S Recently Received A $500 000 Lump Sum - Recently received a $500,000 lump sum retirement buyout from her employer. Study with quizlet and memorize flashcards containing terms like s recently received a $500,000 lump sum retirement buyout from her. Given s's need for guaranteed lifetime income starting immediately, the correct answer is c. Deciding between a $500,000 lump sum or $3,500 monthly annuity payments for your pension isn’t straightforward and involves. Study with quizlet and memorize flashcards containing terms like s recently received a $500,000 lump sum retirement buyout from her. She would like to buy an annuity that will immediately furnish her. Immediate annuities are purchased with a single lump sum payment and will start providing income payments within the first year, but usually.

She would like to buy an annuity that will immediately furnish her. Study with quizlet and memorize flashcards containing terms like s recently received a $500,000 lump sum retirement buyout from her. Recently received a $500,000 lump sum retirement buyout from her employer. Deciding between a $500,000 lump sum or $3,500 monthly annuity payments for your pension isn’t straightforward and involves. Study with quizlet and memorize flashcards containing terms like s recently received a $500,000 lump sum retirement buyout from her. Immediate annuities are purchased with a single lump sum payment and will start providing income payments within the first year, but usually. Given s's need for guaranteed lifetime income starting immediately, the correct answer is c.

Given s's need for guaranteed lifetime income starting immediately, the correct answer is c. She would like to buy an annuity that will immediately furnish her. Deciding between a $500,000 lump sum or $3,500 monthly annuity payments for your pension isn’t straightforward and involves. Study with quizlet and memorize flashcards containing terms like s recently received a $500,000 lump sum retirement buyout from her. Immediate annuities are purchased with a single lump sum payment and will start providing income payments within the first year, but usually. Recently received a $500,000 lump sum retirement buyout from her employer. Study with quizlet and memorize flashcards containing terms like s recently received a $500,000 lump sum retirement buyout from her.

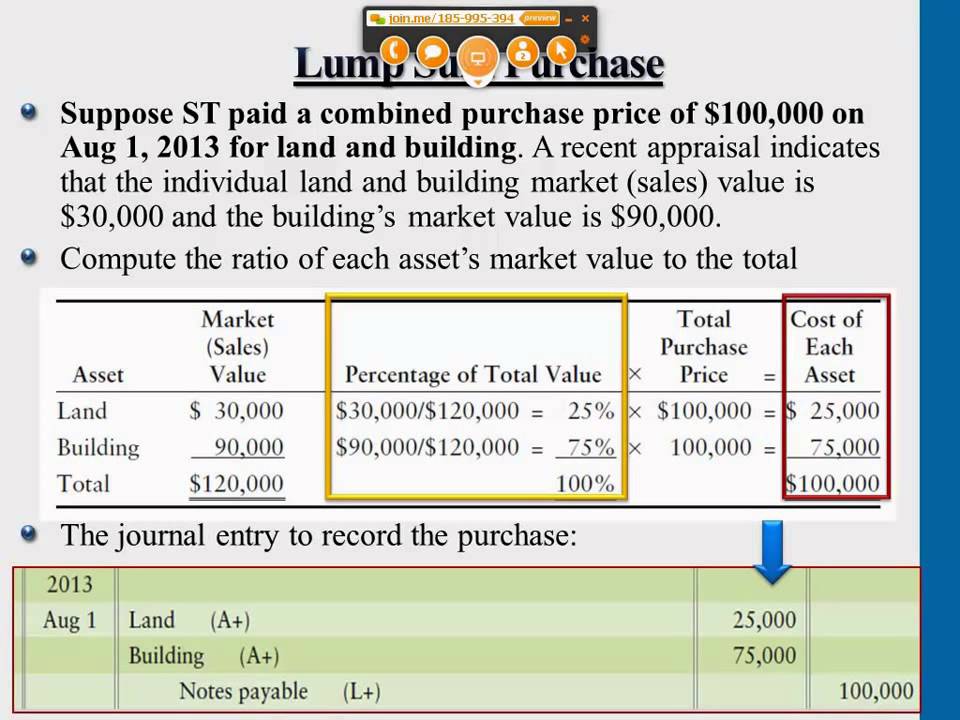

What to Do When You Receive a Lump Sum of Money The Budget Mom

Recently received a $500,000 lump sum retirement buyout from her employer. She would like to buy an annuity that will immediately furnish her. Study with quizlet and memorize flashcards containing terms like s recently received a $500,000 lump sum retirement buyout from her. Deciding between a $500,000 lump sum or $3,500 monthly annuity payments for your pension isn’t straightforward and.

LumpSum Payment What It Is, How It Works, Pros & Cons

Immediate annuities are purchased with a single lump sum payment and will start providing income payments within the first year, but usually. Given s's need for guaranteed lifetime income starting immediately, the correct answer is c. Recently received a $500,000 lump sum retirement buyout from her employer. Deciding between a $500,000 lump sum or $3,500 monthly annuity payments for your.

