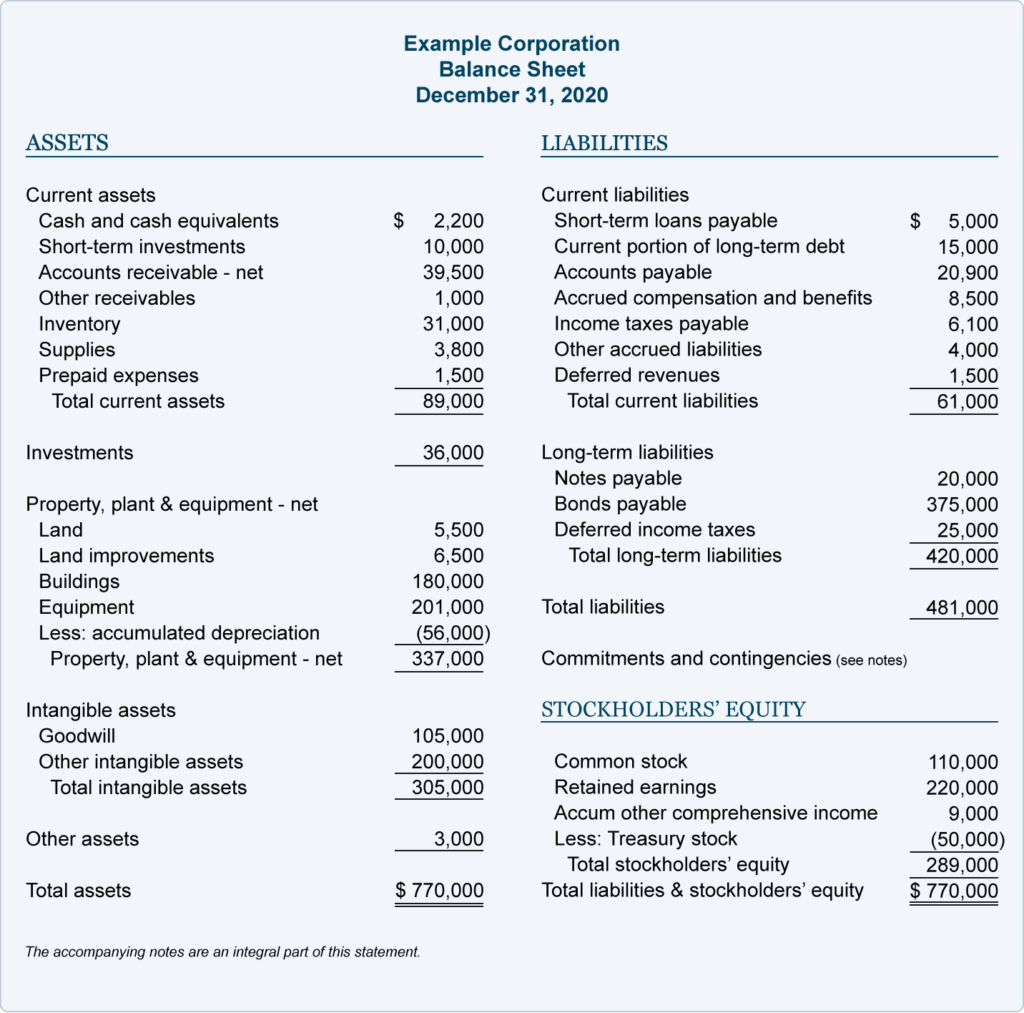

Understanding Your Balance Sheet Financial Accounting Protea

Thus, the offsets to accruals in. The unbilled revenue account should appear in the current assets portion of the balance sheet. On the income statement, it increases revenue, which. Accrued revenue affects both the income statement and the balance sheet. Accrued revenue is income earned for goods or services sold but not yet paid, recorded as an asset on the.

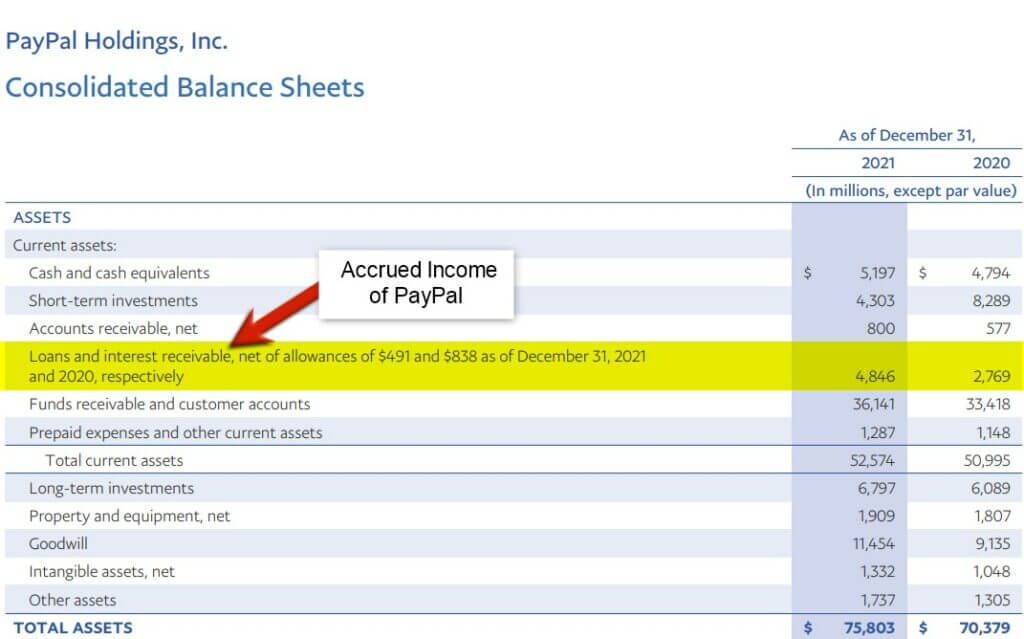

Is accrued revenue a debit or credit? Leia aqui Is accrued revenue a

Thus, the offsets to accruals in. Accrued revenue affects both the income statement and the balance sheet. Accrued revenue is the revenue that the company already earned through providing goods or services to the customer, but the company has. The unbilled revenue account should appear in the current assets portion of the balance sheet. On the income statement, it increases.

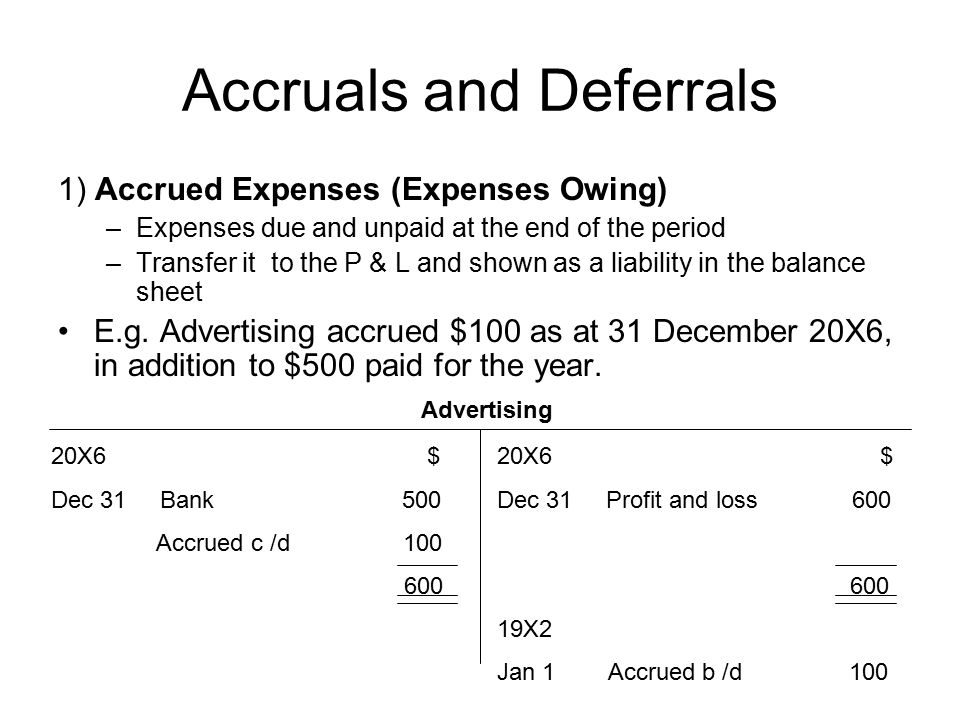

What is Accrued Journal Entry, Examples, How it Works?

The unbilled revenue account should appear in the current assets portion of the balance sheet. Thus, the offsets to accruals in. Accrued revenue is income earned for goods or services sold but not yet paid, recorded as an asset on the balance sheet until. On the income statement, it increases revenue, which. Accrued revenue affects both the income statement and.