Lump Sum adalah Definisi, Jenis, dan Contoh Penerapannya dalam Finansial

Given s's need for guaranteed lifetime income starting immediately, the correct answer is c. Recently received a $500,000 lump sum retirement buyout from her employer. Deciding between a $500,000 lump sum or $3,500 monthly annuity payments for your pension isn’t straightforward and involves. Study with quizlet and memorize flashcards containing terms like s recently received a $500,000 lump sum retirement.

Lump Sum Tax What Is It, Formula, Calculation, Example

Recently received a $500,000 lump sum retirement buyout from her employer. Study with quizlet and memorize flashcards containing terms like s recently received a $500,000 lump sum retirement buyout from her. Given s's need for guaranteed lifetime income starting immediately, the correct answer is c. Immediate annuities are purchased with a single lump sum payment and will start providing income.

Lump Sum Payments Defined and Explained Accounting

Immediate annuities are purchased with a single lump sum payment and will start providing income payments within the first year, but usually. She would like to buy an annuity that will immediately furnish her. Study with quizlet and memorize flashcards containing terms like s recently received a $500,000 lump sum retirement buyout from her. Deciding between a $500,000 lump sum.

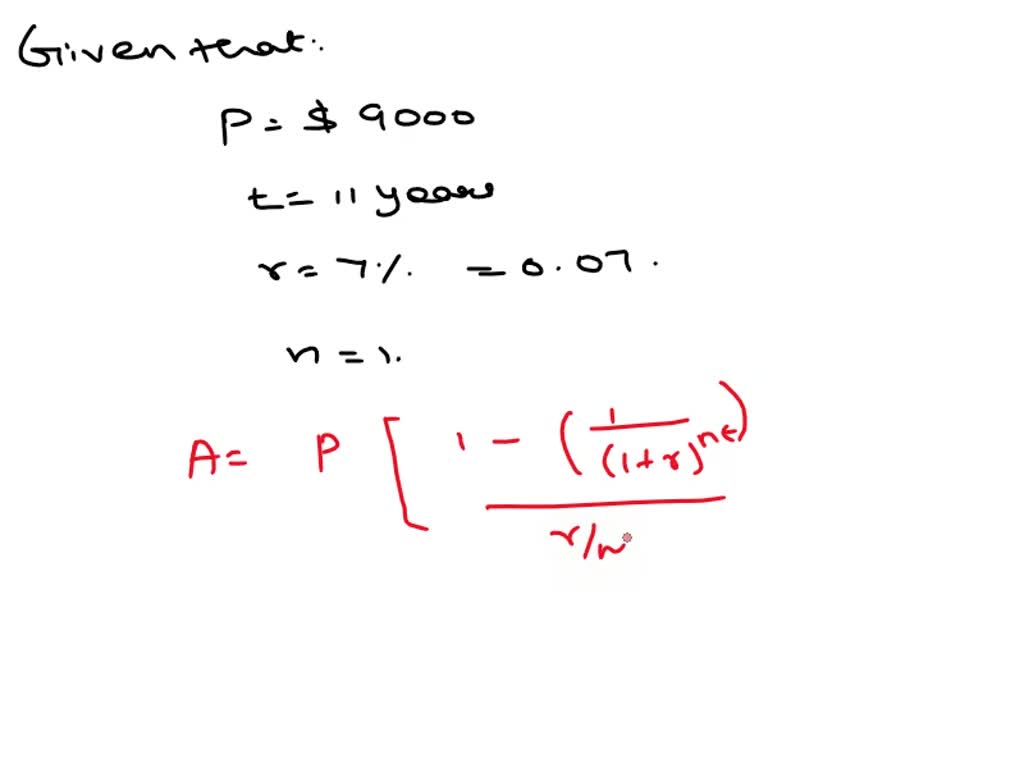

Lump Sum Calculation

Recently received a $500,000 lump sum retirement buyout from her employer. Study with quizlet and memorize flashcards containing terms like s recently received a $500,000 lump sum retirement buyout from her. Study with quizlet and memorize flashcards containing terms like s recently received a $500,000 lump sum retirement buyout from her. She would like to buy an annuity that will.

DCA vs lump sum investing how do the two approaches compare? Pearler

Study with quizlet and memorize flashcards containing terms like s recently received a $500,000 lump sum retirement buyout from her. Given s's need for guaranteed lifetime income starting immediately, the correct answer is c. Study with quizlet and memorize flashcards containing terms like s recently received a $500,000 lump sum retirement buyout from her. Recently received a $500,000 lump sum.