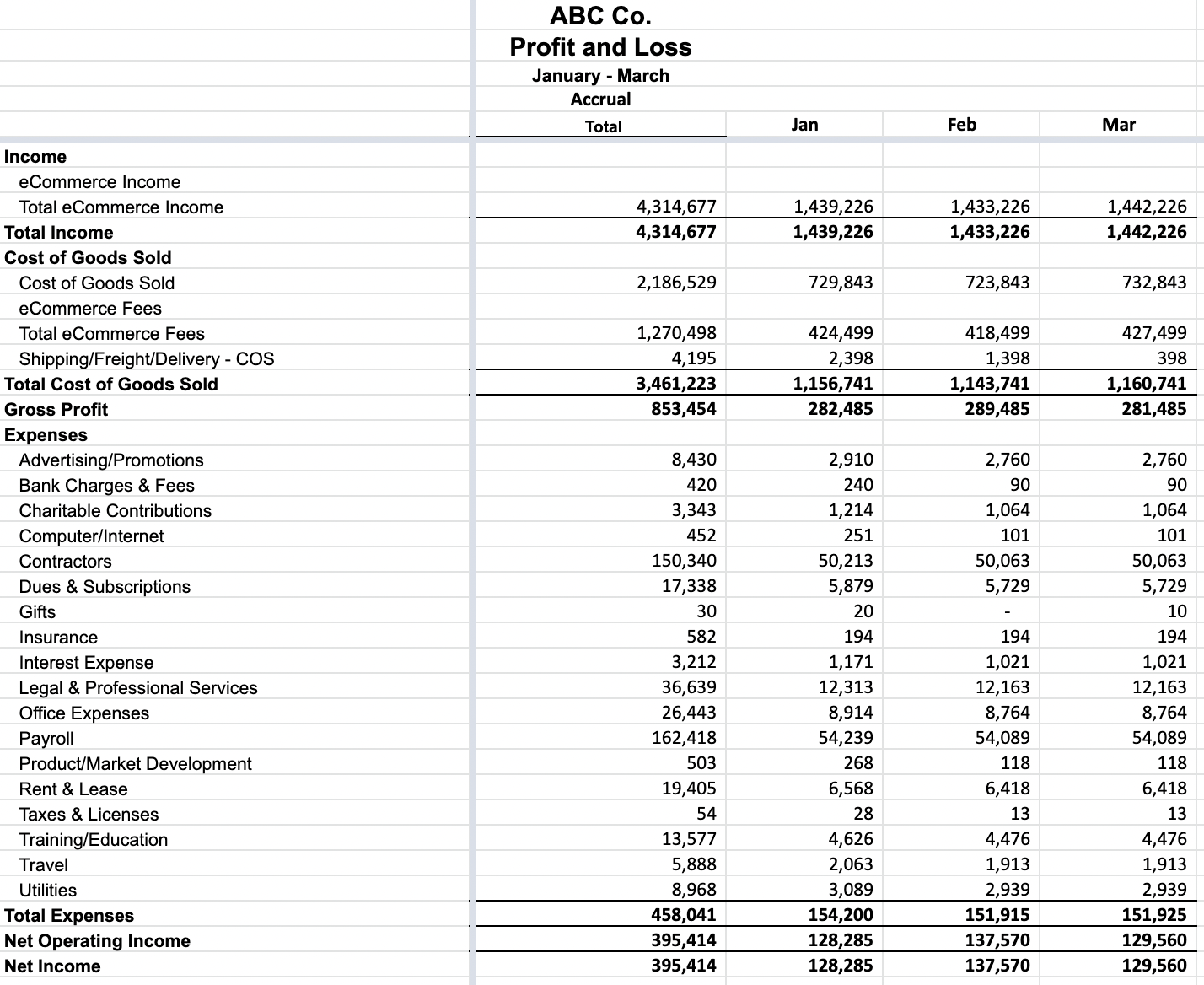

Modified Cash Basis Accounting for Business

On the income statement, it increases revenue, which. Thus, the offsets to accruals in. Accrued revenue is income earned for goods or services sold but not yet paid, recorded as an asset on the balance sheet until. Accrued revenue is the revenue that the company already earned through providing goods or services to the customer, but the company has. The.

The accrual basis of accounting Business Accounting

Accrued revenue affects both the income statement and the balance sheet. On the income statement, it increases revenue, which. Thus, the offsets to accruals in. The unbilled revenue account should appear in the current assets portion of the balance sheet. Accrued revenue is income earned for goods or services sold but not yet paid, recorded as an asset on the.

Accrued Revenue Accounting Double Entry Bookkeeping

Accrued revenue is the revenue that the company already earned through providing goods or services to the customer, but the company has. The unbilled revenue account should appear in the current assets portion of the balance sheet. Accrued revenue is income earned for goods or services sold but not yet paid, recorded as an asset on the balance sheet until..

The Importance of an Accurate Balance Sheet

The unbilled revenue account should appear in the current assets portion of the balance sheet. On the income statement, it increases revenue, which. Accrued revenue is income earned for goods or services sold but not yet paid, recorded as an asset on the balance sheet until. Accrued revenue affects both the income statement and the balance sheet. Accrued revenue is.

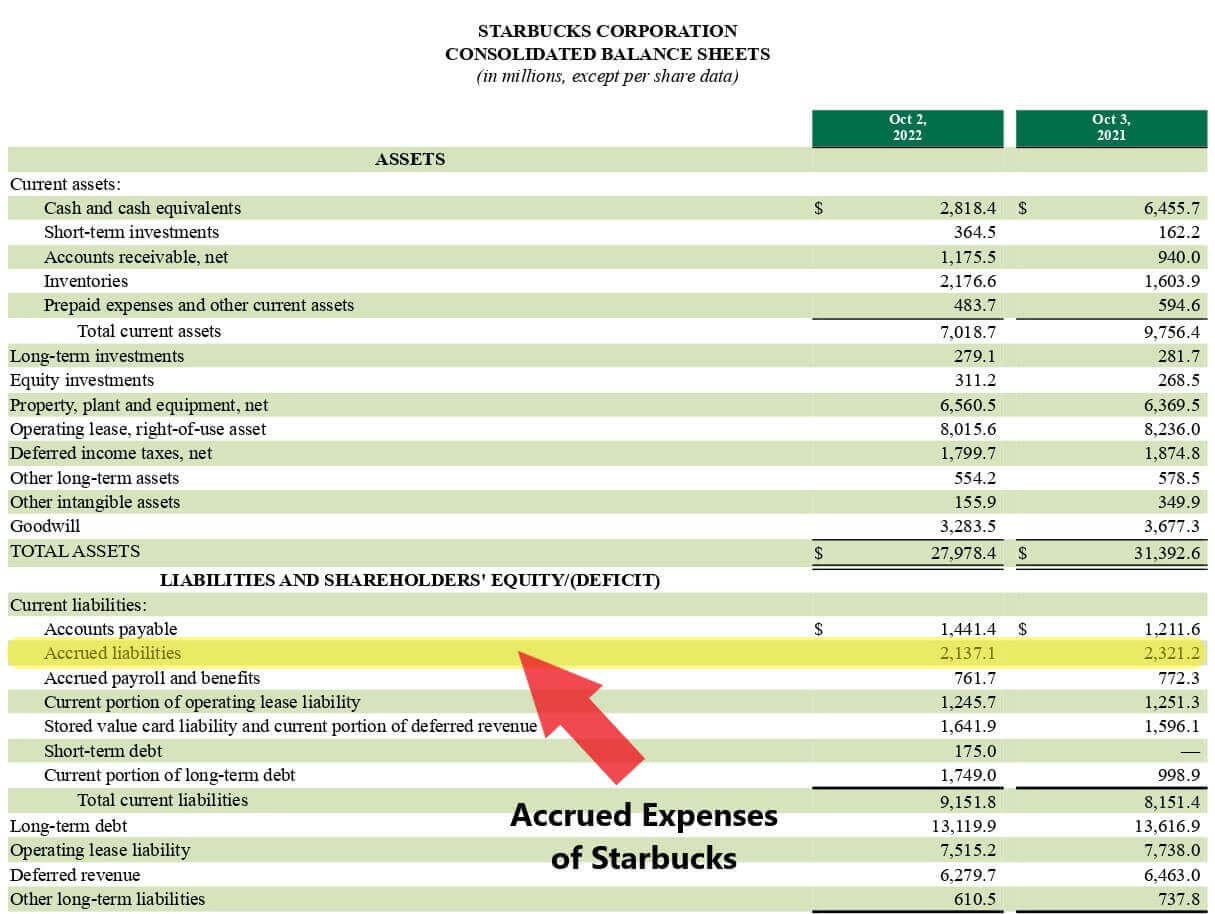

Accrued Expense Examples of Accrued Expenses

Accrued revenue is the revenue that the company already earned through providing goods or services to the customer, but the company has. On the income statement, it increases revenue, which. Accrued revenue affects both the income statement and the balance sheet. Thus, the offsets to accruals in. Accrued revenue is income earned for goods or services sold but not yet.

Accrued revenue how to record it in 2023 QuickBooks

Accrued revenue is the revenue that the company already earned through providing goods or services to the customer, but the company has. On the income statement, it increases revenue, which. Thus, the offsets to accruals in. Accrued revenue is income earned for goods or services sold but not yet paid, recorded as an asset on the balance sheet until. Accrued.

Accrued Revenue Is The Revenue That The Company Already Earned Through Providing Goods Or Services To The Customer, But The Company Has.

Thus, the offsets to accruals in. On the income statement, it increases revenue, which. Accrued revenue affects both the income statement and the balance sheet. Accrued revenue is income earned for goods or services sold but not yet paid, recorded as an asset on the balance sheet until.