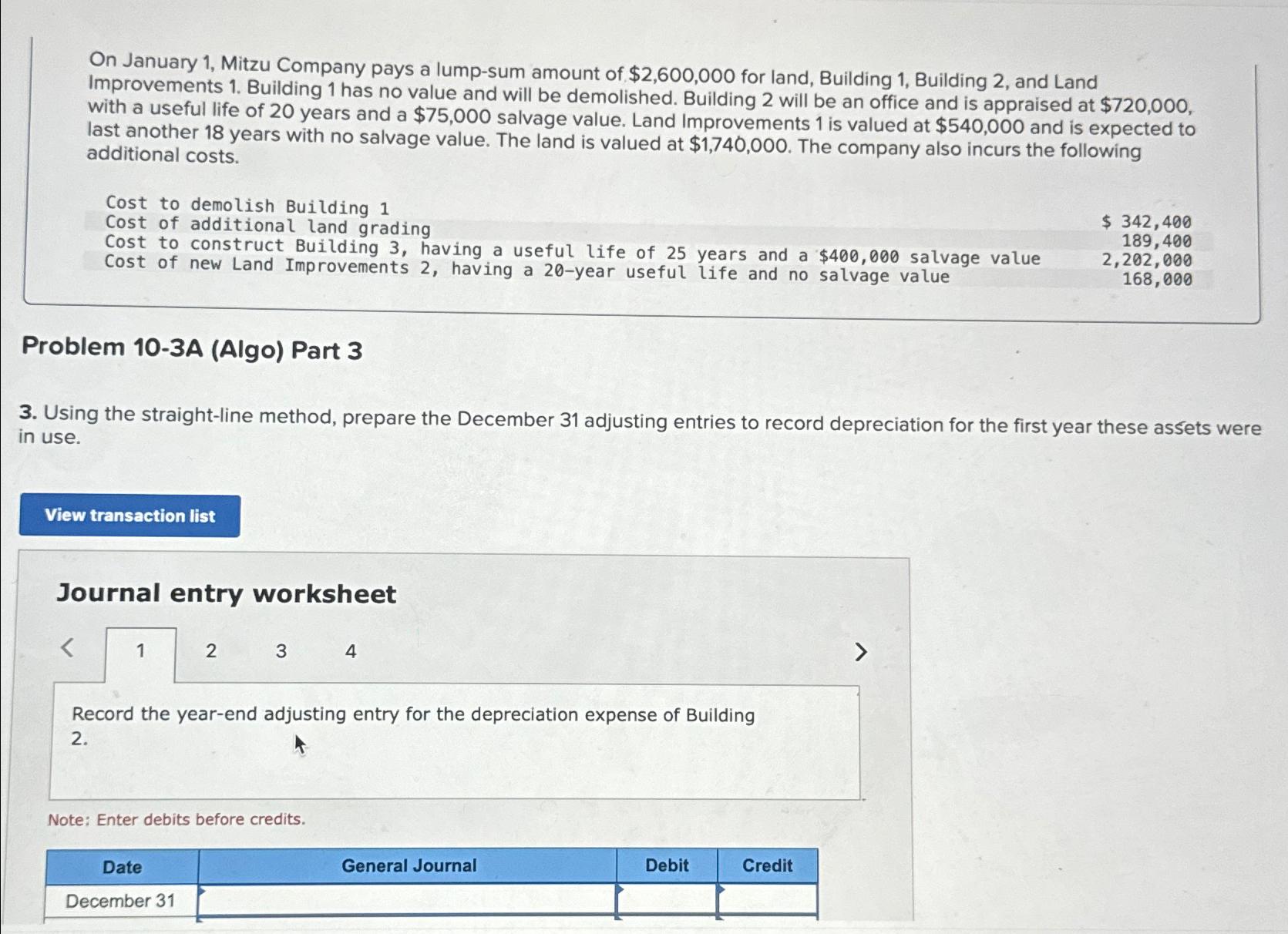

Solved On January 1, Mitzu Company pays a lumpsum amount

Study with quizlet and memorize flashcards containing terms like s recently received a $500,000 lump sum retirement buyout from her. Given s's need for guaranteed lifetime income starting immediately, the correct answer is c. She would like to buy an annuity that will immediately furnish her. Study with quizlet and memorize flashcards containing terms like s recently received a $500,000.

Lump Sum Definition, Calculation, and Practical Examples Explained

She would like to buy an annuity that will immediately furnish her. Study with quizlet and memorize flashcards containing terms like s recently received a $500,000 lump sum retirement buyout from her. Given s's need for guaranteed lifetime income starting immediately, the correct answer is c. Recently received a $500,000 lump sum retirement buyout from her employer. Deciding between a.

SOLVED Calculate the present value of each of the following future

She would like to buy an annuity that will immediately furnish her. Given s's need for guaranteed lifetime income starting immediately, the correct answer is c. Study with quizlet and memorize flashcards containing terms like s recently received a $500,000 lump sum retirement buyout from her. Deciding between a $500,000 lump sum or $3,500 monthly annuity payments for your pension.

Recently Received A $500,000 Lump Sum Retirement Buyout From Her Employer.

Study with quizlet and memorize flashcards containing terms like s recently received a $500,000 lump sum retirement buyout from her. Immediate annuities are purchased with a single lump sum payment and will start providing income payments within the first year, but usually. Given s's need for guaranteed lifetime income starting immediately, the correct answer is c. She would like to buy an annuity that will immediately furnish her.

Study With Quizlet And Memorize Flashcards Containing Terms Like S Recently Received A $500,000 Lump Sum Retirement Buyout From Her.

Deciding between a $500,000 lump sum or $3,500 monthly annuity payments for your pension isn’t straightforward and involves.